Late tax filings, mismatched TDS, unexplained reimbursements, and payroll errors don’t just happen at scale; they start small. These problems may seem small at first, but they can quickly escalate, leading to costly penalties, internal friction, and a higher risk of compliance violations.

For teams managing payroll across fast-moving organisations, the margin for error is shrinking. This is why businesses are moving towards automation. And it shows; businesses using automated, strategic payroll systems report 70% fewer compliance issues.

This guide is for HR and finance leads who are tired of playing catch-up and want a sharper, audit-ready process built for accuracy from the ground up.

A payroll audit is a structured review of your salary disbursement, tax deductions, and employee records to ensure they match legal and internal requirements.

It helps uncover common payroll issues like incorrect TDS, unpaid bonuses, duplicate payments, and missing exit settlements.

The audit process involves checking employee data, timesheets, variable pay, and reconciling payroll with ledgers and bank transactions.

A well-structured HR payroll audit checklist reduces errors, improves accountability, and highlights areas needing immediate correction.

Craze supports audit readiness with auto-synced records, policy-based controls, and downloadable payroll compliance reports.

A payroll audit is a detailed examination of your company’s payroll system to confirm that every payment, deduction, and record aligns with policies and legal requirements. It checks whether employees are being paid accurately, taxes are withheld correctly, and documents reflect real-time data.

This process isn’t just about compliance; it’s also about catching inefficiencies, preventing fraud, and protecting both your employees and your business from avoidable mistakes. An audit also reveals gaps between your policies and their actual implementation across departments.

