Getting compensation right is about aligning people, performance, and purpose.

In fact, a recent Aon survey shows salary increments averaged 9.3 % in 2024 and are projected to stabilise at 9.2 % in 2025, while companies are shifting toward performance-linked compensation models to retain critical talent. For Indian startups and growing businesses, a well-structured compensation system can improve retention, boost productivity, and simplify compliance with wage laws.

But “compensation” in HRM goes far beyond take-home pay. From performance incentives to non-cash perks, it plays a critical role in shaping culture, driving accountability, and meeting workforce expectations in a competitive market.

This article covers the compensation definition in HRM, the different types of HR compensation, why it matters, and how to build a future-ready compensation process that works for both business and people. Let’s get started.

Compensation in HR isn’t just about salaries. A well-structured system aligns people, performance, and purpose, driving retention and productivity.

Today, compensation models are shifting. With salary increments averaging 9.3% in 2024 and projected at 9.2% in 2025, companies are increasingly moving toward performance-linked and equity-based rewards to retain top talent.

Effective compensation goes beyond paychecks. From health benefits and ESOPs to flexible perks and recognition, it shapes culture, builds accountability, and attracts the right talent.

The process matters as much as the package. Job evaluation, benchmarking, reward design, and performance-linked reviews create fairness, compliance, and motivation at scale.

The best HR leaders treat compensation as a strategy, not just an expense. They build systems that balance fixed and variable pay, comply with wage laws, and adapt to changing workforce needs — all while reinforcing business goals.

Compensation in Human Resource Management (HRM) is the total package of monetary (salary, bonuses, benefits) and non-monetary (perks, recognition) rewards employees receive for their work, strategically designed to attract, motivate, and retain talent while aligning with business goals and ensuring fairness. It's a crucial function that manages all forms of pay, from base wages to complex incentives, aiming to maximise return on human capital and maintain a competitive edge.

Compensation shapes how your workforce performs, grows, and stays with you. In competitive markets, the way you structure compensation can directly influence your ability to scale and retain top talent.

Here's why it deserves a front-row seat in every HR and finance discussion:

Strategic use in attracting and retaining talent

A competitive compensation package helps attract high-quality candidates and reduces voluntary attrition among top performers.

Enhances motivation and productivity among employees

Fair and well-structured compensation directly influences employee morale, leading to stronger performance and greater ownership.

Critical for aligning with organisational goals and culture

Compensation plans that reflect company values and growth objectives help reinforce the behaviours that drive business outcomes.

Also read: Comprehensive Guide to Payroll Management.

Now that we understand why compensation is critical, let’s unpack the different types that make up a complete HR compensation structure. From base pay to performance perks, it’s all in the details.

To build compensation structures that attract, motivate, and retain talent, HR professionals must understand the full range of compensation elements available. Compensation broadly falls into direct financial rewards and indirect (financial and non‑financial) rewards, both of which contribute to an employee’s total compensation package.

Direct Financial Compensation

Direct compensation refers to the monetary rewards employees receive from their employers for the work they perform. These payments are typically structured, measurable, and legally governed.

1. Hourly Wages

Employees paid by the hour receive compensation proportional to time worked, including overtime for hours beyond standard schedules. This model suits part‑time, temporary, or contract roles.

2. Salaries

Salaried employees receive a fixed annual or monthly salary regardless of the number of hours worked. This form is common for full‑time, skilled, or professional roles and signals the employer's long-term investment.

3. Commission Pay

Commission pay is often used in sales and revenue‑driven roles and rewards employees based on performance against specific targets. This aligns compensation directly with individual or team results.

4. Bonuses and Incentive Pay

These variable rewards are tied to performance goals, project outcomes, or organisational results. Common subtypes include:

Signing Bonus: A one-time payment to incentivise acceptance of a job offer.

Retention Bonus: A reward provided to employees for staying with the company for a defined period.

Merit Pay: Performance-based increases linked to appraisal outcomes.

5. Other Direct Pay Forms

Direct compensation also includes less traditional financial rewards, such as:

Tips and Shared Gratuity: Common in service industries where employees earn extra based on client payments.

Piece-Rate Pay: Payment provided for each unit produced or task completed.

Deferred Compensation: Payments, such as annuities or deferred bonuses, are scheduled for future years.

While direct compensation is crucial, a well-rounded package also includes non-monetary rewards. Let’s look at those next.

Indirect Compensation (Benefits and Perks)

Indirect compensation includes monetary and non‑monetary rewards that have value but are not paid as regular cash wages. These enhance the overall employment experience and are key to engagement.

