As an HR or finance leader, you’re likely aware that pay discrepancies can create tension and hurt employee morale. In fact, 23% of salaried women in Indian metros perceive a gender pay gap in their workplace, which could lead to disengagement and turnover. This perception of unfair compensation is a serious issue that many companies face, whether they realise it or not.

A pay equity audit is an essential tool for identifying and addressing these gaps. By taking a closer look at your pay structures, you can ensure fairness and avoid potential legal risks. This blog will walk you through the necessary steps to conduct an effective audit and take action to resolve any disparities.

A pay equity audit helps identify and fix pay gaps in your company based on gender, race, and job role.

Conducting a pay equity audit ensures your company follows the law and reduces the risk of discrimination claims.

Pay equity audits provide clear steps to adjust salary structures and ensure equal pay for equal work.

The audit process includes collecting data, analysing pay differences, identifying disparities, and taking corrective actions.

Regular pay equity audits promote transparency, improve employee satisfaction, and make your company more attractive to top talent.

A pay equity audit is a thorough review of your organisation’s compensation practices to ensure fairness and equity. It identifies and addresses pay disparities based on factors like gender, race, job roles, and experience.

The audit examines key elements, including salaries, bonuses, benefits, overtime, and performance metrics. It compares compensation across different employee groups to ensure no biases influence pay decisions.

A clear understanding of a pay equity audit naturally leads to the question: Why should your company conduct one in the first place?

A pay equity audit isn’t just a tool for ensuring fairness; it’s also critical for legal compliance. Adhering to Indian labour laws, such as the Equal Remuneration Act, helps avoid potential lawsuits related to pay discrimination and ensures that your company stays within the boundaries of the law.

A pay equity audit plays a vital role in building a fair workplace. It helps create an environment where employees are compensated fairly, regardless of their gender, race, or background. This fairness promotes a healthy work culture where everyone feels valued.

