Salary Slip in India: Key Elements, Free Format & Template

Did you know nearly 41% of Indian businesses experience payroll problems every year, and 55% of SMEs face compliance challenges around PF, TDS, and ESI? These gaps often surface first on salary slips, triggering employee disputes, audit observations, and repeated correction cycles.

The real challenge is visibility. Even small inconsistencies in monthly pay details can raise questions about accuracy, compliance, and fairness, turning payroll from a routine process into a business concern.

In this blog, you will learn what an Indian salary slip represents, why it matters for employers, and how to structure it clearly and accurately, with ready-to-use formats included.

Bonus: you can use our free salary slip generator here to generate payslips for your employees in a consistent format.

Key Takeaways

Salary slips serve as legal documents that provide official proof of income and employment.

Ensuring accuracy in earnings and deductions helps protect your organisation from audits and disputes.

They play a vital role in supporting tax filings, loan applications, and other statutory processes.

Digital salary slips make it easier to store, retrieve, and verify records efficiently.

Well-formatted and clear salary slips reduce employee queries and lighten the HR workload.

What is a Salary Slip?

A salary slip is an official document issued to employees each month that details their earnings, deductions, and net pay. It provides a clear breakdown of the pay package, including basic salary, house rent allowance (HRA), dearness allowance (DA), performance-based incentives, and other allowances.

The slip also records statutory and other deductions, such as provident fund (PF), professional tax, and tax deducted at source (TDS). While salary slips were traditionally printed, most organisations now issue them digitally through payroll software or employee portals, making them easy to distribute, store, and verify.

Why Providing Accurate Salary Slips Matters?

Salary slips serve both administrative and legal purposes for employees and are essential documentation that employers provide accurately every month. They ensure transparency in compensation and serve as proof during audits, compliance checks, and external verification.

Salary slips provide employees with the following benefits:

Legal Proof of Employment: Documented evidence of designation, salary, and employment period.

Support for Loans, Credit Cards, and International Applications: Proof of income and employment history.

Income Tax Filing Support: Details of gross pay, deductions, and exemptions for accurate tax reporting.

Provident Fund Contribution Tracking: Clear records of both employee and employer PF contributions.

Access to Government Welfare Schemes: Verification of income for eligibility to state-sponsored benefits.

Job Search and Salary Negotiation: Used to confirm current designation and pay when moving to a new employer.

Also Read: Salary Certificate Format: Free Word Format & Templates

To ensure clarity and compliance, it’s crucial to understand the key elements every salary slip should include.