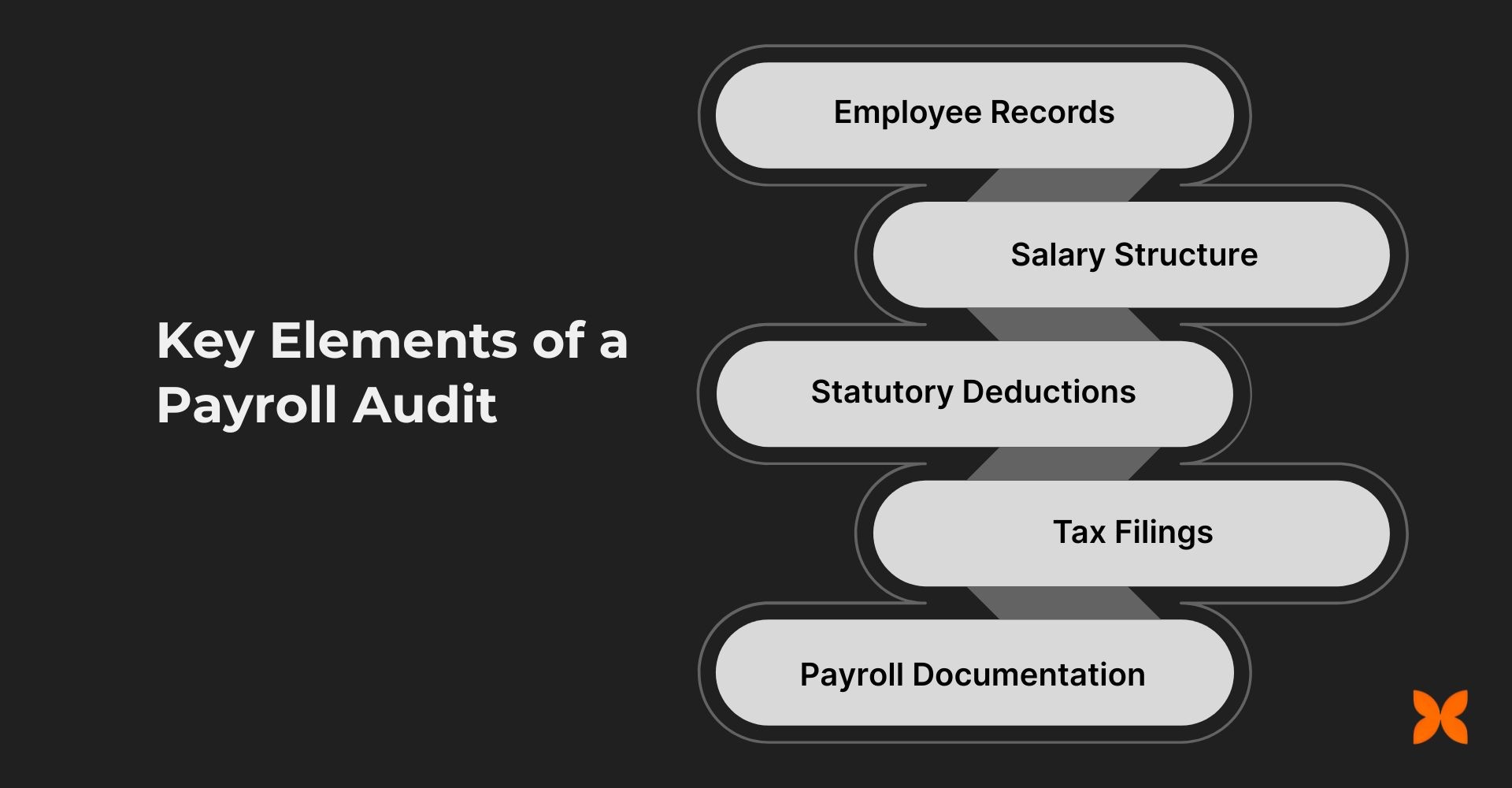

Key Areas to Check in a Payroll Audit

Each audit focuses on verifying the following core areas:

Employee records: Confirm that only active employees are on the payroll and their personal and job-related data is up to date.

Salary structure: Ensure that salary components (basic, HRA, variable pay, etc.) match offer letters, revision documents, and internal policies.

Statutory deductions: Validate deductions for PF, ESI, PT, and other regulatory components based on current Indian labour laws.

Tax filings: Review how TDS is calculated, withheld, and reported. Ensure consistency between payroll records and filings with authorities.

Payroll documentation: Check that salary slips, Form 16s, reimbursement proofs, and other records are securely stored and match audit data.

The main question for most growing teams is why a payroll audit is worth doing in the first place.

As payroll grows more complex, audits help you stay in control of compliance, accuracy, and costs without adding extra overhead.

Legal Compliance and Cost Avoidance

Inconsistent or incorrect payroll processing can lead to compliance issues under Indian labour laws. Missed deductions, wrong tax calculations, or delayed filings put businesses at risk of penalties and interest charges.

Regular audits help teams stay up to date with PF, ESI, TDS, and other statutory requirements. For companies operating across multiple states, audits also ensure alignment with region-specific rules that may change without notice.

Employee Trust and Satisfaction

When payroll errors go unnoticed, employees notice. Delays, missing payments, or unexplained deductions can cause dissatisfaction and frustration, especially when they happen more than once.

Auditing payroll helps catch these issues early. It gives HR and finance teams the chance to correct mistakes and maintain credibility with the people who rely on timely, accurate payouts.

Budget Control and Resource Planning

Without audits, it’s hard to know if payroll numbers reflect actual costs. Errors in overtime pay, bonuses, or classification can distort budget forecasts and lead to overspending.

Regularly reviewing payroll data helps align compensation with actual costs. It also supports better planning for future hiring, benefits, and financial decisions.

The way you approach an audit depends on who's running it and what you're trying to uncover.

Not all audits are run the same way. Depending on your company’s needs, structure, or compliance requirements, you may opt for one or more of the following types.