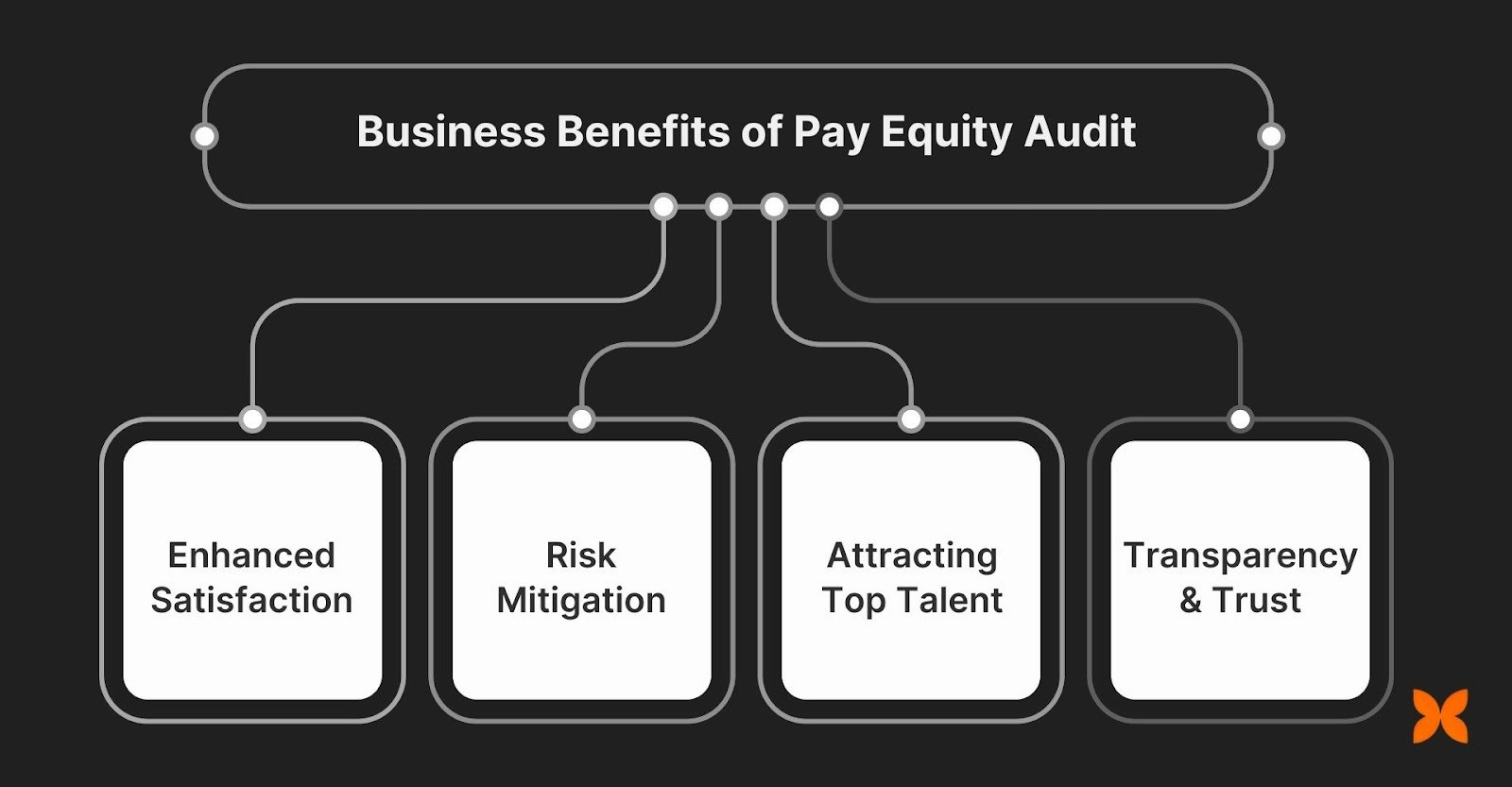

Business Benefits of Pay Equity Audit

There are several business benefits to conducting a pay equity audit:

Improved Employee Satisfaction: Employees who feel they are paid fairly are more likely to stay longer and contribute more to the organisation’s success.

Risk Mitigation: By addressing pay discrepancies, businesses can reduce the risk of discrimination lawsuits and reputational damage.

Attracting Top Talent: Companies committed to pay equity attract diverse and highly skilled professionals who value an inclusive workplace.

Transparency and Trust: A transparent and fair compensation structure leads to higher transparency and trust between employees and management.

Given the clear advantages of conducting a pay equity audit, it’s time to move beyond the why and focus on the practical steps to carry it out in your organisation.

