Processing payroll feels straightforward when your team is small. Then growth kicks in. Suddenly you are juggling multiple salary structures, new joiners and exits every month, variable pay, reimbursements, and constant attendance changes. One missed input or wrong deduction can lead to incorrect payslips, rework across HR and finance, and unhappy employees on pay week.

The real problem is not just time. It is control. As payroll complexity increases, spreadsheets and disconnected tools make it harder to maintain compliance confidence, keep an audit trail, and answer employee questions quickly. Small errors repeat, fixes get buried in email threads, and month-end turns into a fire drill.

Payroll software solves this by automating calculations, connecting attendance and leave, generating statutory outputs, and giving employees self-service access to payslips and tax documents. This guide compares 10 of the best payroll software options in India for 2026, so you can shortlist the right tool based on compliance, automation, integrations, scalability, and support reliability.

Choosing the right payroll system requires evaluating capability against your actual operating model, not feature lists. Use the factors below to shortlist tools that match your team size, payroll complexity, and internal workflows.

1) Compliance management

Indian payroll involves PF, ESI, PT, TDS, gratuity, and other statutory requirements. Shortlist tools that automate calculations, support required reporting outputs, and minimise manual steps that create risk. Also confirm whether the product supports the compliance workflows your organisation needs, such as approvals and audit trails.

2) Automation and accuracy

Beyond basic salary calculations, assess how much the system automates end to end. Look for support for arrears, bonuses, reimbursements, variable pay, and retroactive changes without spreadsheet work. If you want a clearer view of what “end-to-end” means in practice, map this to your expected payroll implementation steps.

3) Integration capabilities

Your payroll software should connect with your HR, attendance, leave, and accounting setup. Poor integrations create duplicate work and reconciliation issues. Prefer native integrations where possible, and confirm what is included versus what requires additional technical work. If payroll is one part of a broader people stack, check how it fits with your human resource management system approach

4) Scalability for growth

Choose software that can handle your expected complexity in 2 to 3 years. Consider multi-location payroll, multiple pay groups, changing salary structures, and growth in headcount without a painful re-implementation.

5) Employee experience and self-service

Good payroll software reduces HR tickets by enabling employees to access payslips, tax documents, and payroll-related actions through self-service. A strong employee experience improves trust because payroll becomes more transparent and predictable.

6) Support and onboarding

Payroll issues are time-sensitive, especially around pay days. Evaluate support availability, responsiveness, and whether onboarding includes structured setup and training. In practice, a capable support team often matters as much as the product.

7) Commercial fit and constraints

Even if you are not comparing prices line by line, you should still evaluate commercial fit. Check contract terms, minimum user commitments, roll-out effort, and whether you will need additional tools to complete your workflow.

With these selection factors in mind, here are 10 payroll software options commonly evaluated by Indian businesses, presented in a consistent format to make shortlisting easier.

Here’s a list of the top payroll software in India, each offering unique features to simplify payroll management and ensure compliance:

