When you’re running HR operations in a growing business, you quickly realise something: the cost of HR is rarely the HR team’s salaries alone. It’s the hidden hours spent chasing approvals, fixing payroll errors, reconciling attendance, answering repetitive queries, and patching gaps between tools.

That is where HR software ROI comes in.

Not as a vague “HR tech is good” story, but as a CFO friendly way to answer a simple question:

If we invest in HR software, what do we get back in money, time, and reduced risk?

In this guide, you’ll learn how to calculate ROI with a simple formula, build a baseline that Finance will trust, model realistic scenarios, and then increase returns over the first 30, 90, and 180 days.

HR software ROI is not subscription cost vs headcount. It’s the net financial impact of operational improvements divided by total cost of ownership.

The biggest ROI drivers usually include time savings, reduced errors, faster onboarding to productivity, lower compliance risk, and tool consolidation.

ROI is strongest when you measure from day one, improve adoption, and redesign workflows around the system.

A realistic ROI plan includes two scenarios and a payback period, not one optimistic number.

Integrated HR, payroll, compliance, and IT workflows often produce higher ROI than stitched together tools because they remove handoffs and rework.

Now that you know what we’re aiming for, let’s clarify what ROI actually means in the context of HR software.

HR software ROI is the return you get from implementing HR software, measured as:

Tangible savings (money you can directly quantify)

Efficiency gains (hours saved that translate into cost avoidance or capacity for higher value work)

Risk reduction (fewer compliance issues, fewer payroll mistakes, fewer audit fire drills)

Scalability benefits (the ability to grow headcount without growing admin load at the same rate)

It helps to separate ROI into two buckets because not every business benefit belongs inside a spreadsheet.

1) Tangible returns (include these in your ROI calculation)

These are measurable in currency with reasonable confidence:

HR and payroll admin hours saved

Fewer payroll corrections and rework

Lower payroll vendor fees

Reduced subscription costs after consolidating tools

Reduced compliance penalty exposure (where you can quantify it)

2) Intangible returns (report these separately, but do not force them into the ROI number)

These matter a lot, but the numbers can be subjective:

Better employee experience

Better visibility for leadership decisions

Higher trust in payroll and HR data

Better manager accountability

Stronger audit readiness and governance

A clean approach is:

Use tangibles for ROI

Use intangibles for stakeholder narrative

Once you draw this line, ROI becomes easier to calculate and much easier to defend.