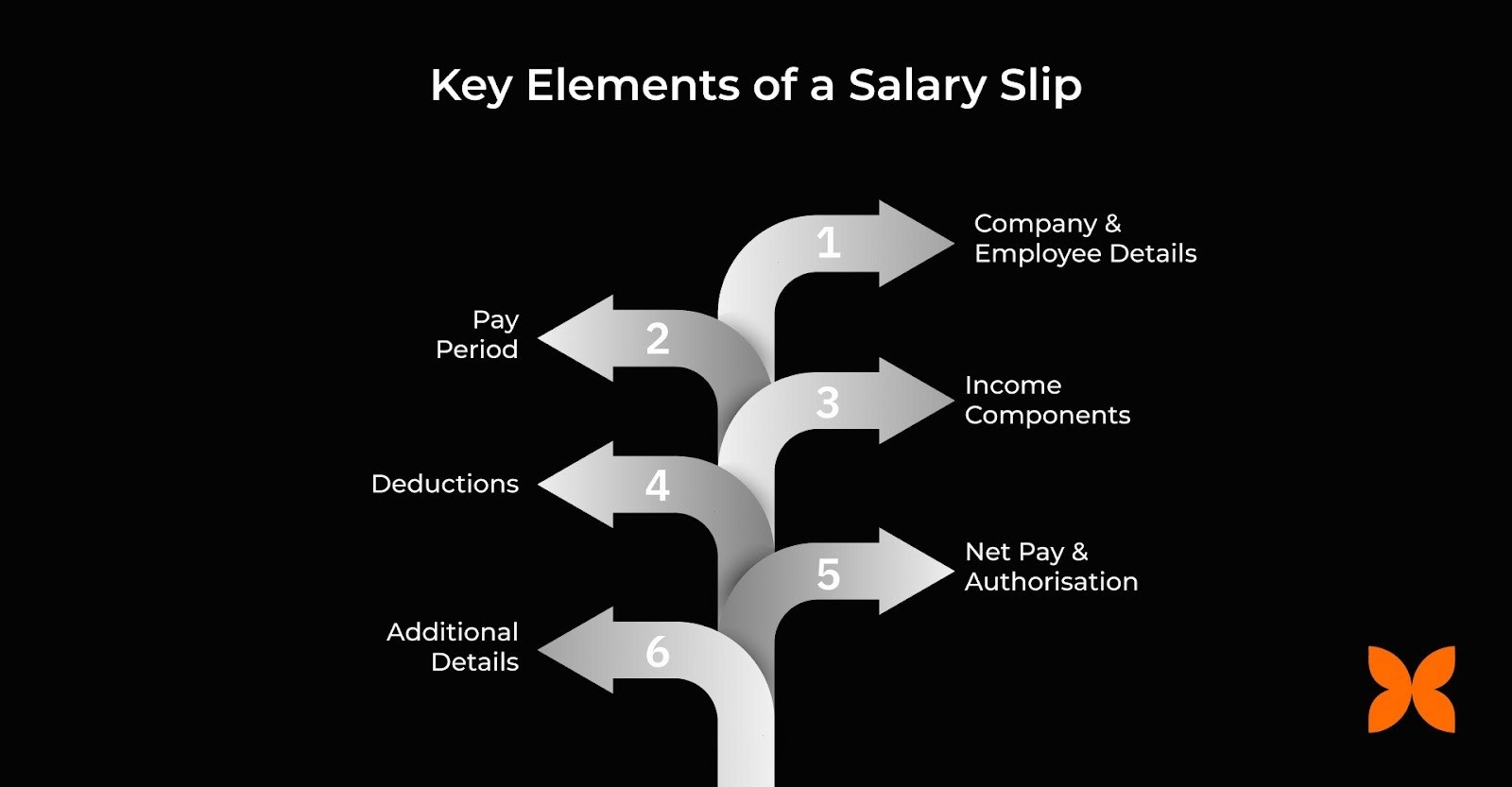

Key Elements of a Salary Slip

A salary slip follows a structured format to ensure clarity and compliance with statutory requirements. It provides a detailed breakdown of the employee’s pay, including personal information, pay period, income components, deductions, and net pay.

1. Company and Employee Details

Include the company’s name, address, and date of joining, along with the employee’s name, ID, designation, department, and optional PAN. It also includes statutory identifiers such as UAN and ESIC, as well as bank details, ensuring accuracy, compliance, and ease of verification.

2. Pay Period

Specifies the month and year for which salary is paid, along with the payment date.

3. Income Components

Lists all earnings that make up gross salary, providing transparency before deductions:

Basic Salary: This is the fixed core of an employee’s pay and often serves as the base for calculating other allowances. It typically accounts for 40–50% of take-home pay. The basic salary is fully taxable, and its amount can influence employees' tax optimisation strategies.

Dearness Allowance (DA): DA is intended to compensate for inflation or rising living costs. It is computed as a percentage of the basic salary, may vary by region and sector, and is fully taxable as part of the employee’s salary.

House Rent Allowance (HRA): HRA helps employees meet housing costs. Its exemption limit varies by city, state, and sector, typically up to 50% of basic pay in major cities and around 40% in smaller towns. Tax exemptions are available up to the actual rent paid, subject to statutory limits.

Conveyance Allowance: This allowance covers commuting expenses between home and office. For tax purposes, the exempt amount is the lower of the actual expenses incurred for official purposes or the allowance received.

Leave Travel Allowance (LTA): LTA reimburses travel expenses incurred during approved leave periods. Tax exemption is available when employees submit proof of travel, provided it meets the statutory conditions.