Type of Audit | Who Conducts It | Purpose | Common in |

Internal Payroll Audit | HR and finance teams within the company | To review payroll processes, catch internal errors, and improve efficiency | Startups, SMEs, growth-stage firms |

External Payroll Audit | Independent auditors or CA firms | To get an unbiased review and ensure financial accuracy and compliance | Mid-sized and funded companies |

Statutory/Regulatory Audit | Government authorities or mandated auditors | To verify legal compliance under laws like the Companies Act, 2013 | Large enterprises, public companies |

Once the audit approach is clear, the next step is to identify the specific issues these reviews are likely to uncover across your payroll process.

Payroll audits are often eye-opening because they expose problems that are often hidden in daily operations. These issues tend to build slowly and quietly until they start affecting compliance, budgets, or team trust.

Here are some of the most common problems audits help uncover:

Over or underpayments: Incorrect salary calculations due to outdated salary structures, manual errors, or missed revisions.

EPF/ESI misclassification: Employees wrongly categorised, leading to incorrect or missed contributions under Indian statutory schemes.

Bonus or commission errors: Discrepancies in performance-linked payouts, especially when variable pay isn’t tracked or approved properly.

Payroll fraud: Includes ghost employees, duplicate payments, or unauthorised changes to pay details.

Inaccurate tax deductions: TDS errors caused by old tax slabs, missing declarations, or incorrect salary breakup.

Missed compliance updates: Payroll not updated to reflect the latest central or state-level changes in labour laws or tax policies.

Spotting these issues early depends entirely on how the audit is run, which makes having a clear and structured approach all the more important.