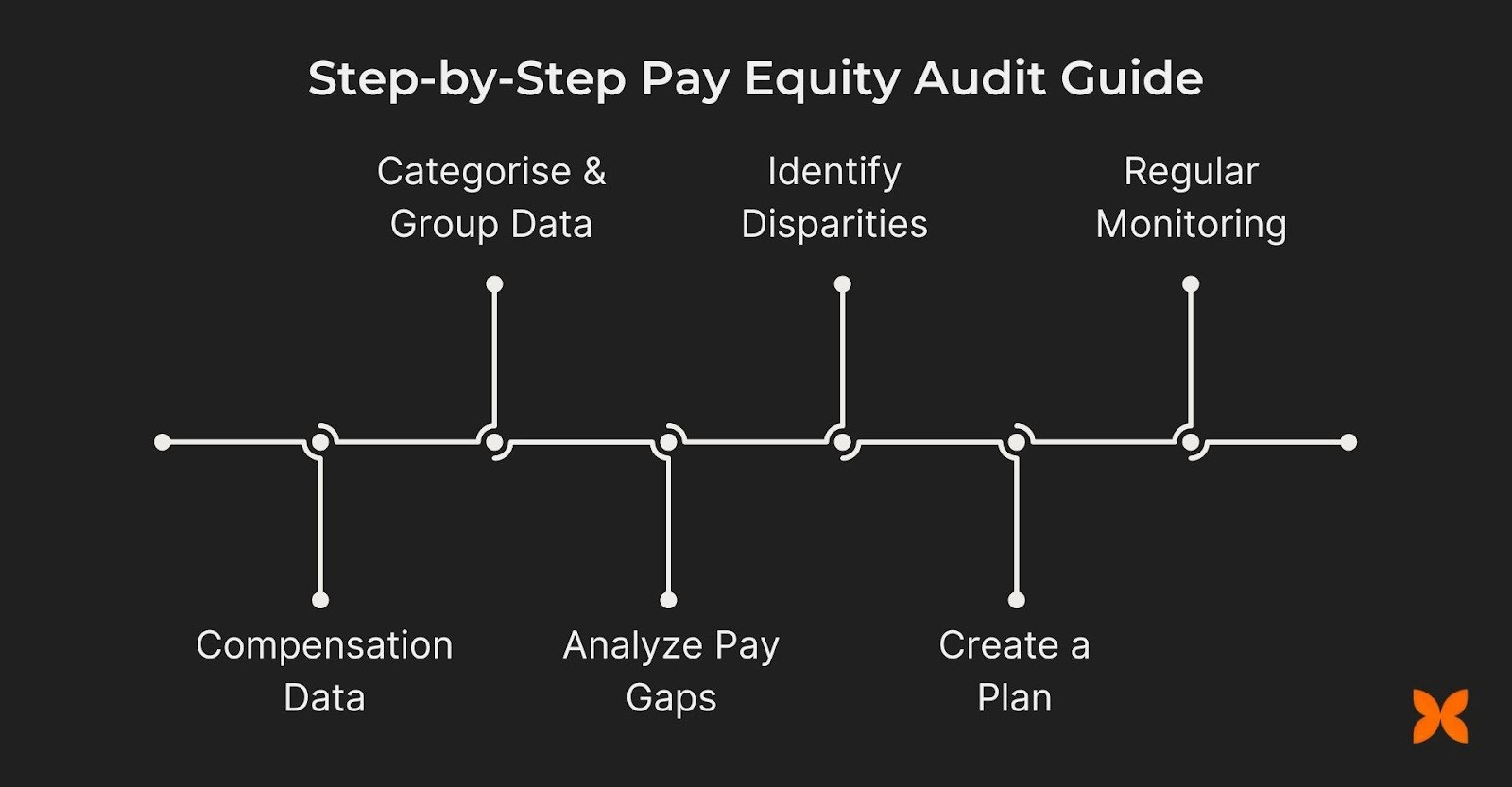

To effectively address pay disparities and ensure fairness in your organisation, a structured approach is necessary. Below are the key steps involved in conducting a pay equity audit that not only identifies gaps but also enables your business to take meaningful action.

Step 1: Collect Compensation Data

The first step in a pay equity audit is to gather all relevant compensation data. This will form the foundation of your analysis.

What to collect:

Base pay: The fixed salary for each employee ensures that the same role is consistently evaluated across the company.

Bonuses: Any variable pay tied to individual performance, team performance, or company-wide achievements.

Benefits: Include healthcare, paid leave, retirement plans, and other non-monetary benefits that contribute to overall compensation.

Overtime: Track any additional hours worked beyond standard working hours, especially for roles where overtime pay might vary.

Other compensation components: Include stock options, commissions, incentives, and profit-sharing schemes that may influence total earnings.

How to collect:

HR software: Use reliable HR management systems like Craze or payroll software to collect accurate, real-time compensation data.

Spreadsheets: If using spreadsheets, ensure data consistency across different departments and roles to make the analysis more manageable.

Data privacy and security: Protect sensitive employee data by ensuring encryption and access control to prevent unauthorised access.

Step 2: Categorise and Group Data

Once the data is collected, the next step is to organise it by key variables to make meaningful comparisons.

Grouping criteria:

Gender: Ensure both male and female employees are represented and compare their compensation for similar roles and performance levels.

Race and ethnicity: Consider racial or ethnic diversity in the workforce and ensure fair pay practices across these groups.

Job level: Group employees by their level in the organisation (e.g., entry-level, mid-level, senior management) to account for role-specific pay variations.

Experience: When comparing salaries across groups, include factors such as years in the role, education, and work experience.

Job role mapping:

Clearly define job roles and categorise them by function, department, and responsibilities. This will help avoid ambiguity in comparisons and ensure that roles are benchmarked consistently across the organisation.

This process ensures that you are comparing similar positions and can identify discrepancies in pay more accurately.

Step 3: Analyse Pay Disparities

The next step involves analysing the collected data to identify any significant pay disparities across different employee groups.

Comparison:

Compare pay differences across the identified groups (e.g., gender pay gap, race disparities, or role-based inequalities).

Examine whether certain groups are consistently paid lower than others, and identify any patterns that suggest systemic pay inequalities.

Statistical analysis:

Use regression analysis or other statistical methods to evaluate whether pay disparities exist due to factors like gender or race, or if they are attributed to role, experience, or performance.

Quantifying these differences helps provide a clearer understanding of the scale and scope of any existing disparities.

Tools and Resources:

Use specialised pay equity software or HR analytics tools like Craze that can automate this analysis and give you insights into data trends and pay gaps.

Software tools can also help you visualise disparities through graphs and charts, making it easier to identify outliers and patterns.

Step 4: Identify Root Causes of Disparities

Once disparities are identified, it’s important to understand the reasons behind them.

Possible causes:

Unequal access to promotions: If employees from specific groups are not advancing at the same rate as others, it can result in pay gaps over time.

Hiring practices: Unconscious bias in hiring decisions or the use of subjective criteria for setting starting salaries can create disparities in compensation.

Unconscious bias: If pay decisions are influenced by unconscious bias, certain groups may be unintentionally underpaid.

Market differences: In some industries, certain roles may be traditionally undervalued, resulting in lower pay compared to market standards.

Data-driven insights:

Analyse whether disparities are caused by systemic biases or by outdated pay structures.