1. Equity-Based Rewards

These rewards give employees a stake in the company:

Equity Packages: Ownership shares granted outright or on a vesting schedule.

Stock Options: The right to purchase company shares at a fixed price in the future.

Equity Based Rewards like ESOPs: Shares awarded once specific conditions are met.

Stock Appreciation Rights (SARs): Rewards tied to increases in stock value without requiring share purchase.

2. Employee Benefits

These are employer-paid financial supports that improve security and well-being:

Healthcare Coverage: Medical, dental, and vision insurance for employees and their dependents.

Retirement Plans or Pension Plans: Employer contributions to long-term savings and retirement funds.

Disability and Life Insurance: Protection in case of loss of income or life events.

Provident Fund (PF / EPF) contributions: Employer matching of retirement contributions up to a specified level.

3. Non-Monetary Benefits

These perks improve employee experience and work-life balance:

Paid Time Off (PTO): Vacation, sick leave, and personal days that allow employees to rest or handle personal matters.

Flexible Work Arrangements: Options such as remote work or flexible schedules that help employees manage personal responsibilities.

Parental or Childcare Support: Leave policies and childcare assistance to support working families.

Learning and Development: Tuition reimbursements and professional growth budgets for career advancement.

Company-Provided Tools: Laptops, phones, vehicles, or other equipment needed to perform the job.

4. Workplace Perks

These items improve daily engagement and strengthen company culture:

On-site Amenities: Meals, wellness facilities, or fitness centres provided by the employer.

Social Events and Team Experiences: Organised activities that build camaraderie and engagement.

Recognition Programs: Formal acknowledgement of employee achievements to motivate and retain talent.

When designing indirect compensation, HR must customise offerings to workforce demographics and expectations, as these benefits significantly influence recruitment and retention.

Total Compensation: The Complete Reward Picture

Total compensation aggregates all monetary and non‑monetary rewards an employee receives. A clear breakdown helps employees understand not just pay but the entire value of their employment relationship. Two common approaches to presenting total compensation are:

Option 1: Two Main Categories

Total compensation can be grouped into two broad categories:

Direct Compensation: Includes base salary, performance bonuses, commissions, and equity-based rewards such as stock options.

Indirect Compensation: Covers benefits like healthcare, retirement contributions, paid time off, or perks such as a company car.

Option 2: Detailed Breakdown

For greater clarity, total compensation can be subdivided into more specific categories:

Financial Compensation: Salary, bonuses, commissions, and stock-based incentives.

Retirement and Long-Term Benefits: Employer contributions to Provident Fund (PF), NPS, gratuity, or superannuation schemes that support long-term financial security.

Health and Wellness Benefits: Medical, dental, and vision coverage; mental health support; and wellness programs, such as gym memberships.

Learning and Development Benefits: Professional growth budgets, tuition reimbursement, and access to training programs.

Every new hire should receive a clear total compensation report that outlines guaranteed rewards, such as base salary and standard benefits, as well as performance-linked rewards, such as bonuses or commissions tied to individual, team, or company results.

With compensation evolving fast, it’s crucial to manage it with structure. Next, we’ll walk through the full compensation lifecycle.

