For businesses managing growing teams, ensuring accurate attendance data is a constant struggle. Relying on manual systems often leads to payroll discrepancies, time theft, and errors that disrupt operations and create unnecessary administrative work.

A recent example from Cuttack Development Authority, where salaries of 15 employees were withheld due to habitual lateness, highlights the importance of strict attendance audits. Although this example originates from a government body, it highlights the importance of businesses to adopt similar measures.

This blog will show how an effective attendance audit can improve payroll accuracy and help your business maintain smooth operations.

An attendance audit ensures accurate payroll, reduces errors, and helps meet labour law requirements.

Manual attendance systems often cause issues like buddy punching, payroll discrepancies, and compliance problems.

Automated attendance software captures real-time data, preventing time theft and improving payroll accuracy.

The attendance audit process involves collecting data, checking for errors, comparing with payroll, and ensuring legal compliance.

Craze automates attendance management, making audits easier, faster, and more accurate.

An attendance audit is a systematic review of employee time records to find discrepancies, ensure accuracy for payroll/compliance and verify adherence to policies, using digital systems or manual checks to track punctuality, absences, and work hours, flagging issues like missed punches or excessive leave for correction and analysis.

HR and payroll teams typically conduct this audit to ensure there are no discrepancies and that employee attendance records are correctly aligned with the company’s policies.