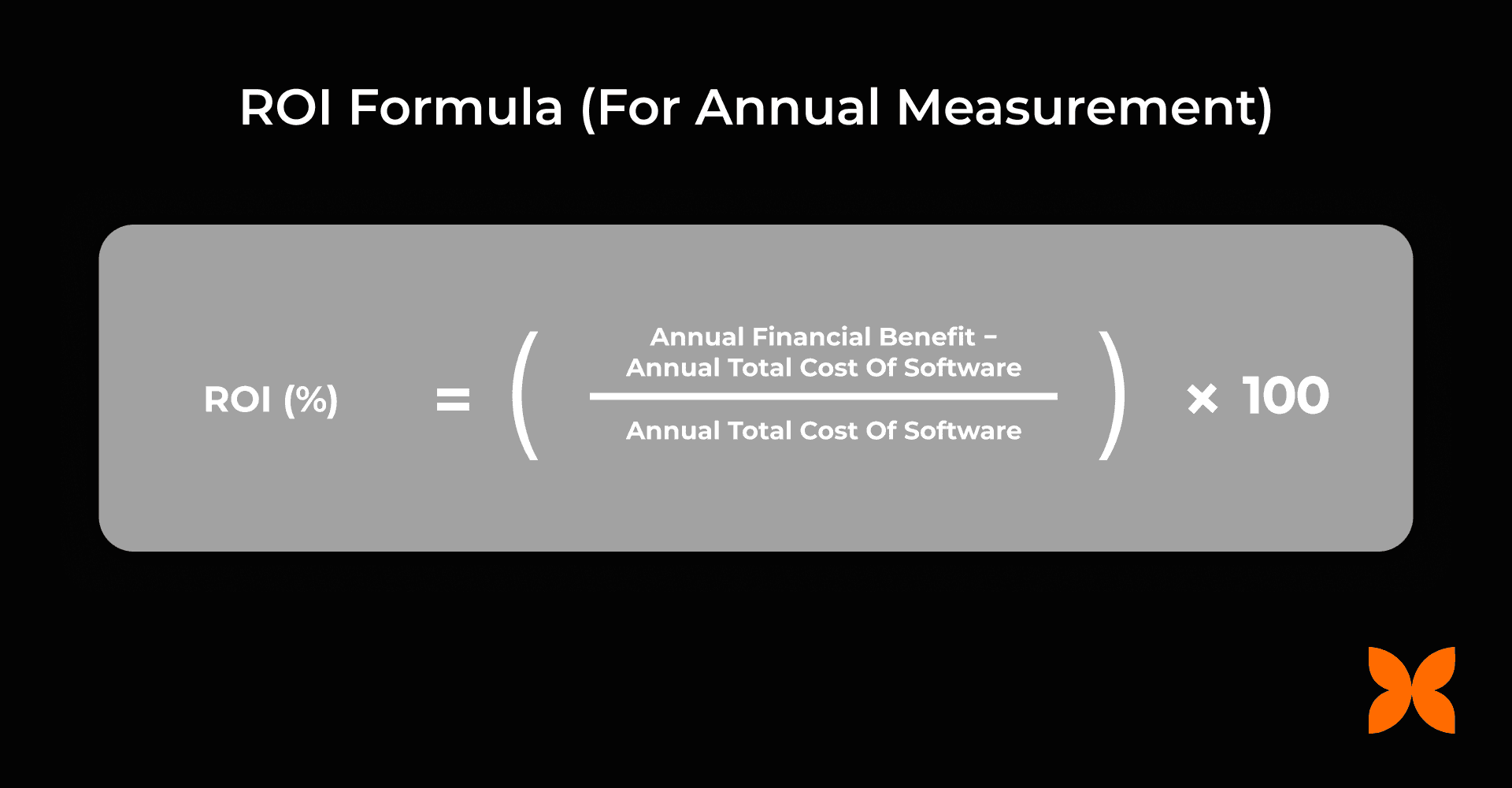

ROI formula

ROI (%) = [(Annual Financial Benefit − Annual Total Cost) ÷ Annual Total Cost] × 100

This gives you an annualised view of returns.

And if you’re wondering, “How do I actually calculate annual benefits and annual costs?”, don’t worry, we’ll walk through it step by step in the next section with a practical worksheet and examples.

Payback period (what most leaders ask next)

ROI is useful, but decision makers often care about speed.

Payback period (months) = Total investment ÷ Monthly financial benefit

If your payback period is 3 to 9 months, the investment typically feels easier to justify. If it is 18 months, you will need a stronger long term case and clearer adoption plans.

With the formula in place, the next step is agreeing on what should count as cost and what should count as benefit.

If you only include subscription fees, your ROI number will look better than reality, and Finance will challenge it.

Include:

Annual subscription and module fees

Implementation and onboarding costs (annualise these across the contract term)

Integrations (accounting, attendance devices, identity tools, payroll payout rails)

Training time (HR, Finance, managers, employees)

Support costs (vendor plus internal admin time)

Transition costs (parallel runs or temporary productivity dip during rollout)

This is your total cost of ownership (TCO) for the year.

Now that costs are clear, let’s look at benefits, because this is where most ROI cases either become convincing or fall apart.

Your benefits should reflect how HR work actually happens in growing organisations:

Manual processes create admin drag

Disconnected tools create reconciliation work

Lack of automation creates repeated errors and delays

Lack of structure slows onboarding and approvals

Most ROI calculations become credible when benefits are grouped into a few clear buckets. Here are the ones that show up most often in real finance conversations.

1) Time savings from automation

This is usually the fastest win.

Common areas:

Payroll preparation and processing

Attendance consolidation

Leave approvals and balances

Reimbursements and claims workflows

HR reporting and monthly MIS

Document generation and follow ups

How to monetise:

Hours saved × loaded hourly cost of the people doing the work.

