Finding the right payroll software is not difficult. Finding one with the right features is. Once you have decided to automate payroll, the next challenge is choosing a system that actually supports your day-to-day operations and ensures compliance without unexpected gaps.

For most Indian businesses, this is where things get complicated. Payroll software may look similar on the surface, but the features they offer can differ significantly, especially when it comes to statutory compliance, integrations, pay runs, security, reporting, and scalability. Missing even one essential capability can lead to payroll errors, compliance penalties, employee dissatisfaction, or costly manual rework.

That’s why understanding the must-have payroll software features is the most important step in your evaluation process. Whether you are upgrading your current system or investing in payroll automation for the first time, this guide will help you identify the features that truly matter for Indian businesses and how to compare different solutions effectively.

Payroll software is a system designed to automate employee compensation, ensuring accurate salary calculations, statutory deductions, and timely disbursements in one platform.

Payroll software provides HR with a well-organised approach that reduces errors, saves time, and enhances the employee experience while ensuring greater visibility and scalability.

Core features to look for include automated salary computation, India compliance, reimbursements/FBP, pay-run management, bulk disbursements, ESS, reporting/analytics, and strong security.

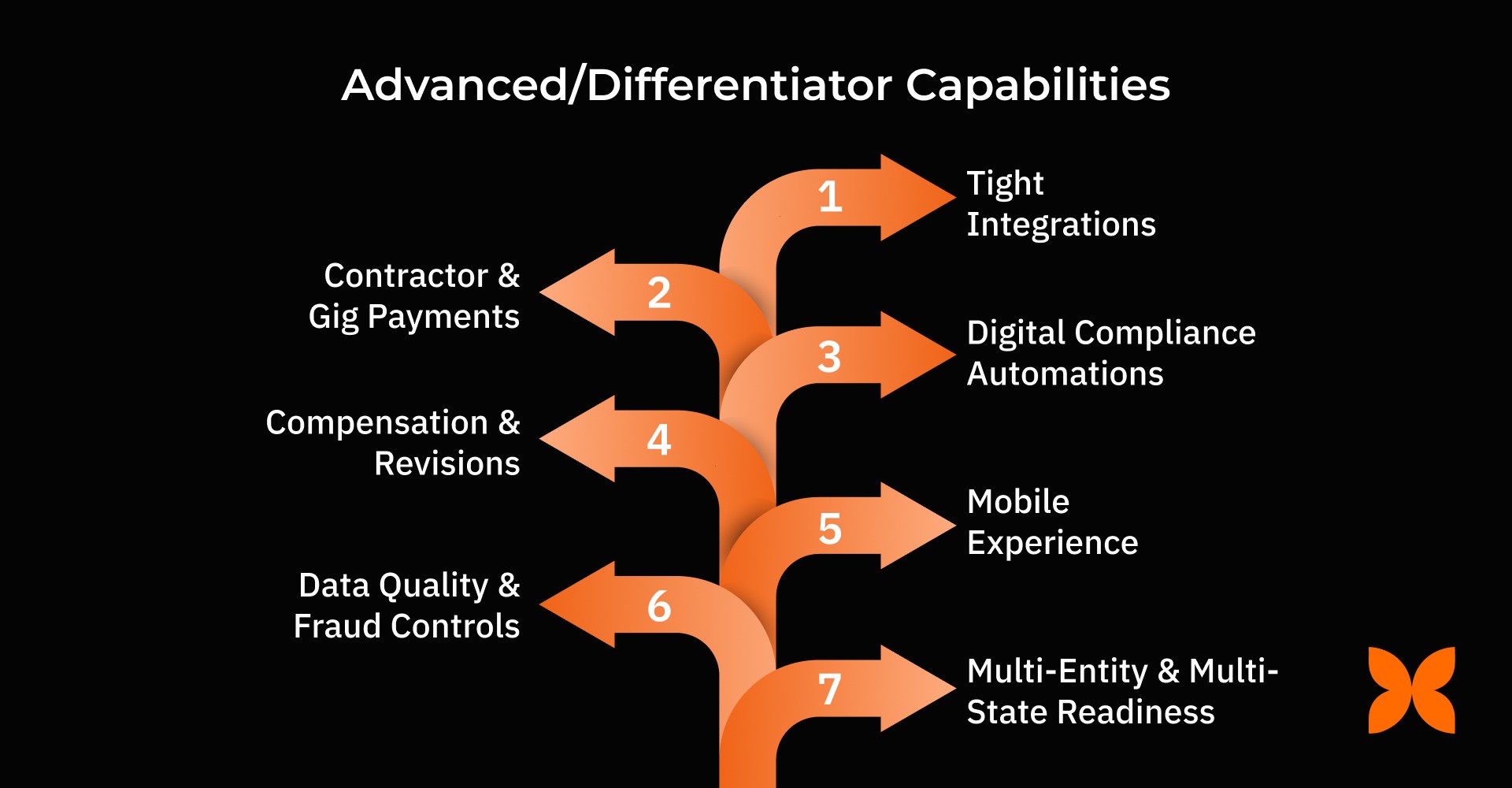

Advanced features such as integrations, contractor/gig payments, digital compliance automation, compensation revision workflows, mobile apps, fraud controls, and multi-entity/multi-state support help businesses scale smoothly.

Choosing a provider requires assessing compliance depth, reliability, and integrations, ensuring the solution supports long-term growth and multi-entity readiness.

Payroll software is a system designed to automate the management of employee compensation. This ensures accurate salary calculations, tax deductions, and timely disbursements.

For Indian businesses, this software simplifies complex payroll tasks by integrating statutory compliance and salary management into one platform. This means that HR and finance teams no longer have to manually calculate TDS, EPF, and ESI, which are prone to errors and can lead to costly penalties.

For companies with a growing team or multi-location setup, it ensures consistent payroll processes across departments and regions. Simply put, this software reduces the workload on HR teams, improves data accuracy, and ensures that employees are paid on time, every month.

By addressing the core functions, payroll software offers a range of key benefits that directly impact both HR efficiency and business operations.