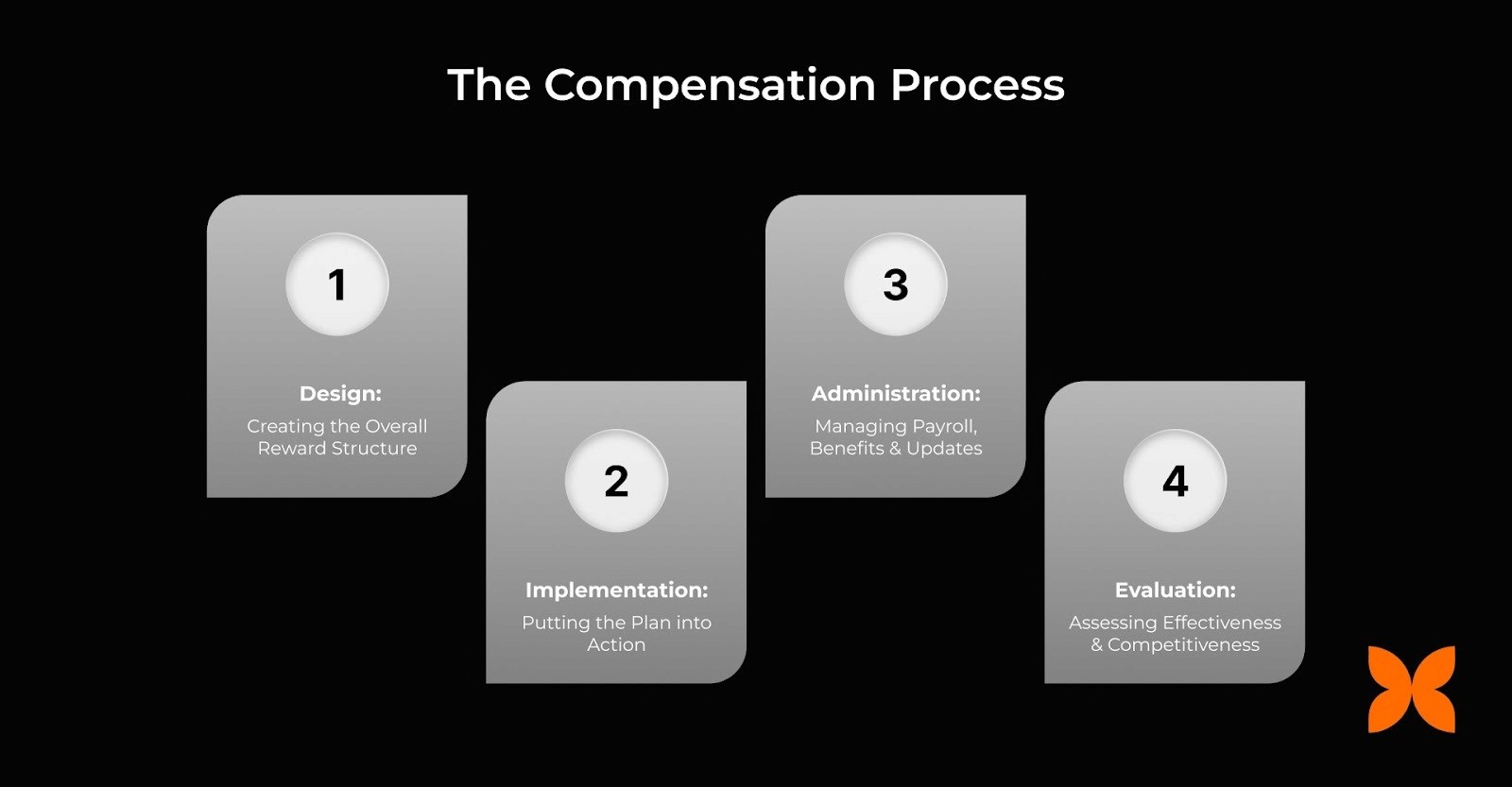

Designing a fair and effective compensation structure is an ongoing cycle that aligns workforce planning with performance and business outcomes. A structured approach ensures pay is competitive, equitable, and motivates employees effectively.

1. Design: Creating the Overall Reward Structure

Begin by analysing roles and responsibilities to establish clear pay bands and internal equity. Conduct job evaluations, assess required skills, and determine contribution levels. Incorporate a mix of base pay, variable incentives, benefits, and long-term rewards aligned with business strategy.

Example: A startup uses Craze HR software to document role definitions across teams, mapping pay ranges by level so junior developers are paid appropriately relative to senior staff.

2. Implementation: Putting the Plan into Action

Translate your compensation strategy into concrete actions, including offer letters, onboarding documentation, and communication of pay structures. Ensure transparency so employees understand the rationale behind their compensation. Use automated tools to streamline approvals and consistency across teams.

Example: An HR team uses Craze to automate new-hire offer letters, standardise pay structures, and avoid errors in variable pay calculations.

3. Administration: Managing Payroll, Benefits, and Ongoing Changes

Maintain accurate records, administer payroll, and manage benefits while tracking role changes or promotions. Regularly update compensation data to reflect market adjustments, new responsibilities, or policy changes. Automation reduces errors and ensures compliance.

Example: A mid-sized firm utilises Craze to manage payroll, benefits, and reimbursements in one system, ensuring timely payouts and accurate tax deductions.

4. Evaluation: Regularly Assessing Effectiveness and Market Competitiveness

Continuously review your compensation programs to ensure fairness and alignment with the market. Conduct internal audits, compare pay to industry benchmarks, and measure employee satisfaction. Use insights to adjust pay bands, incentive programs, or benefits offerings.

Example: HR conducts a quarterly review using Craze analytics to benchmark salaries, identify pay gaps, and adjust bonus structures to retain top performers.

Also Read: Understanding Fixed and Variable Components in Salary Structure

Well-structured compensation is about the right timing, balance, and delivery. But what factors really shape these decisions? Let’s explore the core elements that influence compensation next.

