Month-end payroll can feel like controlled chaos. HR and finance teams chase attendance corrections, leave adjustments, reimbursements, contractor invoices, and last-minute salary changes. In India, the complexity increases further because payroll must also stay aligned with statutory requirements such as TDS, PF, ESIC, and state-wise Professional Tax.

Payroll automation reduces this burden by using software to run payroll as a connected workflow. Instead of collecting inputs across spreadsheets and separate tools, an automated system pulls data from HR, attendance, leave, and claims, applies payroll and compliance rules, and generates outputs like payslips, bank advice files, and audit-ready reports.

This guide explains what payroll automation is, what it includes, how it works in practice, where it typically breaks, and what Indian businesses should look for when evaluating payroll automation software.

Payroll automation uses software to run payroll with minimal manual intervention, from data capture to payouts and reporting.

True payroll automation connects payroll inputs such as attendance, leave, salary changes, reimbursements, and contractor payouts, rather than relying on uploads and spreadsheets.

In India, payroll automation must handle statutory deductions and reporting for TDS, PF, ESIC, and Professional Tax, including state-wise variation.

Many payroll setups fail because of exceptions such as arrears, retro revisions, and location changes, not because of salary calculation complexity.

The best systems are exception-driven, meaning your team reviews variances and approvals, while the system handles repeatable calculations and outputs.

Payroll automation is the use of software to systematise payroll operations and complete recurring payroll tasks with minimal manual effort. It replaces spreadsheet-based workflows and manual re-entry by automating salary calculations, statutory deductions, payslip generation, and payroll reporting.

Payroll automation is not the same as having payroll software. A payroll tool can calculate salaries, but automation requires connected inputs and controlled outputs. In practical terms, automation means payroll data flows from upstream systems, calculations run based on defined rules, and outputs are produced in standardised formats, with checks, approvals, and audit trails built in.

In India, payroll automation typically also includes statutory compliance logic for TDS, PF, ESIC, and Professional Tax, plus handling for reimbursements, flexi benefits, and contractor payments.