Loaded hourly cost should include salary and employer costs, and you can use a conservative overhead factor if you want to be extra safe.

If you want to keep it simple, use:

(Monthly salary × 12) ÷ 1,920 working hours

(assuming 160 hours per month)

2) Reduced payroll errors and rework

Payroll errors are expensive in two ways: the correction itself and the time spent explaining, reassuring, and reprocessing.

Track:

number of payroll corrections per cycle

time spent per correction

time spent on employee queries

How to monetise:

(Hours saved on correction + hours saved on queries) × loaded hourly cost

3) Faster onboarding to productivity

Onboarding ROI comes from reducing the gap between offer accepted, joining day readiness, and full productivity.

Typical levers:

documentation completion

payroll readiness

device and access provisioning

task tracking for managers

How to monetise:

Days saved per hire × value per day × number of hires per year

If “value per day” is hard, use a conservative proxy:

average daily cost of employee (CTC ÷ working days)

oraverage revenue per employee per day (if you have it)

4) Hiring efficiency improvements (especially if you have ATS)

If your HR software includes recruitment or connects closely with it, ROI can show up earlier than expected.

Track:

time to hire

cost per hire

recruiter hours saved

reduction in agency dependency

drop off reduction from better candidate experience and faster turnaround

Even small improvements here can create meaningful savings when hiring volume is high or when roles are revenue critical.

5) Reduced compliance and audit risk

In India, payroll and statutory compliance can be a quiet drain until it becomes a loud problem.

Measure:

number of compliance issues or delayed filings

professional fees to fix them

time spent collecting data during audits

How to monetise:

Avoided penalties + avoided professional fees + internal hours saved

Be conservative. It makes your ROI case more believable.

6) Tool and vendor consolidation

A common ROI unlock is retiring separate tools for:

attendance

payroll vendor arrangements

HR point solutions

document workflows

asset tracking sheets and tools

How to monetise:

Annual licence fees eliminated + vendor fees eliminated + admin hours saved from reconciliation

At this stage, you know what you will count. The next job is turning that into a baseline and a worksheet that leadership will trust.

You can copy this section into a doc or spreadsheet for your internal business case.

ROI input | Where to get it | Conservative assumption | Aggressive assumption |

|---|---|---|---|

Payroll processing hours per month | HR + Finance calendar | Small reduction | Large reduction |

Payroll query hours per month | HR tickets, Slack, email | Some reduction | Major reduction |

Payroll error correction effort | Past cycles, rework logs | Reduce by a bit | Reduce heavily |

Compliance incident cost per year | Finance records | Only confirmed incidents | Include confirmed + frequent minor issues |

Hires per year | Hiring plan | Stable hiring | Growth hiring |

Days saved per hire | Onboarding checklist | 1–2 days | 3–5 days |

Tools you can retire | SaaS stack list | Retire 1–2 tools | Retire multiple tools |

Implementation cost | Vendor quote | Full cost included | Full cost included |

Training time | HR plan | Higher | Lower with better adoption |

This structure helps you defend the number when someone asks, “Where did this come from?”

Now, let’s apply this worksheet using a clear step by step ROI method.

Step 1: Build your baseline (annual cost today)

Start with what your current system costs you.

Include:

HR admin time cost (salary portion spent on admin)

payroll vendor fees

subscription costs of all HR related tools

payroll correction and query time cost

compliance penalties and remediation cost (if any)

onboarding delays you can quantify

asset loss and delayed recovery costs (if you track them)

You do not need perfect data. You need reasonable and conservative data that Finance will accept.

Step 2: Estimate annual financial benefits (after implementation)

Use the benefit buckets above.

Avoid projecting “everything improves by 50%”. Instead, use:

actual time savings from a pilot

time studies on one payroll cycle

baseline query volume and expected reduction

known tool costs you can retire

Step 3: Calculate annual total cost of ownership

Add:

annual subscription

annualised implementation cost

integrations

training time

support

Step 4: Compute ROI

Apply:

ROI (%) = [(Annual Benefit − Annual TCO) ÷ Annual TCO] × 100

Step 5: Add payback period

Calculate:

Payback (months) = Total investment ÷ Monthly benefit

Then present:

a conservative scenario

an aggressive scenario

Once the maths is clear, worked examples help make it feel real. Let’s look at two.