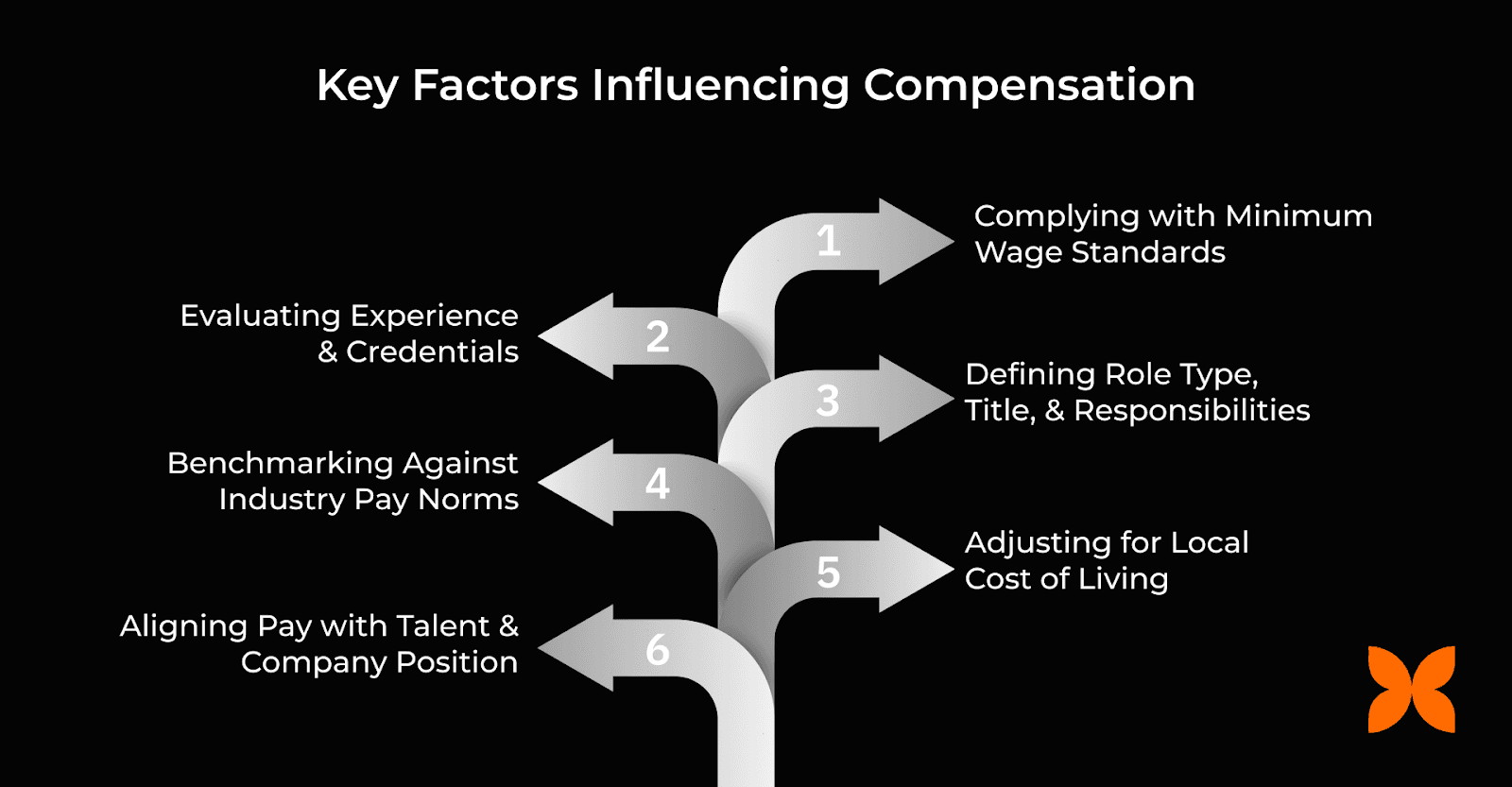

Designing the right compensation package requires balancing multiple internal and external influences. From regulatory requirements to market dynamics and talent availability, understanding these factors helps organisations offer competitive, fair, and sustainable pay.

Complying with Minimum Wage Standards: Organisations must ensure salaries meet or exceed government-mandated minimum wages. Non-compliance can lead to legal penalties and employee dissatisfaction.

Evaluating Experience and Credentials: Pay scales often reflect a candidate’s experience and qualifications. Advanced expertise or certifications justify higher compensation levels.

Defining Role Type, Title, and Responsibilities: The nature of the job and its responsibilities directly influence compensation. Senior or high-impact roles typically pay more than entry-level positions.

Benchmarking Against Industry Pay Norms: Comparing salaries with industry standards ensures competitiveness in hiring. Companies lagging behind risk losing talent to better-paying peers.