Also read: A Comprehensive Guide to Payroll Management

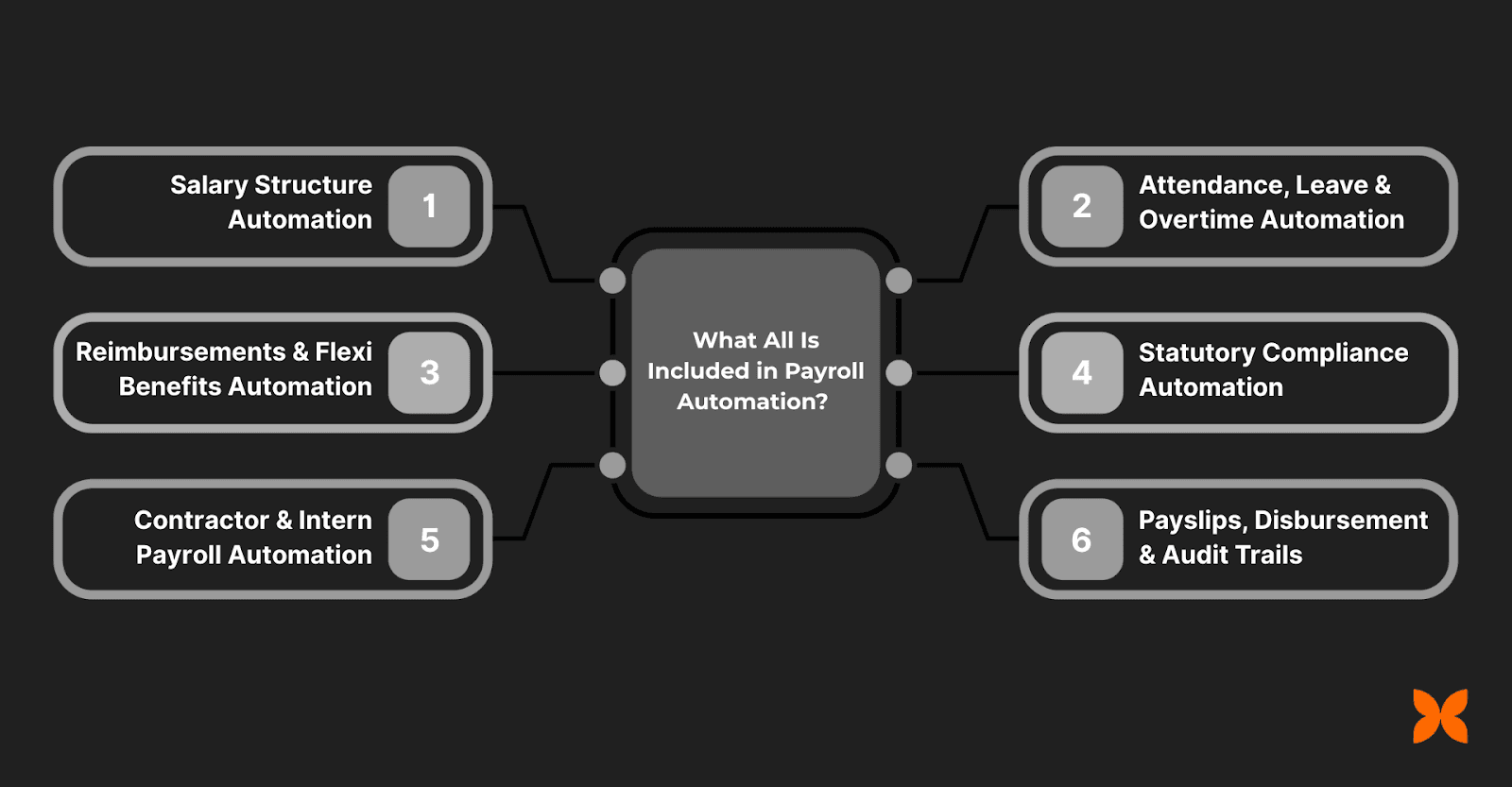

Now that the definition is clear, the next step is to break payroll automation down into the specific tasks it covers.

Payroll automation covers multiple stages of the payroll cycle. The easiest way to assess whether a system is genuinely automated is to map inputs, processing, and outputs.

Payroll stage | What gets automated | Typical data source | Output |

Employee master and salary structures | Salary components, effective dates, role changes, increments | Updated salary computation base | |

Attendance and leave | Worked days, loss of pay, overtime, shift rules, holidays | Attendance-derived payroll inputs | |

Reimbursements and flexi benefits | Approved claims, exemptions, taxable treatment | Claims and approvals | Pay additions with correct taxability |

TDS, PF, ESIC, Professional Tax calculations | Payroll rules, employee declarations, location | Statutory deductions and contribution amounts | |

Payroll outputs | Payslips, bank advice files, pay registers | Payroll finalisation | Payslips and payout instructions |

Reporting and registers | Payroll summaries, statutory reports, audit logs | Payroll records | Audit-ready reporting pack |

Employee self-service | Payslip access, payroll history, tax documents where supported | Employee portal | Fewer payroll queries and faster visibility |

This table also highlights a common gap. Many organisations automate the calculation step but still handle inputs and exceptions manually. The flow below shows how automation works when these stages are connected.

An automated payroll workflow typically follows five steps. The steps remain consistent across organisations, even if policies and pay structures differ.

1) Data capture

The system collects payroll inputs from connected sources:

Employee changes such as new joiners, exits, salary revisions, role changes, and location changes

Attendance, approved leave, holidays, weekly offs, and overtime

Approved reimbursements and flexi benefit claims

Contractor invoices or payout schedules, where applicable

When data capture is automated, payroll teams stop spending the first few days of the cycle collecting and reconciling inputs. That creates a cleaner foundation for computation.