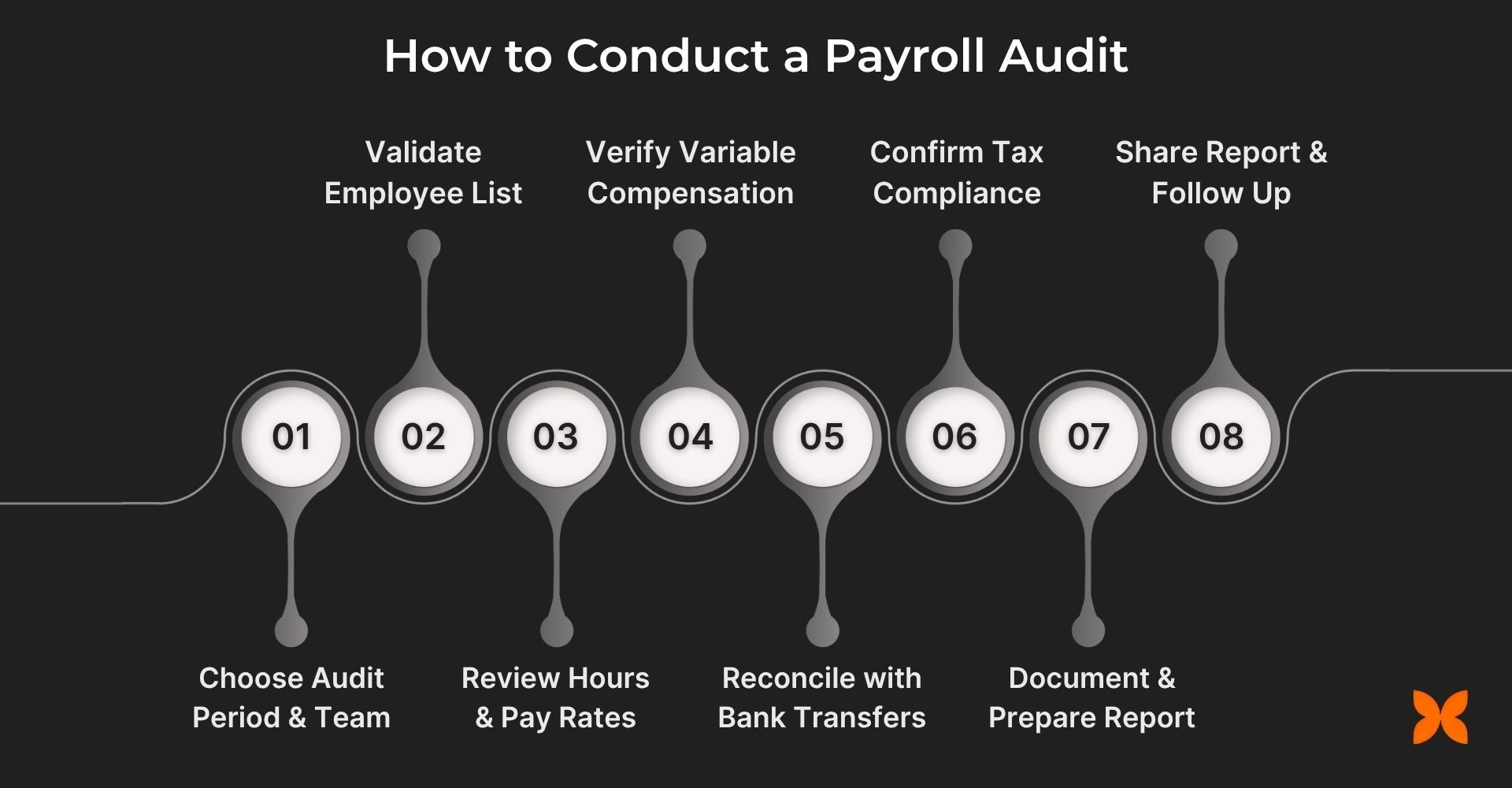

A clear, structured audit process helps your team work faster, avoid oversights, and handle audits without second-guessing each step.

Step 1: Choose the Audit Period and Team

Decide how far back the audit should go and who will lead it based on your company’s structure.

Select a time frame: monthly, quarterly, or year-end, based on your payroll cycles and compliance needs.

Involve HR for employee data, finance for disbursements, and IT if payroll is integrated with attendance or asset tools.

Consider third-party auditors for statutory audits or when internal bandwidth is limited.

Step 2: Validate Active Employee List

Start by ensuring that everyone being paid is currently employed and properly documented.

Cross-check payroll records with your HR database to confirm that all listed employees are actively working.

Flag payments made to exited employees, employees on unpaid leave, or those with unclear employment status.

Verify that job titles, employment types (full-time, intern, contractor), and joining/exiting dates are accurate.

Step 3: Review Hours Worked and Pay Rates

Audit attendance data and verify if compensation matches what’s officially recorded.

Compare timesheets or biometric logs with salary payouts to catch any mismatch in hours logged versus hours paid.

Confirm that each employee’s pay rate matches the most recent offer or revision letter, including probationary or training pay, if applicable.

Step 4: Verify Variable Compensation

Variable pay needs extra attention, as it's often miscalculated or misapplied.

Review bonuses, incentives, overtime, and shift allowances to ensure they are policy-aligned and not duplicated.

Validate whether approvals for each payment exist and whether calculations follow the correct formula (e.g, OT multiplier).

Step 5: Reconcile with Bank Transfers and Ledger

Your payroll data should align exactly with financial transactions and records.

Match every employee’s net pay with corresponding bank transfer logs and ledger entries.

Check for any duplicate payments, delays, or discrepancies between processed payroll and actual disbursed amounts.

Ensure reimbursements or advances are properly offset and recorded.

Step 6: Confirm Tax Compliance and Deductions

Incorrect deductions can lead to penalties or employee complaints. Check each one.

Validate TDS against declared income and submitted proofs under the applicable tax regime.

Review deductions for PF, ESI, and PT to ensure compliance with the latest statutory rules, including state-level differences.

Confirm that all statutory filings have been submitted on time and records are up to date.

Step 7: Document Findings and Prepare Audit Report

Organise every issue you uncover in a format that’s easy to act on.

Log findings by category: payment errors, classification issues, non-compliance, or policy gaps.

Indicate the root cause, teams involved, and the timeline required for resolution.

Use clear formatting so reports are readable and actionable by both HR and finance.