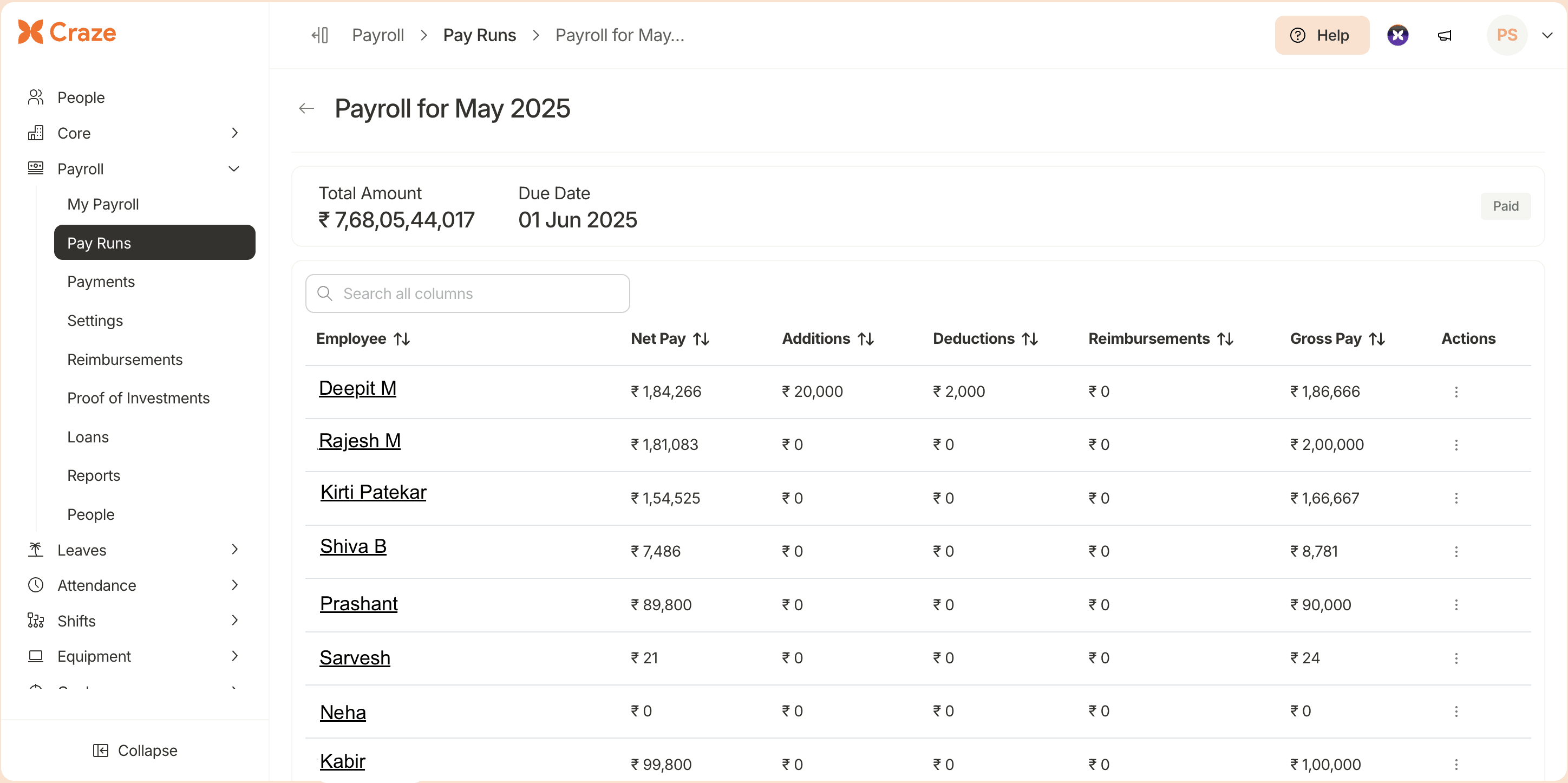

1) Craze

Craze is an all-in-one People OS that combines HR, payroll, and IT management for Indian teams. It is designed to reduce fragmented workflows by keeping payroll connected to attendance and leave in the same system, so monthly processing requires fewer manual reconciliations. Craze supports multiple salary structures and is positioned for fast-growing startups and SMEs that want quick onboarding and responsive support.

Key features

Automated statutory compliance for India, including PF, ESI, PT and TDS calculations with payroll-ready outputs

End-to-end payroll automation to reduce errors, including support for common scenarios such as arrears, bonuses, reimbursements and variable pay

Real-time leave and attendance sync to minimise manual inputs and reconciliation during payroll runs

Employee self-service access via web & mobile app to payslips and payroll documents to reduce HR queries

Scalable setup for growing teams with multiple salary structures, pay groups and flexible components

Guided onboarding and responsive support (in minutes, not days) during payroll cycles for time-sensitive issues

Best for

Startups and fast-growing SMEs (with 50-500 employee headcount) that want an integrated HR and payroll system with simple operations.

2) Keka

Keka is a widely used HR and payroll platform with strong configuration options for salary structures and payroll policies. It is often shortlisted by companies that want a comprehensive HR suite with payroll included, plus process controls for approvals, declarations, and payroll review cycles. Keka is typically used by mid-sized to larger organisations that value configurability.

