Understanding how to calculate Provident Fund (PF) from an employee’s Cost to Company (CTC) is crucial for both accurate payroll and statutory compliance. Although PF is included as part of the CTC, it is not calculated on the total CTC; rather, it is based solely on the basic salary, with both the employer and employee contributing 12% each.

Accurate calculation ensures employees build a reliable retirement corpus while helping employers avoid legal issues, penalties, and payroll discrepancies. Misunderstanding the difference between CTC and the PF calculation base is a common source of errors in salary structuring.

This guide explains step by step how to calculate PF from CTC, including contribution splits, wage ceilings, and tax implications. Following these rules allows employers to maintain compliance, plan costs effectively, and helps employees understand how their retirement savings grow over time.

To calculate PF from CTC, first identify the Basic Salary, as PF contributions are based only on this component.

Employer contributions are split between EPF and EPS, with EPS capped at ₹1,250 per month.

PF contributions offer tax benefits to employees and are deductible for employers.

Compliance requires timely deposits, accurate ECR filing, and proper record maintenance.

Errors in PF calculation can lead to penalties, disputes, and compliance issues, making automation helpful.

Provident Fund is a statutory retirement savings scheme governed by the Employees’ Provident Funds (EPF) and Miscellaneous Provisions Act, 1952. Both the employee and the employer contribute a portion of their salaries to PF. Over time, these savings grow with interest, and employees can access the fund when they retire or in emergencies, such as medical needs.

Cost to Company represents the total annual cost incurred by an employer for an employee. It includes fixed salary components, variable pay, benefits, statutory contributions, and employer-paid allowances. CTC is a compensation packaging concept and not a statutory calculation base.

Example CTC Structure: An employee with a CTC of ₹10,00,000 may have the following components. Together, these elements represent the total cost borne by the employer.

Basic Salary: Fixed component forming the base for PF and other statutory calculations

House Rent Allowance (HRA): Allowance provided to meet rental housing expenses

Special Allowance: Residual component used to balance the salary structure

Employer PF Contribution: Statutory contribution included within CTC but not paid as cash to the employee

Insurance or Other Benefits: Employer-paid health insurance or similar benefits

The employer’s Provident Fund contribution is included in the CTC figure, even though it does not form part of the employee’s take-home salary.

With PF and CTC defined, it is important to clarify the actual salary component on which the Provident Fund is legally calculated.

Provident Fund is not calculated on CTC. The PF contribution is calculated only on the employee’s eligible wages, which include basic salary and dearness allowance, as defined under the EPF Act. Other salary components such as HRA, bonuses, and special allowances are excluded from the PF calculation.

CTC comes into the picture only for cost structuring. In most organisations, the employer’s PF contribution is included in the CTC, so it is not an additional expense over and above the offered CTC. It is simply a statutory cost accounted for within the total compensation package.

Key Clarification for Employers

Calculation base: Eligible components of salary, such as Basic, Special Allowance, and other components as defined under the EPF Act.

Accounting placement: Employer PF contribution is usually included in CTC

Statutory responsibility: Employer is legally responsible for the correct calculation and timely deposit

Understanding this distinction helps employers design accurate salary structures, avoid compliance errors, and prevent payroll disputes with employees.

Now that you understand the basics, let’s see in detail how employer and employee contributions are distributed in the CTC.

Both the employer and the employee contribute to the Provident Fund (PF). While the contribution rate is the same for both parties, the way these contributions are allocated differs. Together, these contributions form the foundation of an employee’s long-term retirement savings.

1. Employee’s Contribution

The employee contributes 12% of their basic salary towards the Provident Fund. This amount is deducted from the employee’s monthly salary and credited in full to the EPF account. The entire employee contribution earns interest and becomes part of the employee’s retirement corpus.

Example: If an employee has eligible wages of ₹15,000 per month, the employee’s PF contribution will be 12% of that amount, or ₹1,800 per month.

2. Employer’s Contribution

The employer contributes 12% of the employee’s basic salary towards the Provident Fund. This contribution is divided between two statutory schemes as prescribed under EPF regulations.