2) Rules and salary calculations

The payroll engine applies configured rules to compute pay:

Earnings and deductions based on salary structure

Proration for joiners and exits

Loss of pay based on attendance and leave policy rules

Overtime and shift-related calculations

Arrears and effective date changes, where supported

At this stage, rule quality matters as much as automation. If salary structures and policy rules are inconsistent, payroll automation can reproduce errors faster. Once the pay computation is stable, statutory deductions become the next high-impact layer.

3) Compliance and deductions

The system computes statutory deductions and employer contributions:

TDS based on employee declarations, selected tax regime, and applicable slabs

ESIC eligibility and contributions

Professional Tax based on employee work location and state slabs

In India, compliance logic is not a one-time setup. Thresholds, eligibility, and reporting requirements can change, and multi-location companies must apply location-specific rules consistently. That is why review and controls remain essential even in automated payroll.

4) Review, approvals, and controls

Payroll automation still requires oversight. Good systems are designed so your team reviews exceptions rather than redoing calculations.

Typical controls include:

Variance reports comparing current payroll to the previous cycle

Approval steps for unusually large changes or high-impact exceptions

Payroll locking after finalisation to prevent silent edits

Role-based access to limit who can change structures, deductions, and payouts

Controls make payroll predictable. Without them, teams still end up doing manual cross-checking and post-pay corrections. Once payroll is reviewed and locked, the final step is output generation and record-keeping.

5) Payout, records, and reporting

After approval, the system produces outputs:

Bank advice files or payout instructions

Accounting entries or exports, where supported

Reports and registers for audit and compliance

At this point, payroll automation delivers its main value: repeatability. Instead of rebuilding payroll every month, your team runs a defined process and focuses on exceptions. To understand how far you can take this, it helps to view automation as a maturity journey.

Many organisations believe they have payroll automation because they use payroll software. In reality, maturity depends on whether payroll inputs and outputs are connected, controlled, and traceable.

Level 1: Spreadsheet payroll

Payroll is built in Excel.

Compliance calculations are manual or consultant-led.

There is little audit traceability.

At this level, risk is high because calculations, approvals, and change history are difficult to track reliably.

Level 2: Payroll software with manual inputs

A payroll tool is used for salary calculation.

Inputs like attendance, reimbursements, and changes arrive through uploads and emails.

Errors persist due to hand-offs and reconciliations.

This level often feels better than spreadsheets, but it still creates rework because upstream inputs remain fragmented.

Level 3: Integrated payroll inputs

Attendance and leave data flows into payroll automatically.

Claims and reimbursements are connected to payroll.

Manual uploads reduce significantly.

This is usually the first point where teams notice a clear drop in payroll cycle time, because data collection and reconciliation reduce.

Level 4: Exception-driven payroll

Payroll runs automatically for most employees.

The team focuses on variances, approvals, and exceptions such as arrears or location changes.

Payroll locking and audit logs reduce compliance risk.

At this level, automation is no longer about calculation speed. It is about governance, controls, and avoiding avoidable corrections.

Level 5: Continuous compliance and audit-ready payroll

Compliance reporting is generated as part of payroll closure.

Accounting sync and payout workflows are integrated.

The system maintains full traceability for audits without manual compilation.

The key shift at Level 5 is that payroll records are audit-ready by default, rather than assembled after the fact.

A practical way to identify your maturity level is to ask one question: how many inputs are still coming through spreadsheets? Once you know your level, the benefits of moving up become easier to quantify.

Payroll automation delivers benefits that scale with headcount. The bigger the organisation, the higher the cost of errors and manual rework.

Accuracy and fewer reversals

Automated calculations reduce common errors such as incorrect loss of pay, missed reimbursement adjustments, or wrong statutory deductions. As accuracy improves, you also reduce downstream issues like reversals, bank corrections, and employee escalations.