Key features

Configurable salary structures with multiple pay groups

Payroll preview and review workflows before finalisation

Tax declarations and investment proof workflows

HR suite modules alongside payroll

Employee self-service via web and mobile experiences

Best for

Mid-sized and larger companies that want a configurable HRMS with payroll built in.

3) Darwinbox

Darwinbox is an enterprise HCM platform used by large organisations, including multi-location operations. Payroll is positioned as part of a broader suite that includes workforce management, approvals, and employee experience layers. It is often evaluated by enterprises that need strong process governance, integrations, and reporting across departments.

Key features

Enterprise HCM suite with payroll as a core module

Workflows and approvals aligned to multi-team operations

Integration support for complex environments

Reporting and analytics for payroll and workforce costs

Employee experience components across devices

Best for

Medium to large enterprises and MNCs with complex HR and payroll requirements.

4) RazorpayX Payroll

RazorpayX Payroll focuses on payroll processing combined with compliance workflows, with an emphasis on operational simplicity. It is often considered by companies that want a clean payroll process with statutory outputs and a straightforward employee portal, especially when teams prefer modern, cloud-first tools.

Key features

Payroll processing with statutory compliance workflows

Employee portal for payslips and payroll documents

Support for common payroll scenarios and deductions

Integrations with selected HR and attendance systems

Product experience designed for quick adoption

Best for

Businesses that want a modern payroll and compliance workflow with an employee portal.

5) Zoho Payroll

Zoho Payroll is a good fit for companies already using Zoho products. It integrates well within the Zoho ecosystem and supports payroll processing, statutory compliance requirements, and structured payroll administration. It is commonly evaluated by SMBs that want a familiar interface and ecosystem integrations.

Key features

Payroll processing with statutory compliance support

Integration across the Zoho ecosystem

Role-based access controls and admin workflows

Employee access to payslips and payroll records

Reporting support for payroll administration

Best for

Businesses already using Zoho applications and want payroll as part of that ecosystem.

6) greytHR

greytHR is commonly used by SMEs that want a straightforward payroll system with compliance support and employee self-service. It is frequently evaluated by non-tech industries due to its focus on core HR and payroll workflows and ease of adoption for smaller teams.

Key features

Payroll processing with compliance outputs

Employee self-service for payslips and HR requests

Core HR features bundled with payroll

Reporting for common payroll and compliance needs

Workflows suited to SMEs across industries

Best for

SMEs that want a practical payroll solution with self-service and compliance support.

7) HROne

HROne positions itself as a broad HR platform with payroll, workflows, and reporting. It is often shortlisted by organisations that want automation and structured processes, plus a suite approach where payroll is connected to HR operations.

Key features

Payroll processing with workflow support

HR suite modules alongside payroll

Reporting and dashboards for payroll administration

Employee self-service features and admin controls

Support for common salary changes and adjustments

Best for

Mid-sized organisations that want payroll combined with broader HR workflows.

8) Zimyo

Zimyo offers HR and payroll modules aimed at small to medium businesses. It is often evaluated by companies that want core payroll, compliance outputs, and employee self-service without the complexity of enterprise platforms.

Key features

Payroll processing with compliance support

Employee self-service access to payslips and records

HR modules that connect to payroll workflows

Support for reimbursements and allowances where applicable

Admin tools for payroll processing and reporting

Best for

Small and mid-sized businesses wanting a balanced HR and payroll setup.

9) Kredily

Kredily is often evaluated by smaller businesses that want a simple payroll experience and basic HR tools. It is typically considered by teams that want to move away from spreadsheets quickly and keep processes straightforward.

Key features

Payroll processing and payslip generation

Basic HR tools connected to payroll records

Support for common salary and deduction structures

Employee access to payroll documents

Admin workflows aimed at quick adoption

Best for

Small businesses that want a simple payroll tool to replace spreadsheets.

10) Qandle

Qandle provides an HR suite approach with payroll as part of a broader set of modules. It is often considered by teams that want customisable workflows and a configurable HR system whilst keeping payroll within the same platform.