These examples are simplified on purpose. Replace the assumptions with your own numbers.

Example A: 60 employee company (India based)

Baseline annual costs

HR and payroll admin time: 25 hours per month

Loaded hourly cost: ₹800

Annual admin cost: 25 × 12 × 800 = ₹2,40,000

Payroll errors and corrections: ₹60,000

Asset loss and delayed recovery: ₹1,20,000

Multiple HR and payroll tools: ₹1,80,000

Total baseline cost: ₹6,00,000

Annual financial benefits

Admin time reduced by 60%: ₹1,44,000

Error reduction and rework avoidance: ₹40,000

Faster onboarding (3 days saved per hire): ₹96,000

Better asset recovery: ₹80,000

Tool consolidation savings: ₹1,20,000

Total annual benefit: ₹4,80,000

Annual software cost (TCO): ₹2,40,000

ROI

ROI = [(4,80,000 − 2,40,000) ÷ 2,40,000] × 100

ROI = [2,40,000 ÷ 2,40,000] × 100 = 100%

If adoption is slower and only half the benefits materialise, benefit becomes ₹2,40,000 and ROI becomes 0% in year one. That is exactly why adoption planning matters.

Example B: 300 employee company

Baseline annual costs

HR and payroll admin time: 120 hours per month

Loaded hourly cost: ₹1,000

Annual admin cost: 120 × 12 × 1,000 = ₹14,40,000

Payroll errors and compliance remediation: ₹3,00,000

Asset loss and delayed recovery: ₹6,00,000

Multiple HR, payroll, IT tools: ₹8,40,000

Total baseline cost: ₹31,80,000

Annual financial benefits

Admin effort reduced by 65%: ₹9,36,000

Error and compliance reduction: ₹2,20,000

Faster onboarding at scale (5 days saved per hire): ₹6,00,000

Asset recovery gains: ₹4,80,000

Tool consolidation: ₹6,00,000

Total annual benefit: ₹28,36,000

Annual software cost (TCO): ₹7,20,000

ROI

ROI = [(28,36,000 − 7,20,000) ÷ 7,20,000] × 100

Net benefit = ₹21,16,000

ROI = (21,16,000 ÷ 7,20,000) × 100

ROI ≈ 294%

As you can see, ROI scales quickly when complexity increases. The more handoffs and rework you remove, the larger the return.

The next piece is making sure those returns actually show up in the first six months. That is where a timeline plan helps.

ROI does not show up because software exists. It shows up because behaviour changes.

First 30 days: baseline and quick wins

Focus on:

single source of truth for employee data

payroll workflow setup and first payroll run

leave and attendance stabilisation

employee self service basics

Measure:

payroll processing hours

number of payroll queries

number of payroll corrections

report preparation time

Outcome you want:

payroll closes faster

HR time shifts from manual work to exception handling

Day 31 to 90: expand automation and reduce rework

Focus on:

onboarding workflows and document completion

approvals automation (claims, reimbursements, requests)

compliance reporting consistency

manager usage (approvals, updates, performance touchpoints)

hiring workflow improvements if ATS is included

Measure:

time to onboard a new hire to “ready to work”

time spent on follow ups

compliance effort hours

adoption rates across managers and employees

time to hire and cost per hire (if applicable)

Outcome you want:

fewer follow ups

faster onboarding

fewer recurring payroll and policy issues

Day 91 to 180: consolidation and scale

Focus on:

retiring redundant tools

deeper reporting and workforce visibility

tighter joiner mover leaver controls

asset lifecycle tracking and recovery

consistent recruitment workflows and reporting if ATS is in play

Measure:

tools retired and licence savings realised

asset recovery percentage on exits

audit readiness time and effort

retention, absenteeism, satisfaction trends (report separately)

Outcome you want:

ROI becomes durable and repeatable

growth does not create admin chaos

Once you have a plan, it’s also worth knowing what can derail it. Let’s cover the most common ROI mistakes.