Payroll software provides HR teams and founders with a well-organised approach to managing compensation, ensuring greater efficiency and adherence. It helps businesses reduce errors, save time, and improve the overall employee experience, all while providing better control and scalability.

Here are the significant benefits payroll software offers:

Accuracy & Compliance: Automates complex salary components and statutory deductions, reducing errors and ensuring adherence to the latest Indian regulations.

Time Savings & Automation: Cuts manual work by automating calculations, filings, and reports, allowing HR teams to focus on strategic tasks.

Enhanced Employee Experience: Gives employees self-service access to payslips, Form 16, and tax tools, improving transparency and reducing routine HR queries.

Visibility & Control: Offers real-time reports, variance checks, and audit trails, helping leaders track payroll performance and spot issues early.

Scalability & Standardisation: Supports growing teams, multi-location payroll, and consistent processes across departments as the business expands.

Also Read: Best Payroll Software in India for Small Businesses and Startups

Ranging from diverse state laws to the constant need for adherence, choosing the right payroll software features can be the difference between smooth operations and costly errors.

Managing payroll in India no longer requires complex pay structures. Payroll software helps businesses efficiently handle existing challenges, ensuring timely payments and accurate compliance.

Core Capabilities

To effectively manage payroll in India, the software must include these must-haves that address key operational and compliance needs. Here's a look at those essential features.

Automated Salary Computation: Payroll software should automate the calculation of multi-component CTC, allowances, arrears, and deductions like leave encashment notice pay. This ensures accuracy and efficiency, especially for businesses with complex pay structures.

India Statutory Compliance: With frequent changes in TDS (both old and new regimes), EPF, ESI, Professional Tax (state-wise), and other compliance requirements, payroll software should handle all statutory filings automatically, generating Form 16, Form 12BA, and more, ensuring timely submissions and avoiding penalties.

Reimbursements & Flexi Benefits: Businesses can offer employees tax-optimised reimbursements like fuel, meal, and medical allowances. Payroll software should support FBP selection and automate claims with predefined policies and approval workflows to ensure accurate processing.

Pay Run Management: The ability to handle multiple pay groups and pay cycles (monthly, weekly, on-cycle, off-cycle) is essential for businesses with varied payroll structures. Software should also include pre-pay validations and maker-checker approval systems to prevent errors.

Disbursements: Payroll software must support bulk payouts through bank/NACH/NEFT, including split payments. Automatic, multi-language payslips should be generated and securely delivered to employees for transparency.