Bonus and Special Allowances: These are variable payments based on performance, productivity, or company policies. They are fully taxable and form part of take-home pay, reflecting employee incentives in the salary slip.

Other Allowances: Employers may provide additional allowances, such as meals, city compensatory allowances, or shopping/food coupons. These benefits are included in the total salary and should be transparently reflected in the salary slip.

4. Deductions

Deductions reflect the amounts subtracted from the gross salary, including statutory and voluntary contributions. They determine the employee’s net (in-hand) pay for the period.

Provident Fund (PF): This contribution is deducted from the employee’s salary and deposited into their PF account, along with the employer’s contribution. It provides long-term retirement benefits and is exempt from income tax within statutory limits. PF applies to employees meeting specific criteria, such as those in establishments with more than 20 employees or earning up to ₹15,000 per month.

Professional Tax: Many states in India require a professional tax deduction from the salaries of salaried employees. The exact amount depends on the employee’s income slab and must be remitted to the state government.

ESIC (Employee State Insurance Contribution): Applicable to employees earning up to ₹21,000 per month in covered establishments. Both employer and employee contribute, providing medical, sickness, maternity, and disability benefits.

Loss of Pay (LOP): Deduction applied when an employee is absent without leave or exceeds leave limits. It is subtracted from the gross salary to calculate the net pay.

Other Deductions: Includes voluntary contributions, loan repayments, or company-specific deductions. Transparency prevents disputes.

5. Net Pay and Authorisation

This is the actual amount credited to the employee’s account after all deductions, shown both numerically and in words for clarity. The salary slip also records the payment mode and includes the authorised signatory for verification and compliance.

6. Additional Details

Some salary slips may include additional information, such as overtime pay, leave balances, performance bonuses, or variable allowances. Including these details ensures complete transparency and helps employees accurately track their earnings.

Also Read: Taxable and Non-Taxable Salary Allowances in India: Definition & Types

With a clear understanding of the key elements, the next step is to see how these components come together in a standard salary slip format that employers can use for consistency and compliance.

Sample Salary Slip Format and Template

A standard salary slip template helps employers maintain consistency, reduce payroll errors, and stay compliant with statutory requirements. While formats can be customised, the core components should always remain intact.

Below is a structured salary slip template that covers all essential details:

Salary Slip for the Month of [Month, Year] [Company Name] Employee Details

Earnings and Deductions

Net Salary (₹): [Gross Earnings] minus [Total Deductions] equals [Net Salary] Amount in Words: [Net Salary in Words] Payment Date: [Payment Date] Payment Mode: [Bank Transfer, Cash, Cheque] Authorised Signatory: Name: [Name] |

To clarify the structure, here is an illustrative example of how the above salary slip format appears in practice.

Example Salary Slip (Illustrative)

Salary Slip for the Month of January 2026 ABC Technologies Pvt. Ltd. 123, MG Road, Bangalore, Karnataka, India Phone: +91-9876543210 | Email: hr@abctech.com | Website: www.abctech.com Employee Details

Earnings and Deductions

Net Salary (₹): 77,300 Amount in Words: Seventy-seven thousand three hundred rupees only Payment Date: 31-01-2026 Payment Mode: Bank Transfer Authorised Signatory: Name: Ravi Kumar Designation: HR Manager Signature: ______________________ |

Note: After finalising the salary slip, export it to PDF using Excel or Google Sheets to keep it safe, shareable, and tamper-resistant.

Also Read: Understanding LOP (Loss of Pay) in Salary Slip: Meaning and Definition

Now that we have looked at the salary slip format and an example, let’s understand how these figures relate to your pay, including CTC, gross salary, and in-hand salary.

CTC vs In-hand vs Gross Salary: Key Difference

The table below presents a detailed breakdown of Cost to Company (CTC), Gross Salary, and Net (In-hand) Salary, illustrating which components comprise total compensation and which amounts are actually received.