Step 8: Share Report & Follow Up

An audit is only useful if the findings are acted on and improvements are tracked.

Distribute the report to HR, finance, leadership, and other relevant stakeholders with clear action items.

Assign owners for each fix, set internal deadlines, and schedule a follow-up review to confirm implementation.

Maintain a log of completed and pending actions to avoid repeated issues in future audits.

With a solid process in place, it also helps to have a checklist that keeps every critical detail visible as the audit moves forward.

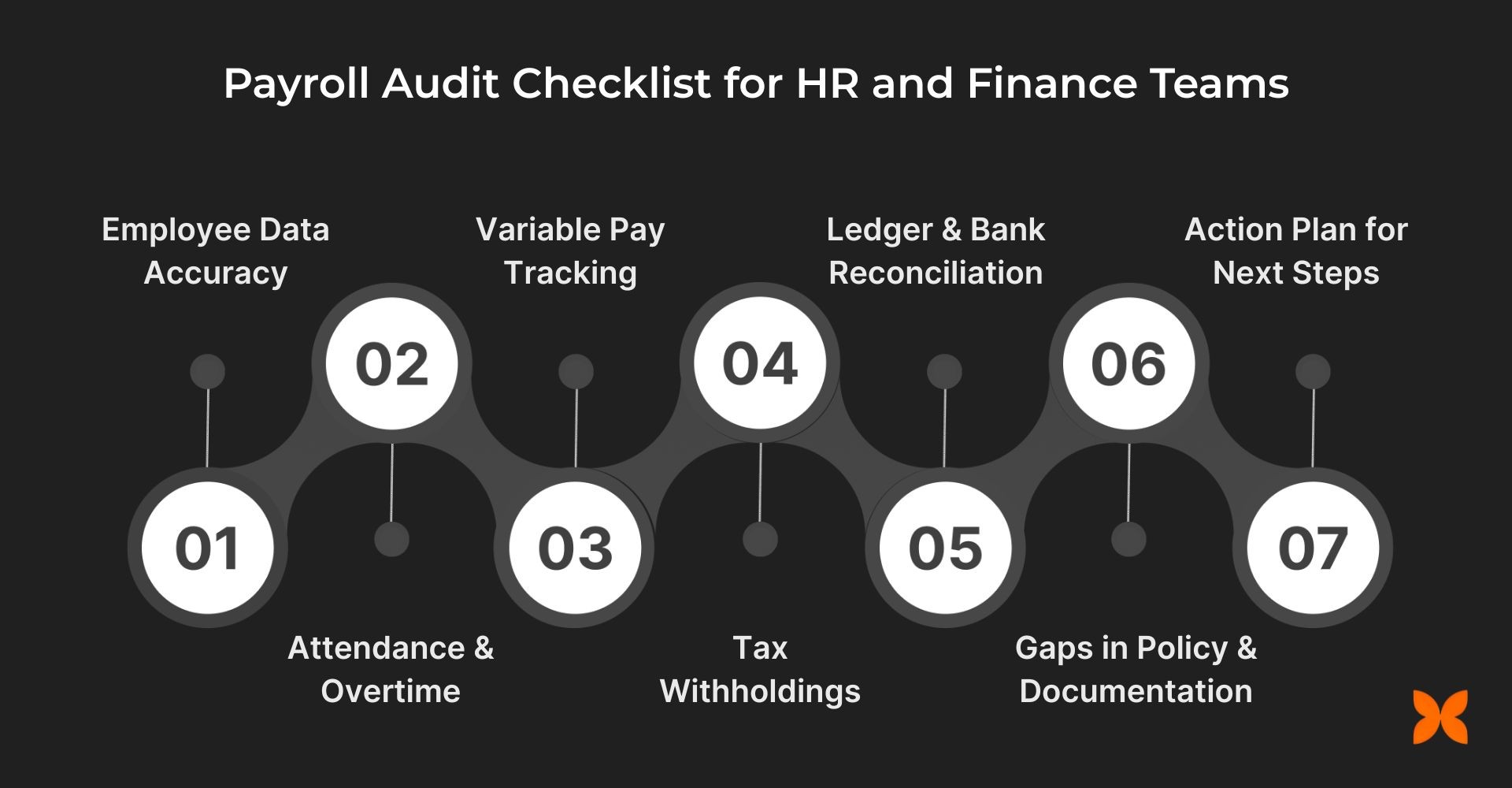

A structured HR payroll audit checklist makes it easier to manage payroll audits across departments. It helps avoid guesswork, reduces rework, and ensures each audit is consistent, regardless of who runs it.

1. Employee Data Accuracy

Start by confirming that employee records are current and match HR documentation. This includes full names, job titles, employment types, and the names of reporting managers.

Mismatches in employee data can cause payroll errors, incorrect classifications, and even regulatory issues if statutory benefits are misapplied. Keeping this data accurate also supports better reporting and analytics.

2. Attendance and Overtime Validation

Review timesheets, leave records, and biometric data to ensure every paid hour is accounted for correctly. This is especially critical for teams with shift work, field staff, or hourly pay.

Inaccurate attendance logs often lead to wrong payouts, unpaid overtime, or overcompensation. Cross-checking against actual payroll figures helps spot these issues early.

3. Variable Pay Tracking

Check how performance bonuses, incentives, commissions, and other non-fixed pay components are recorded and disbursed. These figures should align with internal policies and have proper approvals.

Variable pay errors can add up quickly and are harder to catch if not documented properly. Audits should also ensure that one-time or quarterly payouts are not repeated or misapplied in future cycles.

4. Tax Withholdings

Review all deductions for TDS, PF, ESI, and other statutory contributions. Make sure rates align with the latest laws and that each deduction is accurately reflected in the payroll reports.

Even small mistakes in tax withholdings can result in notices or penalties. It is also important to verify that declarations, proofs, and returns are recorded and submitted correctly.