Employee Self-Service (ESS): ESS portals enable employees to download payslips, update personal information, view Form 16, and even simulate tax estimations and switch between old and new tax regimes, empowering employees with control over their data.

Reporting & Analytics: Payroll software should offer comprehensive payroll registers, variance reports, and custom report builders. The ability to export data into formats like XLS, CSV, and PDF, along with detailed audit trails, ensures proper tracking and reporting.

Security & Access Control: Given the sensitivity of payroll data, robust security features like role-based permissions, data encryption, and session logs are essential. Software should also have backup and disaster recovery measures to ensure data safety.

Advanced/Differentiator Capabilities

In addition to core features, advanced capabilities can provide significant value by enhancing integration, automation, and scalability. Here’s what to look for in these differentiating features.

Tight Integrations: The payroll software must seamlessly integrate with attendance, leave management, shift management, and accounting systems. Integration with APIs and webhooks is crucial for real-time syncing across various departments.

Contractor & Gig Payments: For businesses with contractors or gig workers, payroll software should support TDS under 194C/194J, separate payment cycles, and statements to manage non-regular employees efficiently.

Digital Compliance Automations: Payroll software should automate statutory filings like ECR for ESI, PT, and Form 24Q, with built-in reminders and exception alerts for ESI thresholds, PF wage caps, and other compliance requirements.

Compensation & Revisions: Payroll systems should simplify salary revisions, increment letters, bulk CTC updates, and retro-pay calculations, especially during variable pay cycles.

Mobile Experience: Admins should be able to approve payroll, view reports, and access payslips on the go. Employees should receive alerts for payroll changes and have access to geo-attendance features for location-based attendance tracking.

Data Quality & Fraud Controls: To avoid errors and fraud, the software should include duplicate checks for bank accounts and UANs, alerts for sudden pay spikes, and automatic detection of inactive employees.

Multi-Entity & Multi-State Readiness: For businesses with operations in multiple states, the payroll system should be capable of handling diverse PT slabs, multi-bank integrations, and multi-currency payroll, offering scalability for growing organisations.

Payroll Feature Priorities by Business Stage (Startup to Enterprise)

As your company grows, the importance of each payroll feature shifts. Here is how startups, mid-market companies, and enterprises should prioritise them.

Payroll Software Feature | Startups | Medium-Sized Businesses | Enterprises |

Automated Salary Computation | Essential for accuracy with small HR teams | Mandatory due to expanding salary structures | Critical because of volume, complexity, and multi-grade salary frameworks |

India Statutory Compliance (TDS, EPF, ESI, PT) | Must-have to avoid penalties | High priority due to multi-state compliance | Enterprise-critical with automated e-filing and audit-readiness |

Reimbursements & Flexi Benefits (FBP) | Useful but optional in early stages | Important as companies start offering structured benefits | Essential for tax optimisation and policy automation at scale |

Pay Run Management (on-cycle/off-cycle) | Basic cycles sufficient | Multiple cycles needed for contractors, sales, shifts | Advanced cycles, pre-pay validations, and maker-checker are mandatory |

Bulk Disbursements & Payslips | Automatic payslips beneficial | Necessary for multi-team coordination | Critical with multi-bank, NACH integrations and high-volume payouts |

Employee Self-Service (ESS) | Helps save HR time | Strongly recommended to reduce service tickets | Mandatory for scale, tax regime switching, and self-updates |

Reporting & Analytics | Basic reports sufficient | Important for insights and variance checks | Crucial with custom reports, payroll MIS, and audit trails |

Security & Role-Based Access | Basic access control fine | Important as teams expand | Enterprise-grade encryption, logs, SSO, and IAM are essential |

Integrations (Attendance, HR, Accounting) | Useful but not always required initially | Important to unify HR + payroll workflows | Mandatory for real-time sync across multiple systems |

Contractor & Gig Payments | Useful only if using freelancers | Often required for mixed workforce models | Critical for high contractor volume and compliance under 194C/194J |

Digital Compliance Automations | Helpful for lean teams | Reduces risk and manual filings | Essential to handle EPF/ESI/PT filings across multiple states |

Compensation & Revision Management | Simple revisions only | Needed during appraisal cycles | Must-have for bulk revisions, retro-pay, and variable pay cycles |

Mobile Experience (Admin + Employee) | Good to have | Important for distributed teams | Critical for real-time approvals and the workforce on-field |

Data Quality & Fraud Controls | Useful as a safeguard | Important for payroll accuracy | Essential for fraud prevention across large employee bases |

Choosing the right payroll provider for your business helps you avoid all the troubles and grow efficiently. Here’s how to evaluate and select the best solution for your needs.