Salary Component | Definition | Includes / Notes |

Cost to Company (CTC) | Total annual expense incurred for the employee | Gross salary plus employer contributions (PF, insurance, gratuity, leave encashment) and other benefits; some components, like insurance premiums and gratuity, are not directly payable to the employee |

Gross Salary | Total earnings payable before deductions | Cash allowances, basic salary, HRA, special allowances, bonuses, leave salary, part of CTC |

Net / In-hand Salary | Actual amount credited to the employee’s account | Gross salary minus deductions (employee PF/NPS, professional tax, TDS, ESI); this is what the employee actually receives and is reflected on the salary slip |

Example: CTC, Gross Salary, and In-hand Salary

The table below illustrates an employee’s gross salary, CTC, and net (in-hand) salary, including deductions and tax implications. Employer contributions to NPS can be claimed under Section 80CCD(2), and EPF contributions are tax-exempt within statutory limits.

Income | Salary Slip (₹) | Notes | Deductions (₹) |

Basic Salary | 45,000 | Employee PF/NPS contribution | 5,400 |

Dearness Allowance (DA) | 12,000 | Professional Tax | - |

House Rent Allowance (HRA) | 22,000 | Health insurance premium | 250 |

Conveyance Allowance | 2,500 | Travel allowance | 1,200 |

Medical Allowance | 3,000 | Gratuity provision | 350 |

Special Allowance | 18,000 | Other allowances | - |

Employer Contribution to PF/NPS | 5,400 | - | - |

Calculations:

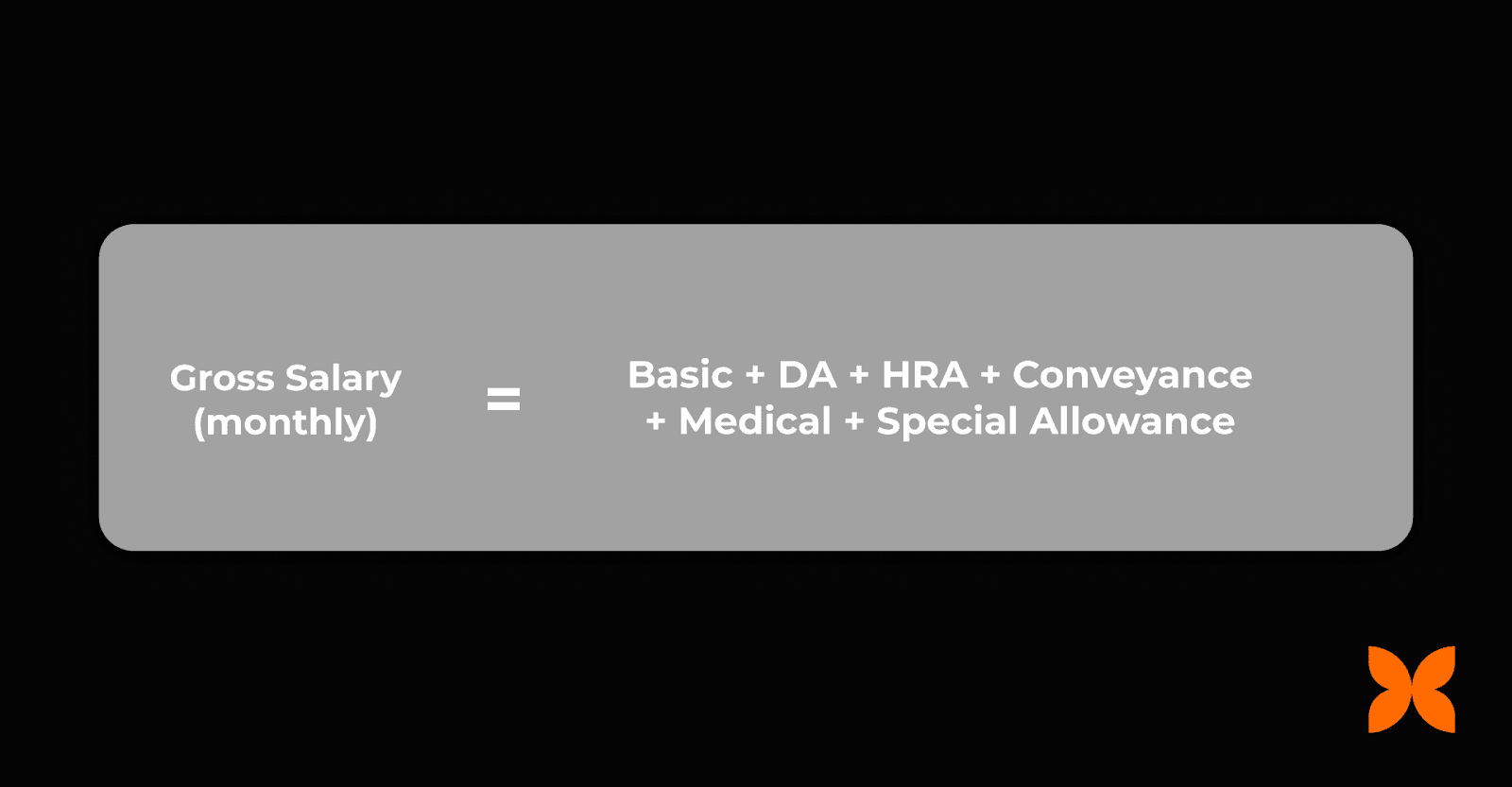

Gross Salary (monthly) = Basic + DA + HRA + Conveyance + Medical + Special Allowance