Employees’ Pension Scheme (EPS): Up to 8.33% of the employer’s contribution is allocated to EPS, subject to a maximum of ₹1,250 per month, calculated on the statutory wage ceiling of ₹15,000.

Employees’ Provident Fund (EPF): The remaining portion of the employer’s contribution, after the EPS allocation, is credited to the employee’s EPF account.

Note: When PF is restricted to the statutory wage ceiling, it typically amounts to 3.67% of salary. If PF is calculated on the full basic salary, the EPF portion increases accordingly.

Example: If an employee’s basic salary is ₹50,000, the employer’s total PF contribution will be 12% of ₹50,000 = ₹6,000 per month. Out of this amount, ₹1,249.50 is allocated to EPS, and the remaining ₹4,750 is credited to the employee’s EPF account.

Employers must also ensure that both contributions are remitted to the PF authorities on time. Failure to do so can lead to penalties or legal action.

Also Read: Understanding PF Arrears and Payment Processes

While both contributions play a role, let’s break down how to actually calculate the PF from the total CTC, ensuring no steps are missed.

Understanding how PF is calculated from an employee’s CTC is essential for accurate payroll structuring and statutory compliance. While PF is included as a cost within CTC, it is not calculated directly on CTC. PF contributions are based on eligible wages, subject to a statutory ceiling of ₹15,000 per month.

Let’s break down the steps clearly:

Step 1: Determine the PF Calculation Base

EPF contributions are payable on eligible wages, subject to a monthly wage ceiling of ₹15,000. Some employers contribute the minimum statutory amount of ₹1,800 per month (12% of ₹15,000) to provide a higher in-hand salary.

Most employers contribute 12% of eligible wages, capped at ₹15,000 for statutory calculation. Employees may choose to contribute more through the VPF(voluntary provident fund), but the employer is not obliged to match contributions above the statutory 12%.

Example: Ravi’s eligible wages for PF calculation are capped at ₹15,000 (statutory ceiling applied), which is the most common scenario. Both the employee and employer contribute 12% each on this wage ceiling.

Employee contribution: 12% of ₹15,000 = ₹1,800

Employer contribution: 12% of ₹15,000 = ₹1,800

Step 2: Calculate the Employee’s PF Contribution

The employee contributes 12% of eligible wages towards the Provident Fund. This amount is deducted from the employee’s monthly salary and fully credited to the EPF account, where it earns interest and grows the retirement corpus.

Calculation (using statutory ceiling):

Eligible wages for PF = ₹15,000 (ceiling applied)

Employee PF = 12% of ₹15,000 = ₹1,800 per month

This ₹1,800 is fully credited to Ravi’s EPF account each month.

Step 3: Calculate the Employer’s Total PF Contribution

The employer also contributes 12% of eligible wages towards PF. This contribution is part of the employee’s CTC and is not paid in cash. The total contribution is split between EPF and EPS in accordance with the statutory rules.

Calculation:

Eligible wages (subject to statutory ceiling) = ₹15,000

Employer PF contribution = 12% of ₹15,000 = ₹1,800 per month

Step 4: Allocate Employer Contribution Between EPS and EPF

From the employer’s 12% contribution, a portion is allocated to the EPS. EPS is calculated at 8.33% of the statutory wage ceiling of ₹15,000, not on the full basic salary. Therefore, the maximum EPS contribution is capped at ₹1,249.50 per month, even if the employee’s actual basic salary is higher.

Calculation of employer split (based on ₹15,000 ceiling):

Employer PF contribution = 12% of ₹15,000 = ₹1,800

EPS contribution = 8.33% of ₹15,000 = ₹1,249.50

Remaining employer contribution credited to EPF = 1,800 − 1,249.50 = ₹550.50

So, out of the employer’s contribution:

₹1,249.50 goes to EPS

₹550.50 is credited to Ravi’s EPF account

Step 5: Determine the Total Monthly PF Cost and EPF Credit

The total monthly PF cost is the combined contribution of the employee and the employer. However, only the EPF portions are credited to the employee’s Provident Fund account.