5. Ledger and Bank Reconciliation

Compare the payroll output against bank transfers and accounting entries. Every disbursement should have a matching transaction and record in the general ledger.

Missed entries or duplicate payments can cause discrepancies in cash flow tracking. Reconciliation ensures payroll figures are clean, auditable, and reflected accurately in financial reports.

6. Policy and Documentation Gaps

Look for missing or outdated documents like offer letters, salary revisions, reimbursement approvals, or exit settlements. Every payout or deduction should be supported by clear documentation.

Without proper records, teams rely on memory rather than data. Fixing documentation gaps also protects the company during regulatory reviews.

7. Action Plan for Next Steps

Summarise your findings with a clear plan. Assign owners to each issue, define timelines, and ensure fixes are communicated and tracked.

An audit isn’t complete until its outcomes are addressed. Following up ensures that improvements stick and the same issues don’t appear again in the next cycle.

With the HR payroll audit checklist in place, a few smart practices can help make each payroll audit smoother, faster, and more reliable over time.

Running a payroll audit is easier and more effective when the right practices are built into how payroll is managed day to day.

Sync payroll with attendance and leave data: Many audit issues start with mismatches in working hours, paid leave, or unapproved absences. Linking payroll with real-time attendance and leave data automatically reduces those gaps.

Automate tax and statutory calculations: PF, ESI, PT, and TDS rules can vary by state and are often updated. Systems that auto-apply the correct slabs and generate compliance-ready reports help minimise audit risks.

Keep employee documents and approvals organised: Offer letters, salary revisions, tax declarations, and reimbursement proofs should be stored in one place, not scattered across email or spreadsheets. Auditors need quick, reliable access.

Control who can edit or approve payroll entries: Role-based permissions help prevent unauthorised changes and make it easier to trace errors. This is especially useful when audits require reviewing who did what and when.