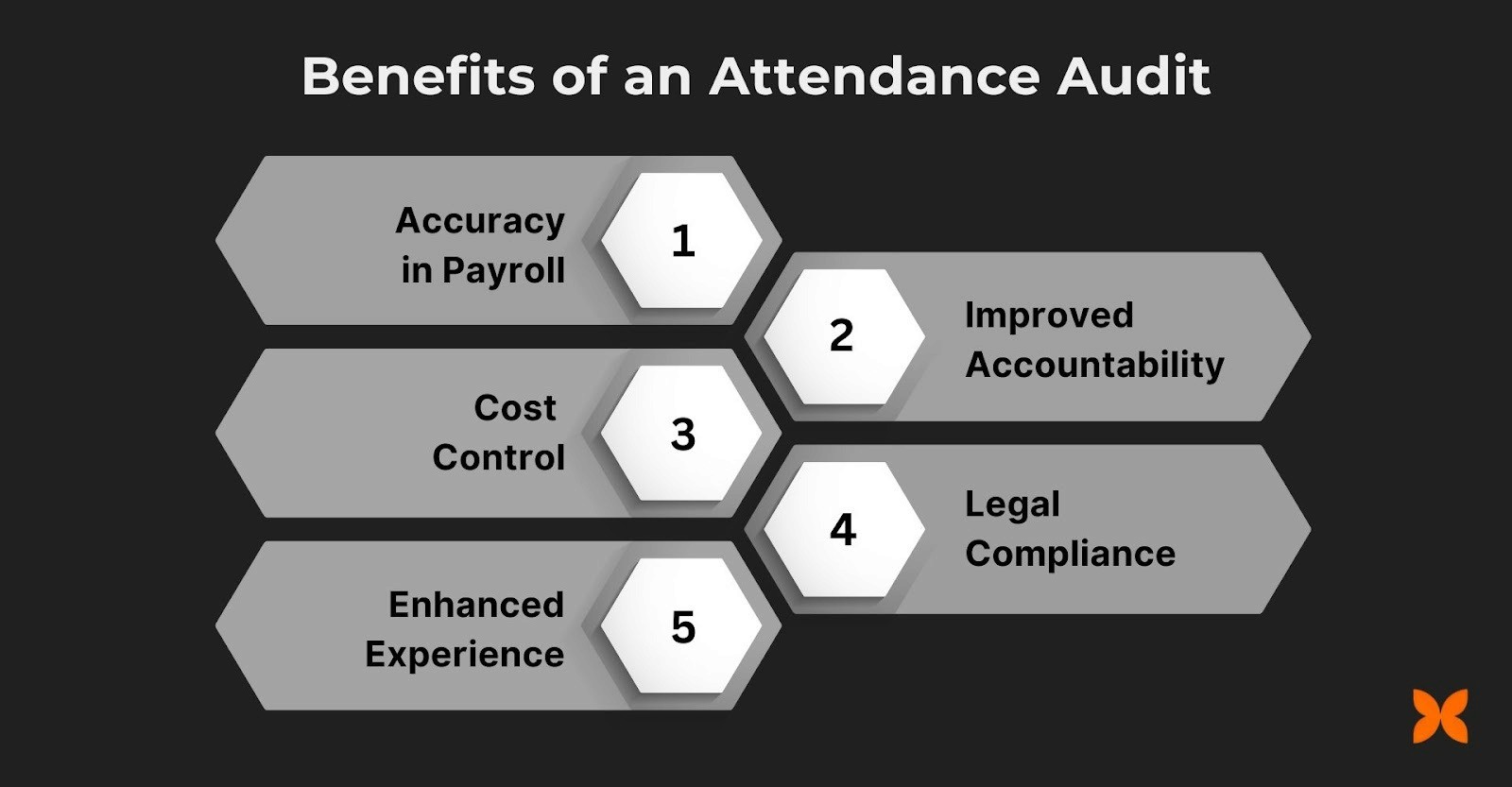

Benefits of an Attendance Audit

An attendance audit ensures accurate records and offers several key benefits that help businesses stay efficient and compliant.

Accuracy in Payroll: Ensures employees are paid correctly based on actual hours worked, preventing payroll discrepancies.

Improved Accountability: Identifies patterns like tardiness or absenteeism, which can be addressed to improve overall productivity.

Cost Control: Helps prevent time theft and fraud, reducing unnecessary payroll costs.

Legal Compliance: Ensures adherence to statutory requirements, including overtime regulations and leave entitlements.

Simplified Reporting: Provides clear, audit-ready reports that can be easily shared with stakeholders or auditors.

However, as businesses grow, managing attendance manually becomes more challenging. This makes it clear why automated systems are becoming essential for accurate audits.

As companies grow, handling attendance manually becomes increasingly difficult. Automated attendance systems offer a better solution for ensuring accurate attendance tracking and easier audits.

Here’s a comparison of how both systems perform in terms of attendance audits:

Criteria | Manual Attendance System | Automated Attendance System |

Accuracy | Susceptible to human errors in data entry. | Ensures accurate and error-free data capture. |

Time Efficiency | Takes time to track and verify manually. | Automates tracking and generates reports quickly. |

Data Access | Hard to retrieve and prone to loss. | Digital storage makes it easy to access and secure. |

Real-Time Tracking | Delayed recording of attendance. | Tracks attendance in real-time using technology. |

Error Detection | Errors are spotted only during manual checks. | Flags errors immediately, speeding up corrections. |

Compliance | Manual checks for legal requirements can be missed. | Automatically tracks and ensures compliance with laws. |

Employee Accountability | Susceptible to buddy punching. | Reduces fraud with biometric or GPS-based tracking. |

Integration with Payroll | Manual entry into payroll systems leads to errors. | Directly integrates with payroll for accurate payments. |

Audit Readiness | Takes time to prepare records for audits. | Generates audit-ready reports instantly. |

Scalability | Becomes harder to manage as the team grows. | Easily handles large teams with minimal effort. |

With these differences in mind, it’s clear that switching to an automated system can simplify the process. Let’s now look at the practical steps to carry out an effective attendance audit.