Monthly contributions for Ravi (based on ₹15,000 ceiling):

Employee EPF contribution: ₹1,800

Employer EPF contribution: ₹550.50

Employer EPS contribution: ₹1,249.50

Additional employer costs (EDLI + Administrative Charges 0.5% + 0.5% of ₹15,000): ₹150

Total monthly PF cost from the employer’s perspective:

Employer EPF + EPS + EDLI/Admin = 550.50 + 1,249.50 + 150 = ₹1,950

Total monthly amount credited to Ravi’s EPF account:

Employee EPF + Employer EPF = 1,800 + 550.50 = ₹2,350.50

The employer’s EPS contribution of ₹1,249.50 is credited to the employee’s EPS account. If the employee is exempt from EPS (e.g., joined after 01-09-2014 with wages above ₹15,000 and no EPS applicable), the entire employer contribution will be credited to the EPF account instead.

Step 6: Calculate the Annual PF Contribution and Annual EPF Credit

To calculate the annual PF contribution, multiply the monthly contributions by 12. The EPF credit and EPS contribution must be viewed separately.

Annual calculations (based on ₹15,000 ceiling):

Employee EPF contribution: ₹1,800 × 12 = ₹21,600

Employer EPF contribution: ₹550.50 × 12 = ₹6,606

Employer EPS contribution: ₹1,249.50 × 12 = ₹14,994

Employer EDLI + Admin Charges: ₹150 × 12 = ₹1,800

Total annual PF cost: ₹45,000

Breakup:

Annual EPF credit to employee account: ₹21,600 + ₹6,606 = ₹28,206

Annual EPS contribution: ₹14,994

Employer EDLI + Admin: ₹1,800

This means that out of the total annual PF contribution credited to accounts, ₹28,206 is credited to Ravi’s EPF account, while ₹14,994 is allocated to the EPS. In addition, the employer bears ₹1,800 annually for EDLI and administrative charges, which is over and above the statutory contributions.

Understanding this breakup helps employees clearly see how much actually builds their PF balance and how much goes toward pension benefits.

Also Read: Statutory Salary Deductions Explained for Employees

In the next section, we will examine how PF calculations change when applied to the statutory wage ceiling versus the full basic salary.

Under the Employees’ Provident Funds and Miscellaneous Provisions Act, the statutory wage ceiling for mandatory PF contribution is ₹15,000 per month. When an employee’s basic salary exceeds this limit, employers need to determine how PF contributions will be calculated. This decision directly impacts payroll costs, employee retirement savings, and long-term compliance.

Once the basic salary crosses the statutory threshold, employers have two legally permitted approaches for calculating PF contributions:

Option 1: Restricted PF Contribution (Statutory Minimum Requirement)

Under this approach, PF contributions are capped at the wage ceiling of ₹15,000, even if the employee’s actual basic salary exceeds this limit.

PF calculation base: ₹15,000

Employer PF contribution: 12% of ₹15,000 = ₹1,800 per month

EPS contribution: ₹1,249.50

Employer EPF portion: ₹1,800 − ₹1,250.50 = ₹550.50

This is the most commonly adopted model, as it controls statutory costs while remaining fully compliant.

Option 2: Full Basic Salary PF Contribution (Employer Policy Decision)

In this approach, PF is calculated on the actual basic salary, not limited to ₹15,000. This results in higher contributions and higher long-term retirement benefits for the employee.

PF calculation base: Actual basic salary

Employer PF contribution: 12% of basic salary

EPS contribution remains capped at ₹1,250

The remaining employer contribution flows into the EPF

Note: Once an organisation adopts PF calculation on the full basic salary for an employee category, reverting to restricted contribution later requires regulatory approval and cannot be done unilaterally.