Faster payroll closure

When inputs flow into payroll automatically, payroll teams spend less time collecting and reconciling data. This also shortens the time spent on internal coordination, because approvals happen against a single version of payroll.

Stronger compliance confidence

In India, compliance errors can lead to notices, interest, and penalties. Automation reduces risk by applying consistent statutory rules and producing standard reports and registers. This matters most when your workforce spans locations, salary bands, and employment types with different eligibility rules.

Better employee experience

Employees benefit from accurate, on-time payments and accessible digital payslips. When self-service is available, payroll queries reduce and resolution times improve, which also frees your team from repetitive support work.

Lower operational cost

Automation reduces the number of hours spent on repetitive payroll tasks and lowers dependency on external support for monthly execution. Over time, it also reduces the opportunity cost of senior HR and finance leaders spending time on payroll troubleshooting.

Payroll automation KPIs to track

If you want to measure improvement, track these metrics before and after automation:

Payroll cycle time (days from cut-off to payout)

Number of payroll corrections per cycle

Number of payroll tickets raised by employees

Compliance incidents or rework due to statutory errors

HR and finance hours spent on payroll execution

These benefits are compelling, but they only materialise when automation holds up during real-world edge cases. That is where most systems are tested.

Payroll automation fails most often because of exceptions and weak controls, not because the system cannot calculate salaries.

Common exceptions in Indian payroll

Retro salary revisions that require arrears and backdated recalculation

Mid-month joiners and exits needing proration

Location changes that affect Professional Tax slabs

Leave reversals after payroll cut-off

Attendance corrections submitted late

Reimbursements approved after cut-off

Contractor misclassification affecting TDS treatment, such as 194C vs 194J

One-off payouts such as retention bonuses or variable pay with different tax implications

These exceptions are common in growing organisations. As headcount increases, even a small exception rate can translate into significant monthly rework.

Controls that protect payroll automation

A reliable automated payroll system includes operational controls that keep payroll accurate and auditable:

Clear cut-off rules for attendance, leave, and claims

Approval workflows for sensitive changes and exceptions

Change logs for salary structures, employee master updates, and compliance settings

Payroll locking after finalisation

Variance reporting to highlight outliers and unusual changes

Role-based permissions that restrict who can modify payroll rules and outputs

Controls do not slow payroll down. They allow payroll to run faster because teams can trust outputs and focus on outliers. With controls in place, the next decision is which type of solution best fits your organisation.

Payroll automation can be achieved through different solution types. The right choice depends on headcount, operational complexity, and how much control you need in-house.

All-in-one HR platforms

These combine HR, payroll, attendance, leave, and sometimes reimbursements and accounting exports. They are most effective when you want connected workflows and a single source of truth.

Best for:

Organisations that want end-to-end automation across HR and payroll

Teams that want to reduce tool fragmentation and manual uploads

A key advantage here is fewer integration gaps, because payroll inputs are captured in the same system or through tightly connected modules.

Payroll-only software

These tools focus mainly on payroll processing and compliance outputs. They can work well if your upstream systems integrate cleanly.

Best for:

Organisations with stable, well-integrated attendance and HR systems

Teams that can manage integrations and data hygiene consistently

The trade-off is that automation quality depends on integration reliability. If your inputs still arrive through uploads or manual spreadsheets, payroll-only tools can feel less automated in practice.

Managed payroll services

A provider runs payroll on your behalf, usually with a mix of software and manual processes. This can reduce in-house workload but may limit speed, control, and transparency.

Best for:

Teams without a dedicated payroll owner

Organisations that prefer outsourcing execution

Managed services can work, but you should still validate how inputs are collected, how changes are controlled, and whether you get the audit trail you need.

If you are planning a new rollout or migration, refer to your existing payroll implementation guide for the project steps and execution plan. For day-to-day operations, the next section focuses on what makes payroll automation uniquely complex in India.