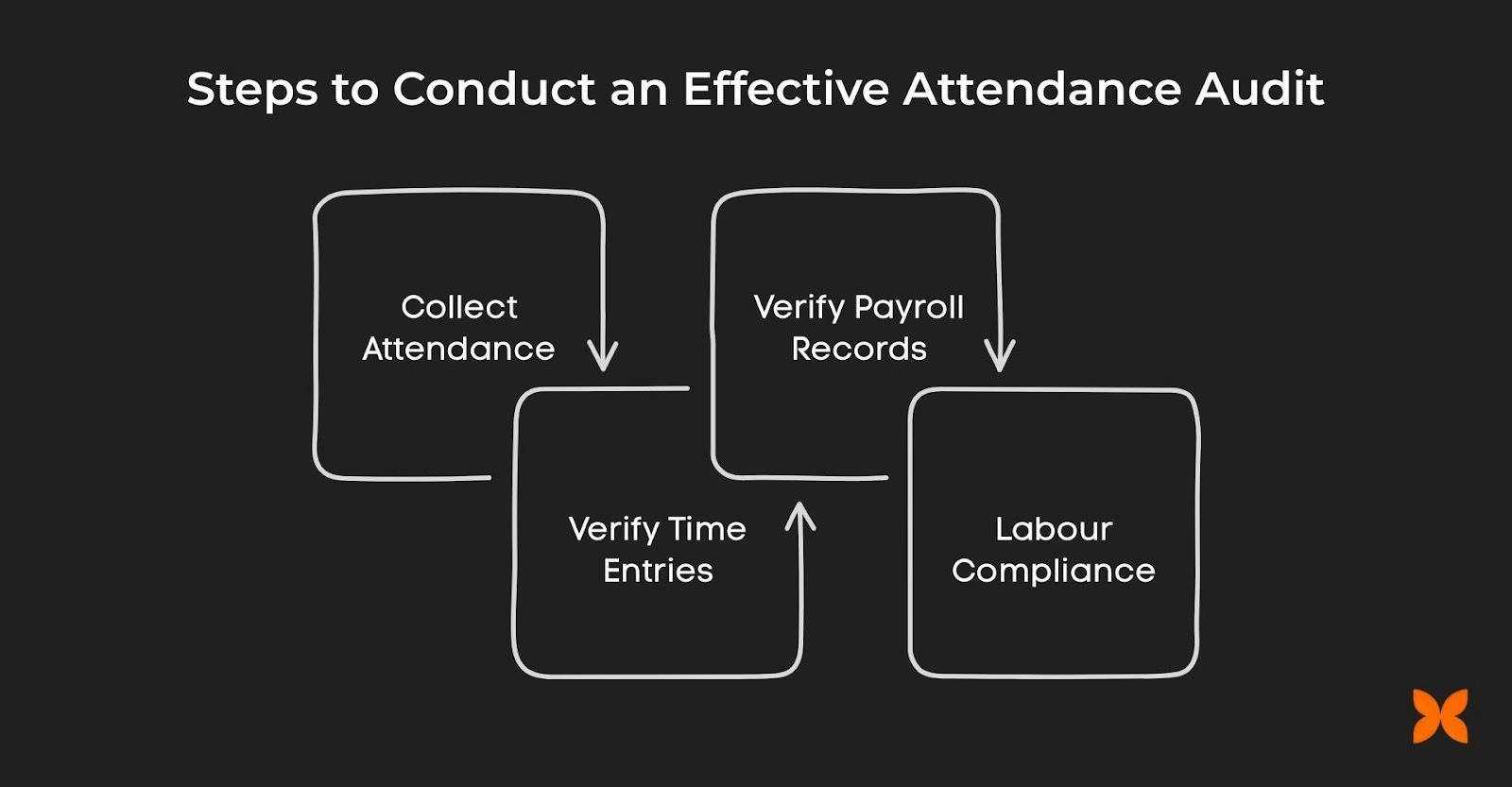

An attendance audit can be completed smoothly if approached methodically. Here are the key steps to ensure an accurate and efficient audit process:

Step 1. Gather Attendance Data

Start by collecting all the necessary attendance data from your automated system. Accurate data is crucial for a reliable audit. The more precise your data collection method, such as using biometric verification or geolocation tracking, the more trustworthy your audit will be.

Retrieve attendance records for the entire audit period, ensuring they are current and complete.

Ensure that all working hours, including overtime, shift hours, and absences, are correctly captured.

Double-check that employee details, like department and location, are accurate in the attendance records to avoid mismatches during the audit.

Gather data from all sources, including biometric devices, mobile apps, and geolocation systems, to ensure no data is overlooked.

Step 2. Check for Errors in Time Entries

Next, verify the accuracy of the time entries. Look for discrepancies that may indicate issues like time theft or errors stemming from manual data input.

Review each employee’s total hours worked and look for any irregularities such as unusually high or low totals.

Check for missing entries or incorrect clock-ins/outs that may suggest time theft or human error.

Investigate any overtime discrepancies to ensure they align with company policies and relevant legal regulations.

Ensure absence records are properly tracked, with no unauthorised time off or inaccuracies in sick leave or personal days.