Use the data to identify whether the issue lies in recruitment, compensation planning, or performance evaluation processes. This will help focus corrective actions on the areas that need the most attention.

Step 5: Develop an Action Plan

With the analysis in hand, it’s time to take corrective action and ensure that any disparities are addressed.

Corrective actions:

Adjust salaries where necessary to ensure fair compensation. This could include salary increases for employees who are underpaid based on their experience and role.

Review and revise pay structures to create more equitable pay ranges. Ensure that salary bands are competitive and internally fair.

Revise compensation policies to reflect changes that promote fairness, such as setting clear criteria for bonuses and performance incentives.

Implementation:

Ensure the adjustments are equitable, ensuring that employees are paid fairly in relation to one another.

Communicate the changes transparently to the affected employees, explaining why the changes were made and how pay equity is being ensured.

Long-term changes:

Update recruitment policies to ensure that new hires are offered competitive and equitable salaries.

Create clear promotion pathways with standardised criteria to ensure that employees are promoted based on merit, not influenced by bias.

Make these policies a part of your long-term pay strategy, ensuring that the company remains committed to ongoing pay equity.

Step 6: Monitor and Evaluate Regularly

A pay equity audit is not a one-time exercise. It’s important to continuously monitor and assess the effectiveness of the actions taken.

Ongoing audits:

Set up a process for annual or bi-annual audits to ensure that your company continues to meet pay equity standards.

Regular audits help track the effectiveness of the corrective measures taken and ensure that any new pay disparities are identified early.

Employee feedback:

Regularly gather employee feedback to assess the impact of the corrective actions taken.

Conduct surveys or focus groups to understand whether employees feel that changes have led to fairer compensation and improved satisfaction.

To ensure that the pay equity audit delivers sustained results, it's essential to focus on the practices that will make the process effective and reliable over time.