PF Contribution Examples Based on CTC Structure

CTC | Basic Salary | PF Calculation Basis | Employer PF Contribution |

₹6,00,000 | ₹20,000 | Restricted to ₹15,000 | ₹1,800 |

₹6,00,000 | ₹20,000 | Full basic salary | ₹2,400 |

₹10,00,000 | ₹40,000 | Restricted to ₹15,000 | ₹1,800 |

₹10,00,000 | ₹40,000 | Full basic salary | ₹4,800 |

What This Means for Employers:

Restricted PF offers cost predictability and simpler payroll management

Full basic PF increases retirement value but raises long-term payroll liability

The choice should be documented in the salary structure and employment terms

Understanding this distinction is critical for avoiding retrospective PF demands, payroll disputes, and compliance exposure.

Also Read: ESI Contribution and Calculation in Salary

With the basic PF computation and wage ceiling clarified, it’s important to understand the factors that influence the total PF amount.

While PF contributions are primarily based on the basic salary, several other factors influence the final amount contributed to the EPF and EPS. Understanding these factors is crucial for employers to ensure accurate payroll, maintain compliance, and help employees maximise retirement benefits.

1. Basic Salary

The fundamental factor in PF calculation is the employee’s basic salary. Both the employee’s and employer’s contributions are calculated as a percentage of this amount. Any increase or decrease in basic salary directly impacts the PF contribution.

Example: If Ravi’s basic salary is ₹50,000, his monthly employee contribution is ₹6,000, and the employer’s EPF portion is ₹4,750. A salary hike to ₹60,000 raises the employee contribution to ₹7,200 and the employer EPF portion to ₹5,350.

2. Allowances

PF is calculated only on eligible salary components, including basic salary, dearness allowance (if applicable), and certain fixed special allowances. Components like HRA, conveyance, performance incentives, and reimbursements are generally excluded from PF calculations.

Example: Ravi earns a basic salary of ₹50,000 and HRA of ₹10,000. PF is calculated only on ₹50,000, not on the combined ₹60,000.

3. Voluntary Provident Fund (VPF)

Employees can opt to contribute more than the mandatory 12% via VPF. These voluntary contributions are added to the employee’s EPF balance but are separate from the employer’s mandatory contribution.

Example: Ravi chooses to contribute an additional 5% of basic salary through VPF. His monthly VPF contribution = 5% of ₹50,000 = ₹2,500. Total monthly employee contribution = ₹6,000 + ₹2,500 = ₹8,500.

4. Pension Fund Allocation (EPS)

A fixed portion of the employer’s PF contribution, up to 8.33% of the statutory wage ceiling of ₹15,000, is allocated to EPS. This cap ensures uniform pension benefits but reduces the EPF portion if the salary exceeds ₹15,000.

Example: For Ravi with a basic salary of ₹ 50,000, the EPS contribution is ₹1,250. Remaining employer contribution credited to EPF = ₹4,750.

5. Salary Structure Changes

Changes in salary, such as promotions, increments, or temporary allowances, directly affect the PF contributions. Employers must update payroll calculations accordingly to ensure compliance and accurate PF credits.

Example: If Ravi receives a bonus or allowance that increases his basic pay to ₹55,000, employee and employer contributions must be recalculated based on the new basic salary.

6. Statutory Wage Ceiling

When the basic salary exceeds ₹15,000, employers must decide whether PF contributions are restricted to the statutory ceiling or based on the full basic salary. This decision impacts long-term retirement savings and compliance obligations.

Example:

Restricted PF: Contribution calculated on ₹15,000 → Employer EPF = ₹550, EPS = ₹1,250

Full basic PF: Contribution calculated on ₹50,000 → Employer EPF = ₹4,750, EPS = ₹1,250

Understanding these factors helps employers ensure accurate payroll, maintain statutory compliance, avoid penalties, optimise employee retirement benefits by correctly applying PF credits, and plan for long-term payroll costs effectively.

Now that you know the contributing factors, let's explore how these contributions can benefit your employees and provide tax advantages.

A Provident Fund (PF) isn’t just about saving for retirement; it offers valuable tax benefits for both employees and employers. Understanding these benefits helps both parties plan better for the future and manage their finances more efficiently.