Run audits on a fixed schedule: Setting a monthly or quarterly audit rhythm helps catch issues before they build up. It also shortens the time needed for annual or statutory audits.

Putting these practices in place is much easier when the tools you're using are built to support them from day one.

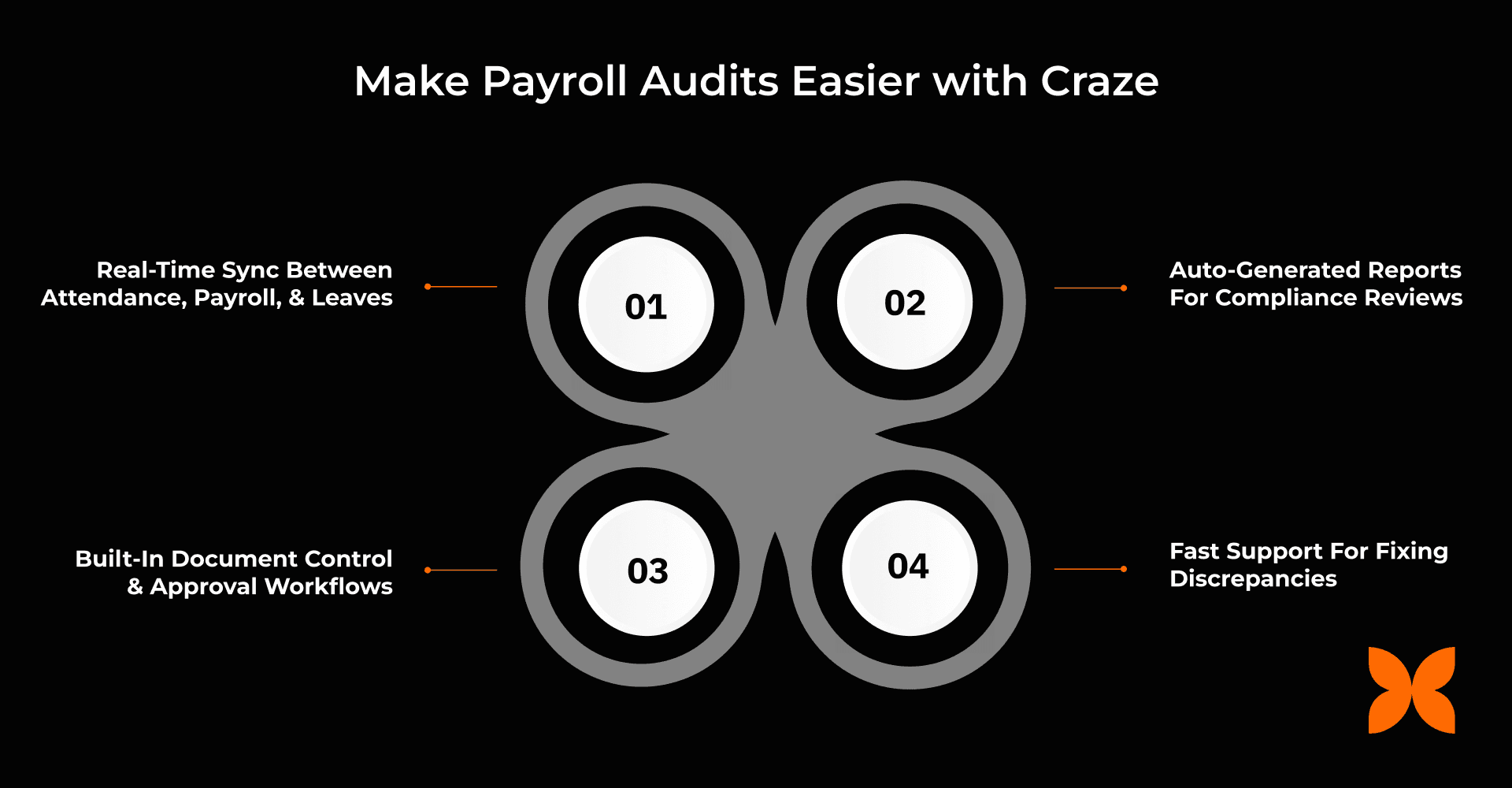

For growing teams, audits can feel like a scramble, chasing down records, reconciling numbers, and piecing together compliance documents. Craze is designed to take the pressure off by building audit-readiness into your daily operations.