Step 3. Cross-Verify with Payroll Records

Once you have the attendance data, compare it with the payroll records to ensure everything aligns. Flag and address any discrepancies before proceeding with the audit.

Cross-check attendance hours with payroll data to ensure that employees are paid accurately for the time they worked.

Look for mismatches between recorded attendance and deductions (e.g., leave without pay, unpaid time off) that might affect payroll.

Ensure that overtime and bonus payments are calculated properly based on actual attendance and work hours.

Pay attention to any discrepancies between reported hours and the payments made, especially for seasonal or contract workers.

Step 4. Review Compliance with Labour Laws

Ensure that the attendance data aligns with relevant statutory requirements, such as minimum working hours, overtime, and leave entitlements. Proper compliance is critical to avoid legal issues and fines.

Confirm that employees’ total working hours do not exceed statutory limits, including any restrictions on overtime.

Verify that overtime payments are being made according to labour laws and company policy.

Ensure that leave entitlements, including sick leave, paid time off, and maternity leave, are correctly recorded and used according to legal guidelines.

Double-check that any mandatory breaks or public holidays are reflected accurately in the data, ensuring no violations of work-hour regulations.

To make these steps easier and more accurate, Craze offers a solution that automates and streamlines the entire attendance audit process.

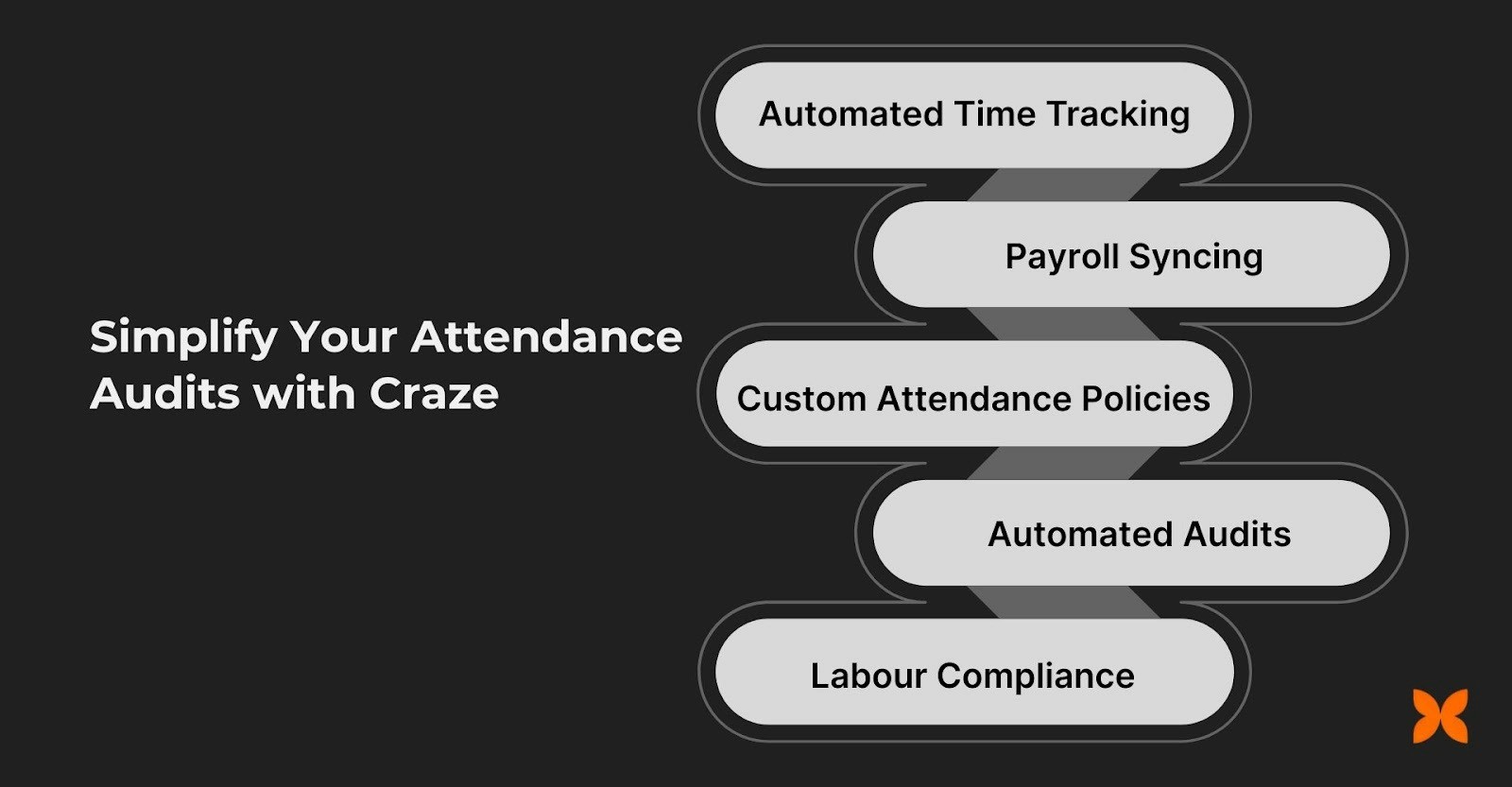

Managing attendance audits can be time-consuming and error-prone. Craze’s Attendance Management System automates the entire process, making audits more efficient and accurate.

1. Automated Time Tracking

Craze automates time tracking, ensuring that every work hour is accurately recorded, whether in the office, remotely, or in the field.

Biometric Integration: Prevents buddy punching and ensures employees mark their own attendance.

Geo-location and Fencing: Tracks clock-ins and outs based on location, ensuring compliance.

Overtime Tracking: Automatically calculates overtime based on customised settings.

2. Real-Time Syncing with Payroll

With Craze, attendance data is instantly synced with payroll, reducing errors and manual work.

Error-Free Payroll: Attendance and payroll are seamlessly integrated for accurate salary calculations.

Instant Updates: Any changes in attendance are reflected immediately, ensuring real-time adjustments.

3. Customisable Attendance Policies

Craze lets you tailor attendance policies to suit your business needs, ensuring audits are aligned with company rules.

Attendance Regularisation: Automate approval processes for leave and attendance adjustments.