Payroll automation in India is not just salary processing. It must address statutory compliance and the operational realities of diverse employee types and locations.

Before diving into individual statutory components, it is helpful to recognise the broader challenge. Payroll data is spread across HR, attendance, claims, and finance workflows. Automation only works when these inputs are reliable and policy rules are clear.

TDS automation

TDS requires accurate tax computation across the year, aligned with employee declarations and proofs. Automation should support:

Tax regime selection and slab application

Handling declarations and proof-based adjustments where relevant

Consistent monthly TDS computation and year-end statement preparation

In practice, TDS errors often come from missing or late employee inputs and inconsistent handling of one-off payouts. Automation can reduce these issues when workflows and cut-offs are defined clearly.

PF automation

PF automation requires:

Eligibility logic based on applicable criteria

Accurate employee and employer contributions

Payroll registers and contribution reporting outputs

PF automation is also closely linked to salary structure design. If components are structured inconsistently across teams, PF computation can become harder to standardise.

ESIC automation

ESIC automation requires:

Eligibility determination based on wage thresholds and rules

Automatic deduction and employer contribution calculation

Reporting outputs for compliance documentation

Here, the main operational risk is misclassification. Automation must consistently identify eligible employees and apply the correct contribution logic without manual overrides.

Professional Tax automation

Professional Tax varies by state. Automation should support:

State-wise slabs based on employee work location

Correct monthly deductions and limits

Handling location changes with appropriate slab updates

This becomes particularly important in multi-location and hybrid organisations. Location changes that are not reflected quickly can cause incorrect deductions and follow-up corrections.

Attendance and leave complexity

Attendance and leave influence payroll through paid days, loss of pay, overtime, and shift rules. Automation must handle:

Policy-driven leave impacts

Cut-offs and late changes

Holidays and weekly offs aligned to location or business rules

Overtime eligibility based on company policy

This is often where payroll teams spend the most manual time. If attendance is captured in one tool and payroll runs in another, reconciliation becomes a recurring monthly project. Integration and cut-offs are the two biggest levers for improvement.

Contractors and interns

Contractors and interns often sit outside standard payroll workflows. Automation should support:

Separate classification and payout logic

TDS deduction aligned to contractor type and thresholds

Unified reporting for audit and reconciliation

The point here is not to force contractors into employee payroll rules. It is to keep payouts, deductions, and records structured and traceable in one workflow.

Audit readiness and traceability

Indian organisations often face audits and statutory inspections. Automation must maintain:

Change history for payroll and employee master data

Approval trails for exceptions and adjustments

Standard registers and exportable reports

When audit readiness is built into payroll operations, your team does not need to rebuild evidence later. That is a major advantage of end-to-end automation.

These India-specific requirements make it easier to see why some tools feel automated on paper but still leave teams doing manual work each month. The checklist below helps you evaluate systems specifically through an automation lens.

Use this checklist to assess whether a payroll system will actually reduce manual work.

A useful way to apply this checklist is to start from your current monthly workflow. Identify which inputs still require uploads or manual reconciliation, then validate whether a tool can eliminate those steps without creating new dependencies.

Integrations and data flow

Attendance and leave integration that removes manual uploads

Claims or reimbursements integration with approvals and taxability logic

Accounting export or sync to reduce manual journal entries

Bank advice file generation and payout workflow support

Strong integrations reduce time, but they also reduce error surface area. When inputs are system-driven, payroll teams can spend more time validating outputs and less time fixing upstream inconsistencies.

Rules engine depth

Multiple salary structures with effective dates

Proration for joiners and exits

Arrears and retro recalculations

Overtime and shift-based policy rules

Handling of one-off payments with correct tax impact

Rules depth is where many systems look similar on a demo but behave differently in real operation. The best validation is to map your actual exceptions and ensure the tool can handle them without spreadsheet overrides.