1) Only counting subscription savings

ROI is almost never “we paid X and saved X”. It is “we removed operational drag and reduced risk”.

2) Leaving out implementation and training costs

If your ROI ignores these, Finance will ignore your ROI.

3) Overestimating adoption

A system only creates savings if people use it consistently. If managers do not approve on time or HR keeps manual workarounds, ROI shrinks.

4) Measuring too late

If you do not track baseline metrics in the first month, you lose the proof later.

5) Treating HR, payroll, IT, and hiring as separate worlds

Onboarding, exits, and hiring cut across multiple teams. When tools are disconnected, rework grows.

Avoid these pitfalls and you’re already ahead of most ROI cases. Next, let’s look at the practical steps that increase ROI after implementation.

Standardise workflows before adding complexity

If each team has a different process, automation becomes messy.

Start with:

standard payroll cycles

clear leave rules

consistent employee data fields

structured onboarding checklist

standard hiring stages if using an ATS

Make employee and manager self service non negotiable

If employees cannot update data, download payslips, raise requests, and track status, HR becomes a helpdesk.

Set expectations early:

employees use self service for routine actions

managers own approvals and updates

recruiters and hiring managers use the ATS consistently if included

Consolidate overlapping tools on purpose

Do not keep old tools “just in case” for six months. Plan a retirement timeline and communicate it.

Integrate payroll and finance workflows

The faster you sync payroll outputs with accounting workflows, the quicker Finance buys in.

Use reporting to prevent problems, not only to explain them

Monthly HR reporting should help you spot:

approval bottlenecks

recurring payroll issues

high query drivers

policy loopholes

hiring stage bottlenecks and drop offs (if using ATS)

That is how ROI becomes a management system, not just a purchase justification.

Now, let’s connect all of this back to how Craze supports ROI in real operations.

Craze is built to reduce operational drag across the employee lifecycle by connecting Core HR, payroll, compliance, IT workflows, and recruitment in one system.

That matters because ROI improves when you remove handoffs and rework.

With Craze, teams typically see ROI drivers like:

less time spent running payroll and fixing issues

fewer manual reconciliations between tools

smoother onboarding with structured workflows

stronger compliance reporting consistency

clearer asset issuance, tracking, and recovery

faster hiring workflows and better visibility with built in ATS and recruitment tracking

If your current HR stack feels like five tools and ten spreadsheets, the biggest ROI lever is often consolidation plus workflow standardisation that can be solved with Craze, Want to know how? Schedule a free demo here.

To wrap it up, here is the simplest way to think about ROI going forward.

A strong HR software ROI case is not built on assumptions. It is built on:

a baseline that reflects how work happens today

a benefits model grounded in measurable changes

total cost of ownership, not just subscription fees

adoption plans that make the improvements real

a 30/90/180 day rollout that turns software into savings

When you treat HR software as an operating system for people workflows, returns become easier to measure, easier to defend, and easier to scale.

If you want to model HR software ROI for your organisation, take the worksheet structure above, plug in your baseline numbers, and build conservative and aggressive scenarios. It will immediately show you where the biggest levers are.

1) How long does it take to see HR software ROI?

Many businesses see early improvements in 30 to 90 days through time savings and fewer errors. A clear financial ROI is often easier to validate within 6 to 9 months once adoption stabilises and tool consolidation begins.

2) Does HR software ROI differ for smaller companies vs mid sized companies?

Yes. Smaller teams often see ROI through admin time savings and basic automation. Mid sized teams see additional ROI from reduced compliance risk, better workflow governance, and retiring multiple tools.

3) Which processes usually deliver ROI the fastest?

Payroll processing, leave workflows, onboarding administration, employee self service, and recruitment workflows (if you use ATS) often deliver early ROI because they are repetitive, high volume, and prone to manual delays.

4) Should intangible benefits be included in ROI?

Report them, but do not force them into the ROI number. Intangibles like employee experience and better decision making support the business case, but tangible savings keep the ROI figure credible.

5) Can we measure ROI without historical data?

Yes, using conservative estimates. Track baseline metrics immediately after implementation so you can replace assumptions with real numbers over the first 30 to 90 days.