Flexible Work Hours: Set rules for half-days, overtime, and minimum working hours.

4. Automated Reports for Easy Audits

Generate detailed, audit-ready reports with just a few clicks, ensuring accuracy and clarity in your audit process.

Timeline View: Quickly see trends in employee attendance over selected periods.

Downloadable Reports: Export attendance records easily for sharing and further review.

5. Compliance with Labour Laws

Ensure your attendance data complies with Indian labour laws to avoid legal issues during audits.

Built-In Compliance: Craze tracks working hours, overtime, and leave in line with statutory requirements.

Customisable Settings: Adjust policies to fit local regulations and specific business needs.

For business sectors like finance, accounting, e-commerce, IT, and SaaS, accurate attendance tracking is vital for smooth operations and effective financial management. As HR, finance, or IT leaders, you know that manual processes can lead to errors, compliance risks, and unnecessary administrative work that hold back growth.

Craze provides a simple solution to these challenges. By automating attendance tracking, payroll integration, and compliance, Craze helps streamline your operations, reduce mistakes, and give you more time to focus on scaling your business.

Q1. How can I identify and address recurring attendance issues within my team?

A1. Regularly reviewing attendance data helps identify patterns. By analysing this data, you can implement targeted strategies to address these issues, such as adjusting work schedules or providing additional training.

Q2. What are the legal requirements for maintaining attendance records in India?

A2. Under the Companies Act, 2013, all companies in India are mandated to maintain an audit trail for all transactions, including attendance records. This ensures transparency and accountability in business operations.

Q3. How can I prevent attendance fraud in my organisation?

A3. Implementing biometric systems and geo-fencing can significantly reduce instances of proxy attendance and time theft. These technologies ensure that attendance is recorded accurately and only by the actual employee.

Q4. What features should I look for in attendance management software?

A4. Key features include real-time tracking, integration with payroll systems, automated alerts, and robust reporting capabilities. These functionalities help maintain accurate attendance records and simplify the audit process.

Q5. How can attendance audits improve employee productivity?

A5. By identifying patterns in attendance, such as frequent lateness or absenteeism, businesses can address productivity issues proactively. Implementing clear policies based on audit data encourages accountability and helps maintain workforce efficiency.