Real-Time Sync Between Attendance, Payroll, and Leaves

When core systems speak to each other, there’s less room for error and less work for your team during audits.

Attendance, leave, and payroll data update automatically; no need for manual exports or approvals over email.

Loss of pay, overtime, or leave encashments are already factored into payouts, with no need for double-checking.

Auto-Generated Reports for Compliance Reviews

Preparing for a compliance check shouldn’t mean pulling late nights. Craze generates key reports in seconds.

Download payroll registers, tax deduction summaries, and statutory filings with one click.

Get pre-formatted reports aligned with Indian laws, including PF, ESI, TDS, and Form 16 requirements.

Built-In Document Control and Approval Workflows

Audits often stall when records are missing or approvals aren’t traceable. Craze keeps everything in one place.

Store salary revision letters, tax declarations, bonus approvals, and FnF details centrally.

Set up approval workflows for exceptions, reimbursements, and compensation changes, including audit trails.

Fast Support for Fixing Discrepancies

Sometimes audits reveal gaps that need to be fixed immediately. Craze’s support is designed for that urgency.

Speak to real people who understand Indian payroll and can help resolve complex issues quickly.

Get priority assistance for urgent corrections or documentation requests during audit cycles.

We’ve explored how conducting a payroll audit helps identify critical issues like overpayments, tax miscalculations, and compliance risks that can derail your business. We discussed the necessary steps to carry out an effective audit, along with a checklist to ensure all critical areas, such as employee data, variable pay, and tax deductions, are meticulously reviewed.

By following these steps, you can stay compliant and maintain employee trust while avoiding costly mistakes.

Running payroll audits doesn’t have to be a stressful, time-consuming task. With Craze, payroll audits become effortless thanks to real-time syncing, auto-generated reports, and built-in approval workflows. Ready to streamline your payroll audits and make your HR processes smoother?

Ensure payroll accuracy, simplify compliance, and stay audit-ready with a smarter payroll solution. Book a Demo today.

Q1. What is the difference between a payroll audit and a payroll reconciliation?

A1. A payroll audit is a full review of all payroll-related processes, including policies, documentation, taxes, and compliance. A payroll reconciliation is a step within a broader audit process, focusing specifically on matching payroll output with actual payments and ledger entries.

Q2. How often should a startup conduct a payroll audit?

A2. While larger firms may opt for quarterly reviews, startups and SMEs should aim for a bi-annual or annual payroll audit. More frequent internal reviews, especially after major hiring phases, help spot issues early and keep payroll audit procedures tight and compliant with statutory payroll requirements in India.

Q3. What should be included in an HR payroll audit checklist for exits and FnF?

A3. A focused HR payroll audit checklist for exits must include notice period calculations, pending reimbursements, unpaid leaves, and full and final settlement payroll audit accuracy. It should also verify final deductions like PF and TDS, ensuring they match compliance and internal policies before disbursing final payments.

Q4. Can incorrect employee classification affect a payroll audit outcome?

A4. Yes, employee classification errors are a common red flag during a payroll audit. Misclassifying employees as exempt/non-exempt or contractors as full-time can trigger compliance issues, especially around tax deductions, overtime, and benefits under Indian labour laws.

Q5. How does a payroll audit help with TDS compliance?

A5. A proper payroll audit checks if the TDS payroll review has been done correctly for each employee based on the latest income slabs. It ensures that deductions are accurate, PAN details are valid, and tax is deposited on time. Errors in TDS can result in penalties and notices from the Income Tax Department.