1. Tax Benefits for Employees

PF contributions by employees offer multiple tax advantages:

Deduction under Section 80C: Employee contributions up to ₹1.5 lakh per financial year are eligible for deduction, reducing taxable income.

Tax-Free Interest: Interest earned on PF is generally tax-free. However, if annual contributions exceed ₹2.5 lakh (or ₹5 lakh for government employees), the interest on the excess is taxable, and TDS may apply.

Tax-Free Withdrawal: PF withdrawals are tax-free if the employee has completed at least 5 continuous years of service. Early withdrawals are subject to TDS (Tax Deducted at Source).

Example (Ravi):

Employee monthly contribution: ₹6,000

Employee annual contribution: ₹6,000 × 12 = ₹72,000

Section 80C deduction: ₹72,000

Interest earned (8% per annum): ₹10,320

Total PF balance at year-end (excluding employer portion): ₹72,000 + ₹10,320 = ₹82,320

Note: Employer contributions exceeding ₹7.5 lakh per year to PF, NPS, or superannuation funds are taxable as perquisites, and interest earned on such excess is also taxable. Separately, interest on employee PF contributions exceeding ₹2.5 lakh per year (₹5 lakh if there is no employer contribution) is taxable.

2. Tax Benefits for Employers

Employers also gain financial advantages from contributing to PF:

Tax-Deductible Expense: Employer PF contributions are deductible as a business expense, thereby lowering the company’s taxable income.

Compliance Protection: Proper PF contributions help employers avoid fines, penalties, or legal action from the Employees' Provident Fund Organisation (EPFO).

Retention and Morale: Demonstrating commitment to employee retirement benefits indirectly reduces turnover and improves employee satisfaction.

Example (Ravi):

Employer total monthly contribution: ₹6,000

Employer EPF portion: ₹4,750

Employer EPS portion: ₹1,250

Annual PF expense for Ravi: ₹6,000 × 12 = ₹72,000

EPF credited to Ravi: ₹4,750 × 12 = ₹57,000

EPS contribution: ₹1,250 × 12 = ₹15,000

3. Long-Term Advantages

PF contributions, combined with interest and pension components, provide financial security for employees while offering predictable tax treatment for employers:

Retirement Corpus Growth: Employees accumulate a substantial retirement corpus over time.

For example, for Ravi, the total annual EPF contribution plus interest = ₹57,000 + ₹10,320 ≈ ₹67,320.

Business and Compliance Gains: Employers gain statutory compliance and enhanced employer branding by contributing to PF and following legal norms.

Financial Planning and Visualisation: A proper understanding of tax benefits enables better payroll and compensation planning and helps employees visualise their actual savings growth.

Note: PF interest rates are announced annually by EPFO and may vary each year, affecting the accumulation of the total retirement corpus.

By integrating PF contributions into your business's planning, you ensure compliance with tax regulations and demonstrate a commitment to your employees' long-term financial well-being.

Also Read: Income Tax on Provident Fund and Gratuity Explained

Tax benefits are only part of the picture. There are also legal obligations that employers need to be aware of, which we'll explore next.

Understanding PF obligations is crucial for employers to ensure compliance, avoid penalties, and maintain employee trust. Once an establishment falls under PF coverage, responsibilities are ongoing, and adherence is mandatory.