For Indian businesses, selecting a payroll provider involves more than just picking a solution that processes salaries. It requires evaluating factors like compliance, integration, and reliability to ensure smooth operations and minimise risks.

Here’s how you can assess the right provider for your payroll needs.

Compliance Depth: Ensure the provider offers comprehensive coverage for TDS, EPF, ESI, PT, LWF, and supports regular updates for changing laws. Look for e-filing readiness and the ability to generate statutory files in the required formats.

Accuracy & Reliability: The software should include pre-pay validations, variance checks, and a rollback mechanism to prevent errors. Detailed audit logs should also be available to track changes and ensure data integrity.

Usability & Time-to-Value: The payroll system should have quick setup options, such as salary templates or importers, and an intuitive user interface. Easy access to documentation and training will also help speed up adoption.

Integrations & Extensibility: The provider should offer native integrations with HR, attendance, and accounting systems, along with open APIs and webhooks for seamless connectivity with other business tools.

Support & Trust: Look for a provider with clear SLAs, onboarding assistance, and a solid security posture. Check their references, uptime history, and responsiveness to ensure reliable long-term support.

Total Cost of Ownership: Evaluate the transparent pricing structure, ensuring there are no hidden fees. Consider the implementation effort required and weigh it against the manual work saved by automating payroll tasks.

These factors will help ensure you choose a payroll provider that meets your immediate needs and supports your business’s long-term growth. To fully realise these advantages, you need a single, unified solution that is built specifically for Indian complexity and compliance.

Also Read: Fast Payroll Implementation: From Start to Launch

Craze is built for growing Indian companies that need payroll to stay accurate, compliant, and connected as teams, locations, and policies expand.

End-to-End India Compliance, Built In

Craze automates TDS (old/new regimes), EPF, ESI, PT, LWF, and statutory outputs like Form 24Q, Form 16, and ECR files. All regulatory updates are handled in the system, so HR and finance no longer have to chase new templates or monthly deadlines.Connected Pay Runs Across People, Time & Benefits

With real-time sync across Attendance & Leave, HR core, and Reimbursements/FBP, Craze keeps employee data aligned before payroll runs. Maker–checker approvals and clean payouts via bank/NACH or direct payout via Craze Dashboard ensure both regular and off-cycle runs stay controlled and predictable.Controls That Protect You as You Scale

Variance checks, exception alerts, role-based access, and full audit trails help catch errors before disbursement. These controls reduce dependency on a single payroll owner, lower risk, and keep the organisation audit-ready.Fast to Implement, Ready for Your Growth Stage

Setup is quick with templates and bulk imports, and you can gradually expand into modules like Performance, OKRs, IT Assets, and IAM. Craze grows with your organisation, supporting more employees, locations, and entities without requiring you to rebuild your payroll system.

1. What are the must-have payroll software features in India?

Automated salary computation, statutory compliance (TDS, EPF, ESI, PT), disbursements, ESS access, reporting, and role-based security.

2. What mandatory tax and compliance filings must payroll software handle for Indian businesses?

A good payroll system should support monthly EPF/ESI/PT filings, monthly and quarterly TDS returns (e.g. Form 24Q / 26Q), and issue annual forms such as Form 16, Form 12BA or Form 12BB, depending on allowances and investments.

3.Can payroll software handle contractors and gig-worker payments?

Many solutions support separate pay cycles and TDS compliance for freelancers under Sections 194C/194J.

4. Do all payroll systems support multi-state payroll?

Not always. Growing businesses should choose the payroll software like Craze that supports diverse PT slabs, compliance, and multi-state & multi-entity configurations.

5. Is employee self-service (ESS) important for payroll management?

Absolutely. ESS portals let employees access payslips, tax forms, and personal payroll data directly, reducing HR queries and improving transparency. It also simplifies updates and communications.