Key features

Payroll module within a broader HR suite

Configurable salary structures and payroll policies

Workflow support and admin controls

Reporting for payroll operations and HR needs

Employee portal for payslips and HR actions

Best for

Businesses that want a configurable HR suite with payroll included.

To make shortlisting easier, here is a quick comparison of three commonly short-listed options based on typical company needs.

Here’s a quick comparison of the top three payroll tools trusted by Indian businesses:

Craze | Keka | Darwinbox | |

Best for | Startups, SMEs & Mid Sized organisations | Mid-sized and larger companies | Enterprises |

Strengths | Integrated HR, payroll, and IT workflows; designed for fast operations | Strong customisation options and HR suite depth | Strong customisation options and HR suite depth |

Potential limitations | Features may be more than small teams needed | Can feel heavy for very small teams | Can feel heavy for very small teams |

A reliable payroll system is not just about paying salaries. It reduces month-end firefighting by keeping calculations consistent, statutory outputs organised, and payroll data traceable when questions come up. As payroll complexity increases, the difference shows up in fewer corrections, fewer employee queries, and fewer last-minute compliance worries, whilst giving HR and finance more time back each cycle.

Use this list to shortlist two or three tools that match your operating needs, then validate them with a realistic test. Run a sample payroll cycle with real-world scenarios like new joiners and exits, variable pay, reimbursements, and attendance changes, and check how cleanly the workflow holds up from inputs to payslips and outputs. The right platform will feel predictable under pressure, not perfect only in a demo.

What is payroll software?

Payroll software automates salary calculations, statutory deductions, and payroll processing workflows. It replaces manual spreadsheets with structured processes that improve accuracy, audit readiness, and employee trust.

How do I choose the best payroll software for my company?

Start with your operating requirements. Confirm statutory compliance support, automation for common scenarios, integration with attendance and leave, employee self-service, and scalability. Then validate with a sample payroll run before committing.

Does payroll software handle statutory compliance in India?

Most payroll tools claim statutory compliance support for PF, ESI, PT, and TDS. However, capability varies in implementation and reporting outputs, so you should verify compliance workflows during evaluation and testing.

Can payroll software integrate with attendance and HR systems?

Many platforms offer integrations with HR and attendance tools, but integration quality differs. Prioritise systems with reliable sync to reduce manual reconciliation and avoid payroll errors.

How long does payroll software implementation take?

Implementation depends on complexity. Smaller teams can often onboard quickly, whilst larger organisations may require structured roll-out planning due to salary structures, approvals, and data migration.

Can payroll software handle freelancers and contractors?

Many payroll systems support multiple worker types, including contractors and freelancers, but workflows vary. If this is important to you, confirm how the tool handles payouts, tax treatment, and documentation.

What is the difference between payroll software and HRMS?

Payroll software focuses on salary processing and compliance. An HRMS includes broader people operations such as onboarding, leave, attendance, performance, and employee records. Many modern tools combine both.

Which is the best payroll software for small & mid-sized businesses in India?

For small to mid sized businesses in India, Craze is considered one of the most user-friendly payroll software options. It offers simple onboarding, easy navigation, and automation that reduces manual HR tasks. Greythr & Zoho Payroll are also good options for small businesses.

What should I test during a payroll demo?

Test a sample payroll cycle end to end. Include allowances, deductions, arrears, variable pay, reimbursements, and employee portal access. Also check reporting outputs and support responsiveness.

Looking to optimise specific HR functions? Check out these comprehensive guides:

Best HR Software in India - Compare HRMS platforms for end-to-end people operations

Best Attendance Software in India - Explore Attendance management tools offering biometric, geo-fencing, shift management, and mobile attendance tracking

Best Leave Management Software in India- Compare leave management tools that automate leave requests, approvals, and balance tracking

Best HR Compliance Software in India - Explore HR Compliance management tools to stay compliant with Indian labour laws and statutory requirements

Best Human Resource Onboarding Software - Compare employee onboarding tools to streamline onboarding workflows, documents, and new hire experience

Best Payroll Automation Software in India - Explore tools built for automation-first payroll processing