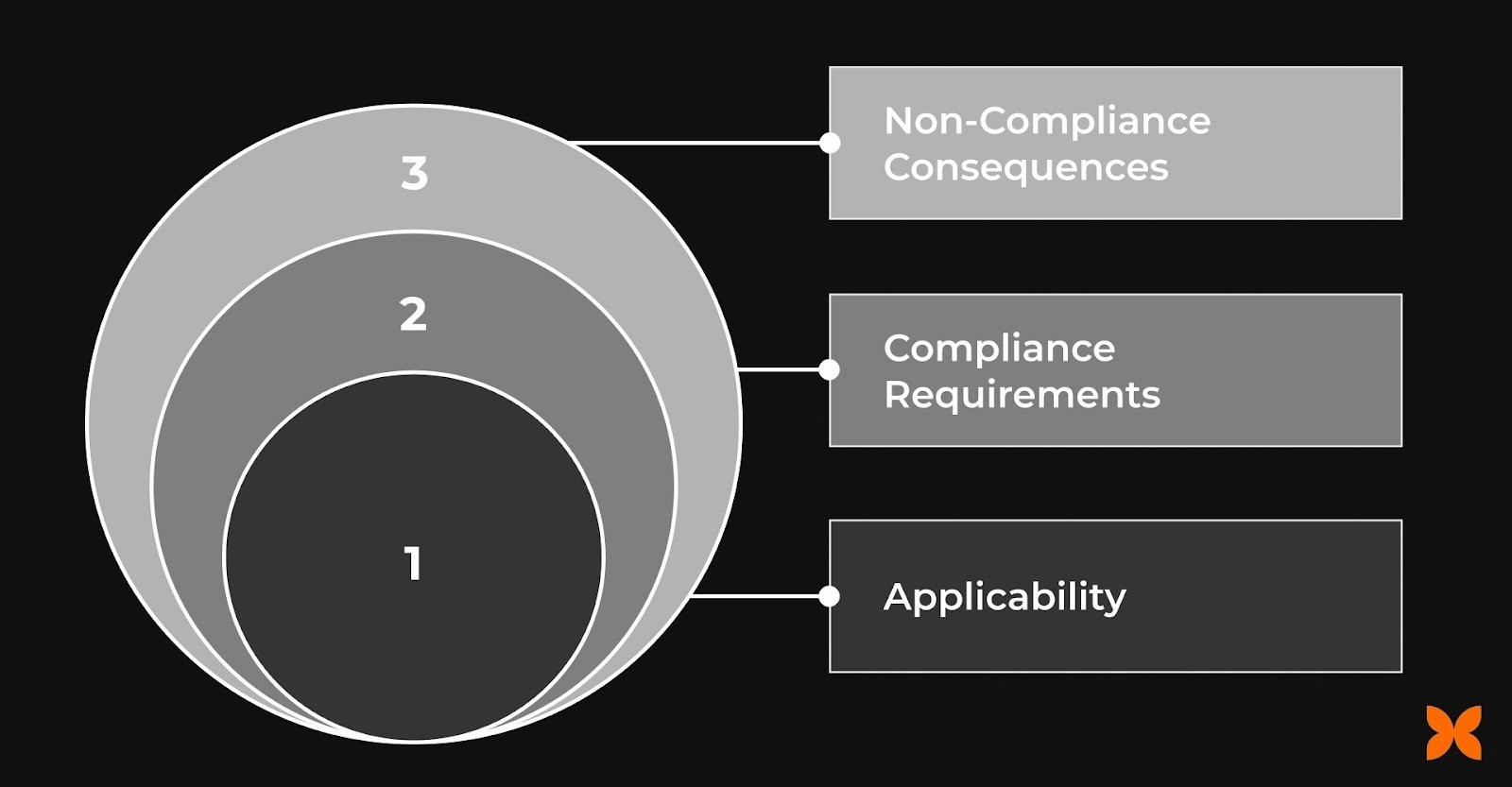

1. Applicability: Employers must know when PF rules apply and who can voluntarily register:

Mandatory for establishments with 20 or more employees.

Voluntary registration is allowed for establishments with fewer than 20 employees.

Coverage continues permanently once applicable, even if the employee count drops below the threshold.

2. Compliance Requirements: Employers are legally required to maintain correct PF operations each month:

Timely Monthly Deposits: Both employer and employee contributions must be deposited into the EPF account by the 15th of the following month.

Accurate ECR Filing: Submit the Electronic Challan cum Return (ECR) with precise employee details.

Record Maintenance: Maintain proper documentation of employee PF contributions, including EPF and EPS splits, for statutory verification.

3. Non-Compliance Consequences: Failing to comply can lead to financial and legal penalties:

Interest on delayed or incomplete PF payments.