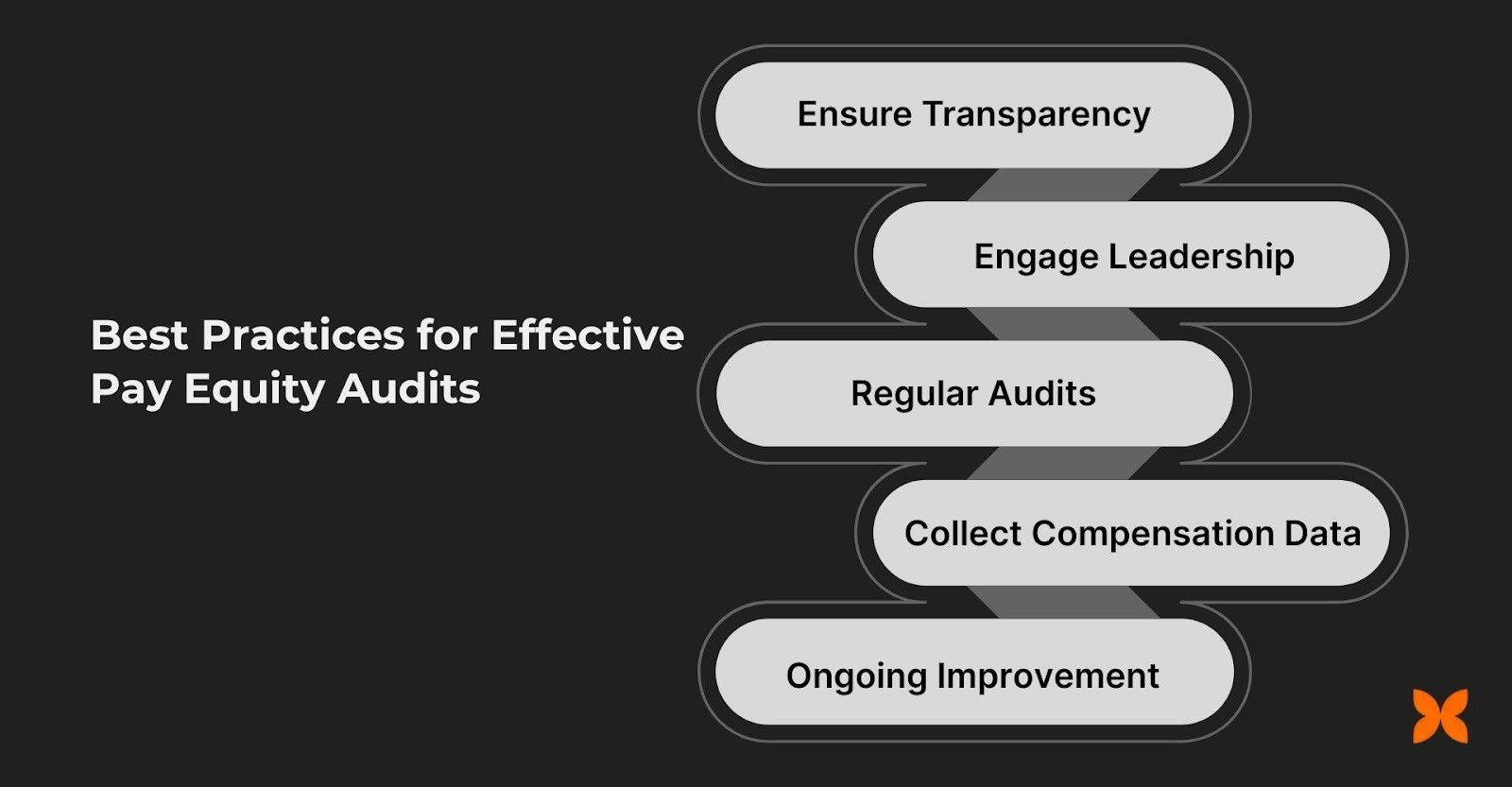

To ensure your pay equity audit leads to long-term success, it's important to follow these key practices that promote fairness, transparency, and continuous improvement.

Ensure Transparency in the Process

Clear communication about the pay equity audit process is essential. Inform your employees about the audit's goals, methodology, and outcomes. Transparency fosters trust and helps employees understand how compensation decisions are made.

It also reassures them that the company is committed to fair pay and is addressing any potential disparities.

Get Leadership Involved

For a pay equity audit to be truly effective, senior leadership must be actively involved. Leaders should champion pay equity initiatives, set clear policies, and ensure resources are allocated for the audit. When leadership leads by example, it signals a strong commitment to fair compensation practices throughout the organisation.

Make Audits a Regular Practice

A pay equity audit should be conducted regularly, not just as a one-time event. Make it a part of your annual or bi-annual compliance calendar. Regular audits help identify pay discrepancies early and ensure that pay equity remains a priority as the company grows and changes.

Gather Comprehensive Compensation Data

Ensure that you collect all relevant compensation data to gain a complete picture. This includes salaries, bonuses, benefits, overtime, and performance-based incentives. The more comprehensive the data, the more accurate your audit will be in identifying any pay disparities.

Commit to Ongoing Improvement

Treat your pay equity audit as a step toward continual improvement. Use each audit to refine your pay structures and compensation policies.

Regular reviews ensure that pay equity is integrated into the culture and that your organisation evolves with fairness and transparency at its core.

Ensuring pay equity is a fundamental part of building a fair, transparent, and inclusive workplace. For businesses focused on long-term growth and employee satisfaction, addressing pay disparities directly through pay equity audits is crucial for building trust, engagement, and reducing potential risks.

With Craze, conducting a pay equity audit becomes simpler and more efficient. Craze’s integrated HR and payroll solutions allow you to collect, analyse, and monitor compensation data seamlessly, ensuring you remain compliant and fair in your pay practices.

Q1. What are the legal requirements for conducting a pay equity audit in India?

A1. In India, the Equal Remuneration Act, 1976, mandates that employees receive equal pay for equal work, regardless of gender. Additionally, the Code on Wages, 2019 requires employers to ensure fair and non-discriminatory compensation practices. Conducting a pay equity audit helps businesses stay compliant with these laws and avoid legal risks.

Q2. How can pay equity audits help address unconscious bias in compensation?

A2. Pay equity audits help identify and address unconscious biases that may affect pay decisions. By analysing compensation data across gender, race, and role, audits highlight any unintended pay gaps, allowing for necessary adjustments. This promotes a fairer compensation structure based on performance and role rather than biases.

Q3. What steps should be taken if a pay equity audit identifies disparities?

A3. If a pay equity audit reveals disparities, businesses should develop an action plan that includes adjusting pay structures, offering salary increases where needed, and ensuring equal access to promotions. These corrective actions will help achieve fairness and maintain compliance with pay equity standards.

Q4. How can conducting a pay equity audit help retain top talent?

A4. Conducting a pay equity audit helps businesses ensure that all employees are compensated fairly and equitably. Fair pay practices lead to higher employee satisfaction, loyalty, and engagement. This, in turn, reduces turnover and attracts top talent, as candidates are more likely to be drawn to companies with transparent compensation structures.

Q5. How often should a pay equity audit be conducted?

A5. It’s recommended to conduct a pay equity audit at least annually or biannually. Regular audits ensure that pay practices remain fair, identify emerging disparities early, and help maintain ongoing compliance with legal and ethical standards.