Gross Salary = 45,000 + 12,000 + 22,000 + 2,500 + 3,000 + 18,000

Gross Salary = ₹1,02,500

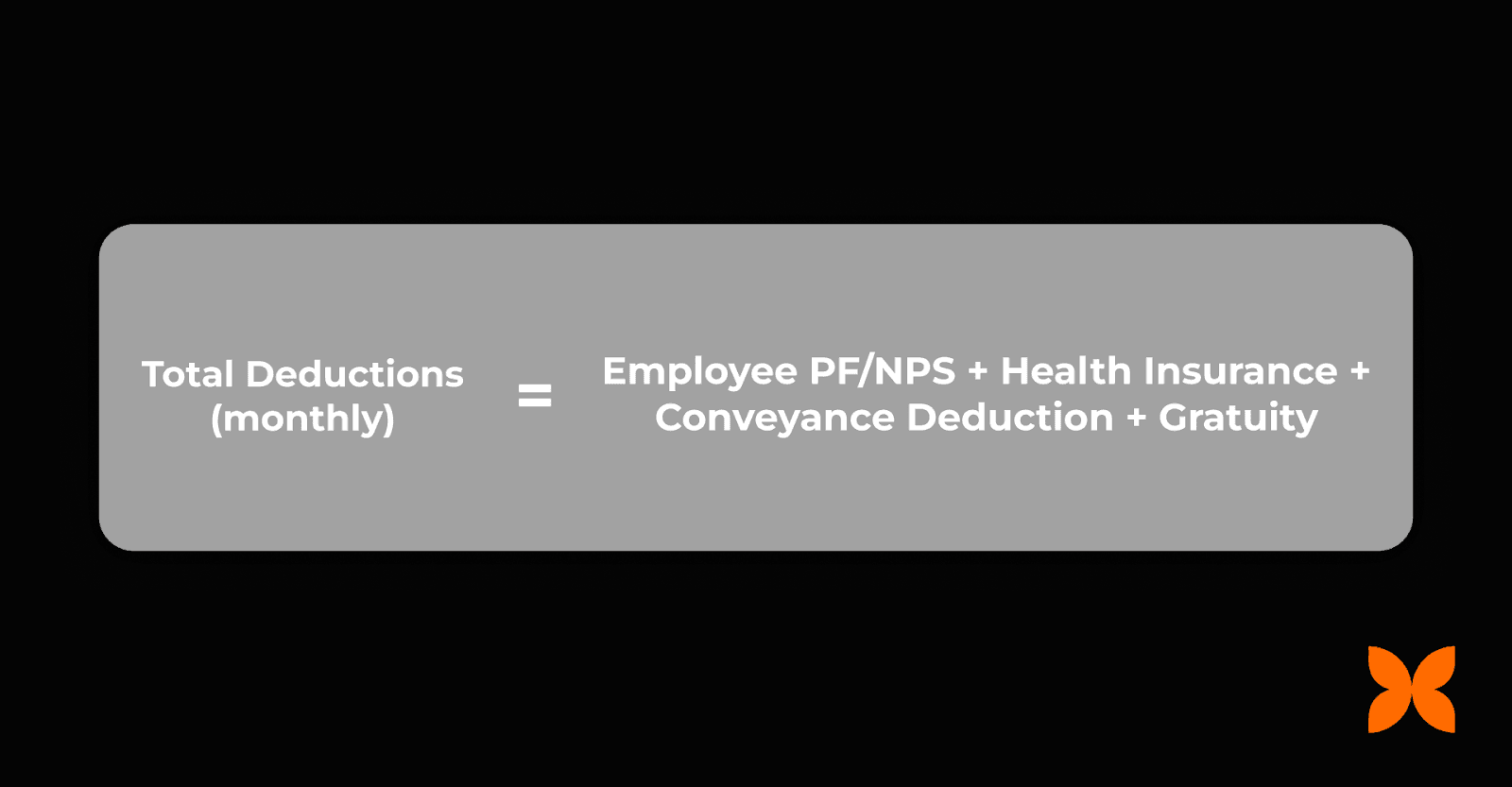

Total Deductions (monthly) = Employee PF/NPS + Health Insurance + Conveyance Deduction + Gratuity