Monetary damages and penalties under EPF regulations.

Legal inspections and potential proceedings by the EPFO for repeated violations.

Even with clear rules, PF calculations can go wrong if attention to detail is lacking. Let’s explore the common mistakes employers make.

Even experienced payroll teams sometimes commit errors that can lead to compliance issues or employee disputes. Awareness of these mistakes allows organisations to correct them proactively.

Calculating PF on CTC instead of Basic Salary: PF must be computed on eligible wages, not total CTC.

Ignoring EPS Contribution Limits: Employers must adhere to the statutory EPS cap of ₹1,250 per month.

Incorrect Head Contributions: Depositing EPS funds for employees who are not registered under EPS is a common mistake.

Inconsistent PF Policy Across Employees: Applying different PF rules for similar employees can lead to disputes.

Delayed Deposits and Incorrect Filings: Late deposits or errors in ECR filing attract interest and penalties.

Poor Communication of PF Structure to Employees: Employees should understand their EPF, EPS, and total PF contributions.

Now that we’ve examined everything, it's time to take control of your PF calculations and make the process smoother for both you and your employees with the right tools.

Understanding how to calculate PF from CTC is essential for both employers and employees. PF is included in the CTC but is calculated on the basic salary component, with both employer and employee contributing 12% each. Correct calculations ensure accurate payroll, proper statutory compliance, and accumulation of employees’ retirement savings.

Manually calculating PF for multiple employees each month can be tedious and error-prone. Craze’s HR software automates the entire process, ensuring accuracy and compliance while saving time and reducing administrative burden.

1. Is employer PF always included in CTC?

In most organisations, the employer’s PF contribution is part of the CTC, meaning it is counted within the total cost the company bears. However, some employers may provide it as an additional benefit outside CTC. Candidates should review their employment contract or salary breakdown to confirm how PF is treated and ensure clarity on their take-home pay versus statutory contributions.

2. Can employers restrict PF contribution to ₹15,000?

Yes. Employers can calculate PF contributions on the statutory wage ceiling of ₹15,000 even if the employee’s basic salary is higher. This is the standard compliance practice for many companies to control statutory costs. A full basic salary contribution can be applied only if the company policy allows it and the EPFO rules are followed, thereby ensuring higher retirement savings for employees.

3. Is PF mandatory for all employees?

PF is mandatory for eligible employees in covered establishments under the EPF Act. Employees in firms with voluntary registration or in firms below the minimum coverage threshold may be subject to different rules. Organisations must ensure proper registration and compliance once eligibility criteria are met to avoid penalties.

4. What happens if PF is calculated incorrectly?

Incorrect PF calculation can result in interest on delayed payments, penalties from EPFO, and potential disputes with employees. Errors may arise from miscalculation of basic salary, failure to apply EPS caps, or delayed deposits. Regular reconciliation and adherence to statutory guidelines help prevent such issues.

5. Can the PF structure be changed after an employee joins?

Yes, but changes must comply with EPFO regulations and internal policies. Employers cannot reduce contributions below statutory minimums or make retrospective adjustments that affect previously credited amounts. Proper documentation and communication to employees are essential when altering PF rules.

6. How often should employers reconcile PF accounts?

Employers should reconcile PF accounts at least monthly, matching each employee’s EPF and EPS contributions with ECR filings. This process helps identify missing contributions, incorrect employee codes, or interest miscalculations early. Timely reconciliation also ensures compliance with EPFO deadlines and avoids penalties or retrospective adjustments.

7. Can PF contributions be adjusted for part-time or contractual employees?

Yes. PF is applicable to eligible part-time or contractual employees if they meet minimum wage and service criteria. Employers must calculate contributions based on the statutory basic salary, even if the employment type differs.

8. What happens to PF when an employee leaves the company?

When an employee exits, the PF account can be transferred to the new employer or fully withdrawn after 2 months of unemployment. Employers must provide complete PF settlement or transfer documentation promptly to avoid delays or loss of interest.