Compliance engine and reporting

Rule updates and state-wise applicability for Professional Tax

PF and ESIC eligibility rules and contribution computation

TDS computation aligned with regime selection and declarations

Standard compliance reports, payroll registers, and year-end outputs

Compliance automation is only as reliable as its update mechanism and reporting coverage. If the system cannot generate the outputs your auditor or consultant expects, teams often revert to manual work.

Controls and governance

Approval workflows for critical changes

Variance reporting to surface exceptions

Payroll locking after finalisation

Role-based permissions and audit logs

Controls are what convert payroll automation into a dependable operating process. Without controls, automation can produce outputs quickly, but teams still have to validate everything manually.

Employee experience

Payslip access and payroll history

Clear breakdown of earnings and deductions

Reduced payroll tickets due to transparency

Employee experience is not just a nice-to-have. When employees can see payslips and history clearly, your team spends less time answering repetitive payroll questions.

Scalability

Multi-location handling for state-wise rules

Support for contractors and interns alongside employees

Ability to scale without adding monthly manual work

Scalability is best assessed by looking at what increases complexity for you today. For many Indian businesses, it is location growth, multiple salary structures, and higher exception volume.

Once you have a checklist like this, it becomes easier to distinguish between tools that only calculate payroll and systems that run payroll as a connected workflow. That sets up the final question: how does Craze support this end-to-end model?

End-to-end payroll automation requires a single connected workflow across HR and payroll inputs. Craze is designed to support this operational model by connecting payroll with the systems that provide payroll data.

Craze enables payroll automation through:

A unified system where employee records, salary structures, attendance, leave, reimbursements, and payroll rules sit in one place

Automated payroll calculations that factor in attendance and policy rules without manual uploads

Statutory deduction automation for TDS, PF, ESIC, and Professional Tax with reporting outputs for compliance and audits

Handling for contractors and interns with separate logic while keeping payroll reporting unified

Controlled payroll closure with audit trails, approvals, and payroll locking to reduce rework and support audit readiness

Payroll outputs such as payslips and bank advice files generated from finalised payroll data, with accounting sync supported where applicable

If your team wants payroll to run as a predictable monthly workflow rather than a spreadsheet exercise, end-to-end automation is the most reliable way to achieve it.

1) What is the difference between payroll software and payroll automation?

Payroll software can calculate salaries, generate payslips, and support compliance reporting. Payroll automation goes further by connecting upstream inputs such as attendance, leave, reimbursements, and employee changes, then applying rules and controls to produce payroll outputs with minimal manual intervention.

2) Is payroll automation compliant in India?

Payroll automation is compliant when the system applies Indian statutory rules for TDS, PF, ESIC, and Professional Tax correctly, maintains audit trails, and generates the required reports and registers. Compliance depends on correct configuration, rule updates, and operational controls.

3) Can payroll automation handle PF and ESIC?

Yes, a good payroll automation system like craze & keka, can determine eligibility, compute employee and employer contributions, and generate the reports and registers needed for PF and ESIC compliance.

4) Can payroll automation handle arrears and retro salary revisions?

It can, but not all systems handle retro changes well. Look for features such as effective-date salary structures, automated arrears computation, and clear audit logs for backdated changes and recalculations.

5) How are reimbursements taxed in payroll automation?

Payroll automation should classify reimbursements and flexi benefits as taxable or exempt based on applicable rules, then include the correct amounts in payroll so that net pay and TDS are calculated accurately.

6) Can payroll automation handle contractors?

Yes, payroll automation can support contractor payouts using separate logic, including correct TDS treatment based on classification such as 194C or 194J, while keeping reporting and reconciliation structured.

7) Is payroll automation suitable for startups?

Yes. Payroll automation is often most valuable for startups as headcount grows, because it prevents payroll work from scaling linearly with the number of employees. It improves consistency, reduces compliance risk, and lowers operational burden.