Adjusting for Local Cost of Living: Geographic location affects compensation to match living expenses. Higher costs in urban or high-cost regions often translate to salary premiums.

Aligning Pay with Talent Market and Company Position: Organisations must balance talent scarcity with company size and brand reputation. Top firms often offer higher pay and perks to attract hard-to-find or highly skilled talent.

The right compensation strategy is a balancing act, but what happens when it starts to wobble? Let’s look at the most significant challenges HR leaders face while managing compensation.

Compensation is about strategy, perception, and business impact. But aligning it all in a way that’s fair, competitive, and compliant is easier said than done. Here are some of the key challenges businesses face:

Balancing budget constraints with competitive market demands

Founders and HR heads often struggle to offer market-aligned pay without overstretching tight startup budgets. This trade-off can impact hiring quality and retention, especially in high-skill functions like product and engineering.

Ensuring fairness and equity across different job roles

Uneven pay structures and legacy pay disparities can breed dissatisfaction. Creating equitable compensation across levels, functions, and locations requires both data visibility and policy consistency.

Adapting to changes in regulatory environments and industry standards

Compensation laws are not static. From PF ceiling updates to new labour codes, staying compliant while keeping internal processes clean is a constant challenge, especially for teams using fragmented tools.

Let’s now examine the key compensation trends that are shaping pay structures and workforce strategies in 2026.

Regulation, workforce expectations, and data-driven governance increasingly shape compensation strategies in 2026. Organisations are moving from static pay structures to transparent, equitable, and performance-linked compensation models.

The following trends are redefining how HR teams design, manage, and govern compensation frameworks:

Pay transparency laws: While India does not yet mandate pay transparency, global best practices and internal equity expectations are pushing organisations to define clear salary bands and document compensation logic. Organisations must standardise pay bands, document compensation logic, and conduct regular pay equity reviews to remain compliant and defensible.

DEI-driven compensation audits: Compensation audits are increasingly structured around measurable DEI metrics. Companies are analysing pay gaps across gender, tenure, and role levels, then correcting inequities through calibrated adjustments rather than ad-hoc fixes.

ESG-linked executive pay: Executive compensation is being tied to ESG performance indicators such as sustainability targets, workforce equity outcomes, and governance benchmarks. This shifts incentive plans from short-term financial goals to long-term enterprise value creation.

Remote work premiums and location-based pay: Remote work has led to differentiated pay models. Employers are adopting location-based salary bands or role-critical premiums to balance cost control with competitive talent acquisition in distributed workforce environments.

With so many shifting rules and expectations, keeping compensation fair, transparent, and compliant can quickly become overwhelming. Let’s see how Craze simplifies these processes and helps your HR team manage compensation efficiently.

Craze gives HR and PeopleOps teams an all-in-one platform to plan, manage, and optimise compensation without toggling between spreadsheets and point tools. Here’s how it helps:

Single Source of Truth: All compensation databases, base salary, bonuses, ESOPs, and deductions live in one place, fully integrated with payroll and HR workflows.

Automated Compliance: Built-in support for Indian PF, ESIC, PT, and evolving labour codes ensures every payout stays compliant, without manual intervention.

Role-Based Access & Approval Flows: Advanced permissions let you set up tailored compensation workflows for HR, finance, and founders, with full audit trails.

Integrated Reviews & Adjustments: Sync performance appraisals with pay revisions and generate custom reports to track fairness and transparency.

Real-Time Insights: Get visibility into cost-to-company, payroll liabilities, and budget impact, instantly and accurately.

How you design compensation directly influences whether employees stay, perform at their best, and view your organisation as a desirable place to work. As your organisation scales, so must your compensation strategy. Effective compensation in HR requires regular reviews, data-backed decisions, and systems that don’t break as you grow, ensuring pay structures remain fair, competitive, and aligned with business goals.

1. What is the primary difference between direct and indirect compensation?

Direct compensation refers to financial payments such as salaries and bonuses. Indirect covers benefits like insurance and perks. Both impact retention and satisfaction.

2. How often should compensation structures be reviewed?

Ideally, once a year or whenever there are significant market or internal changes. This ensures fairness and competitiveness.

3. Can startups use equity as a substitute for high salaries?

Yes, but clarity on vesting, buybacks, and future value is key to making it effective and motivating.

4. How does performance-linked pay align with business outcomes?

It ties rewards directly to results, encouraging ownership. Tools like Craze can help automate this across roles.

5. Is it necessary to offer benefits beyond statutory requirements?

For talent retention, yes. Top candidates increasingly expect competitive benefits, such as hybrid work support and wellness perks.