Total Deductions = 5,400 + 250 + 1,200 + 350

Total Deductions = ₹7,200

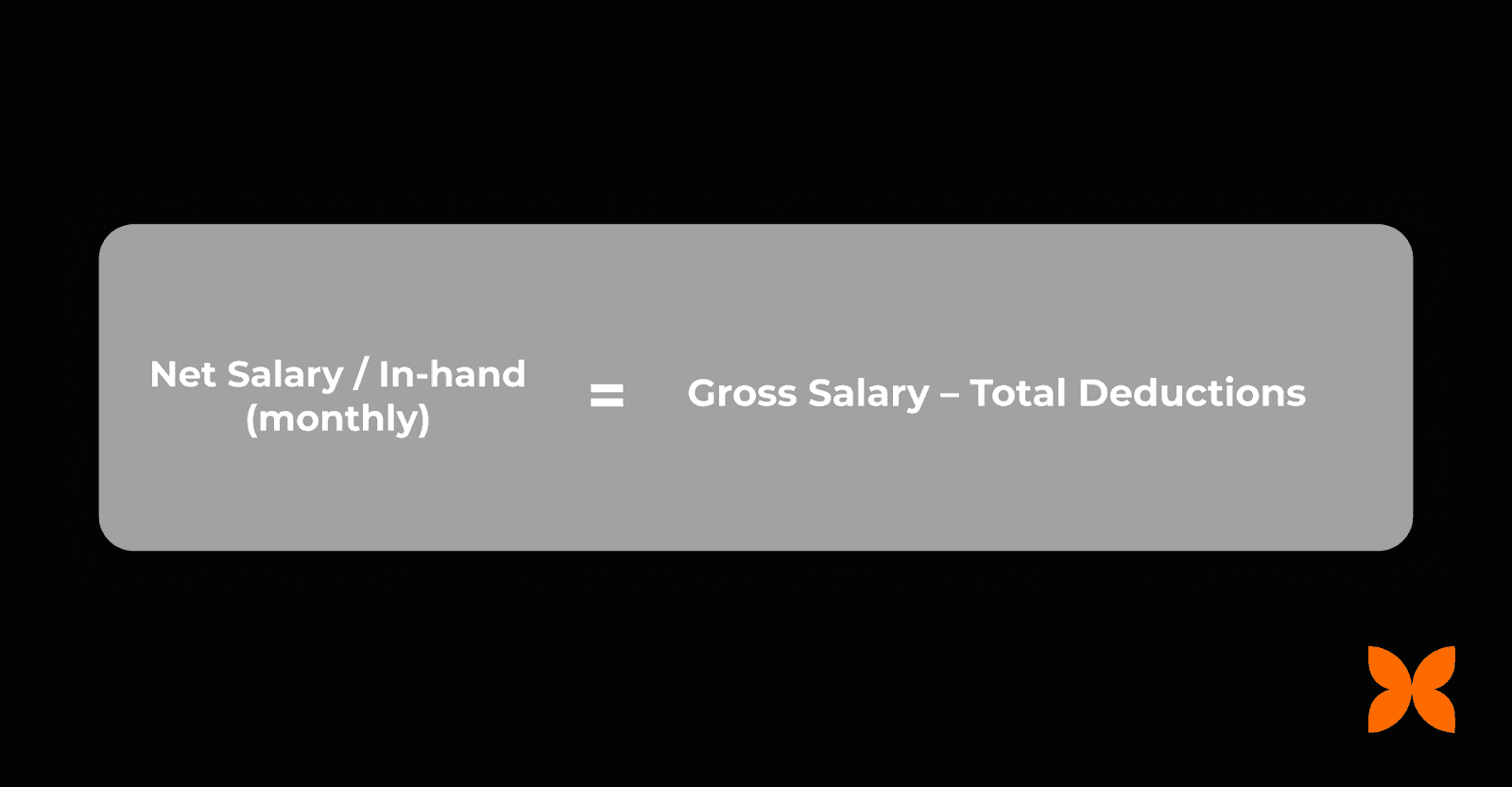

Net Salary / In-hand (monthly) = Gross Salary – Total Deductions

Net Salary = 1,02,500 – 7,200

Net Salary = ₹95,300

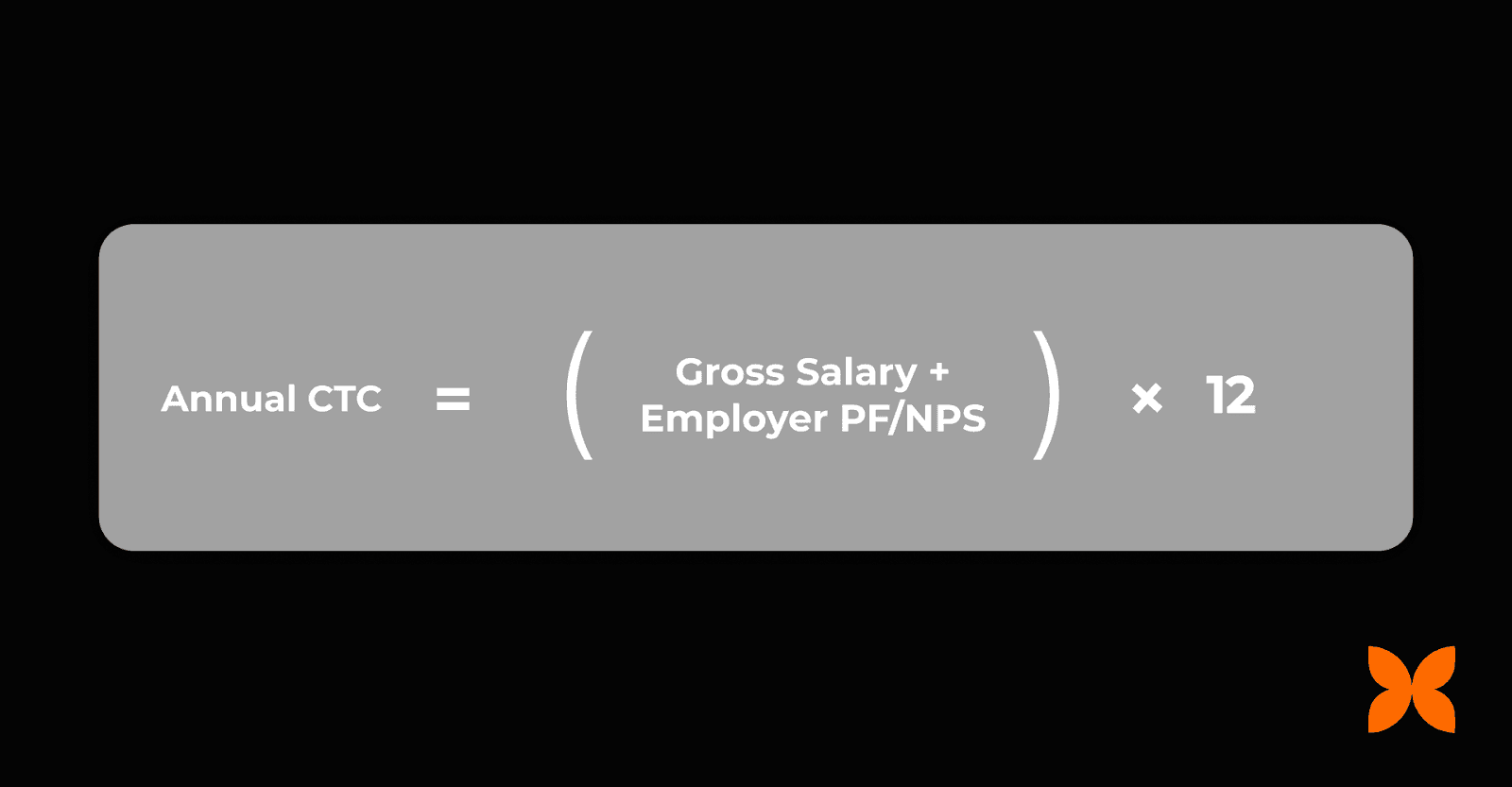

Annual CTC = (Gross Salary + Employer PF/NPS) × 12

Annual CTC = (1,02,500 + 5,400) × 12

Annual CTC = ₹12,94,800

Note: Advance tax is calculated on the gross salary after deductions. Employer contributions to PF, NPS, and gratuity are included in the CTC but are not directly payable to the employee. Special allowances can be provided for work-related expenses and are exempt up to the actual amount spent.

Also Read: Understanding the Meaning and Calculation of Salary Arrears

Conclusion

A well-prepared salary slip ultimately reflects how seriously an employer treats payroll governance. When earnings, deductions, and statutory details are presented clearly, it reduces follow-ups, prevents misunderstandings, and creates confidence in how compensation is handled month after month.

Managing this consistently across teams and pay cycles can be challenging without the right systems in place. Platforms like Craze help you get correct net pay and tax calculations that auto-sync in real time with leave and attendance data, ensuring payroll stays accurate without manual follow-ups.

Ready to stay compliant across every salary slip you generate? Request a Demo to see how Craze payroll software provides out-of-the-box support for tax, labour, wage, and IT laws, keeping salary slips audit-ready.

FAQs

1. Is it mandatory for employers to issue salary slips in India?

Yes. Salary slips are required under the Payment of Wages Act, the Shops and Establishments Acts, and tax regulations. They provide legal proof of income and help avoid disputes, audits, or compliance notices from authorities.

2. Can an employer issue only digital salary slips?

Yes. Digital salary slips are valid if they are secure, tamper-proof, and accessible to employees. Employers must ensure proper authentication and archival for statutory inspections and employee references.

3. How long should employers retain salary slip records?

Employers should retain salary slips for at least seven years, as both income tax and labour authorities may require them during audits, statutory inspections, or legal claims involving employee earnings.

4. Are allowances mandatory components of a salary slip?

Allowances are not mandatory but must be included if paid. Clearly specifying HRA, conveyance, or special allowances prevents misreporting, ensures correct tax treatment, and avoids employee disputes.

5. Can salary slips be corrected after issuance?

Yes. Any errors in earnings or deductions must be corrected immediately. Employers should issue a revised slip, document the reason for the correction, and notify the employee formally to maintain transparency.