Full and Final Settlement Letter: Key Elements and Free Template

When an employee exits your organisation, the final impression you leave behind matters just as much as the first. A professionally handled exit process reflects the maturity of your HR operations and strengthens your employer brand.

In India, full and final settlement is not just a payroll formality; it is a legally sensitive process involving statutory compliance, financial closure, and employee trust. Yet many organisations still rely on informal emails, Excel-based calculations, or verbal confirmations, creating room for disputes, audit risks, and reputational damage.

In this blog, you will learn what a full and final settlement letter is, why it is essential, the key elements it must include, and ready-to-use templates customised for Indian businesses.

Key Takeaways

A full and final (FNF) settlement letter formally confirms that all financial dues between the employer and the employee have been settled upon exit.

The letter ensures payroll closure, statutory compliance, and protects both parties from future disputes.

Each letter should include salary, leave encashment, deductions, gratuity, PF, and a settlement confirmation.

Professionally structured, ready-to-use templates simplify the issuance of letters for different exit scenarios.

Clear documentation, alignment with compliance, and timely closure enhance employer credibility.

What is a Full and Final (FnF) Settlement Letter?

A full and final settlement letter is a formal document issued by an employer confirming that all financial dues of an exiting employee have been calculated, processed, and settled in accordance with company policy and statutory requirements. It serves as official proof that the employment relationship has been financially closed and no further payments or liabilities remain between the employer and employee.

This letter is issued after resignation, termination, retirement, or contract completion and becomes a permanent part of the employee’s HR and payroll records. It documents the final payout components, including salary, leave encashment, gratuity, bonuses, reimbursements, deductions, and statutory contributions.

Now that we understand what a full and final settlement letter is, let us examine why it plays such a critical role in professional workforce management.

Why is a Full and Final Settlement Letter Important?

A full and final settlement letter is essential for closing the employment lifecycle in a structured, transparent, and legally compliant manner. It safeguards both the employer and the employee while ensuring a smooth offboarding experience:

Provides Financial Closure: Confirms that all salary, benefits, reimbursements, and deductions have been settled.

Ensures Statutory Compliance: Aligns with Indian labour laws, PF, gratuity, professional tax, TDS, and bonus regulations.

Creates a Legally Defensible Record: Acts as documented proof in case of audits, disputes, or legal proceedings.

Prevents Future Claims: Eliminates ambiguity regarding pending payments or outstanding liabilities.

Protects Employer Branding: Demonstrates professionalism and strengthens alumni relationships.

Supports Payroll and Audit Processes: Creates a clean financial trail for internal and statutory audits.

To execute this process correctly, it is important to understand what goes into a well-drafted full and final settlement letter.

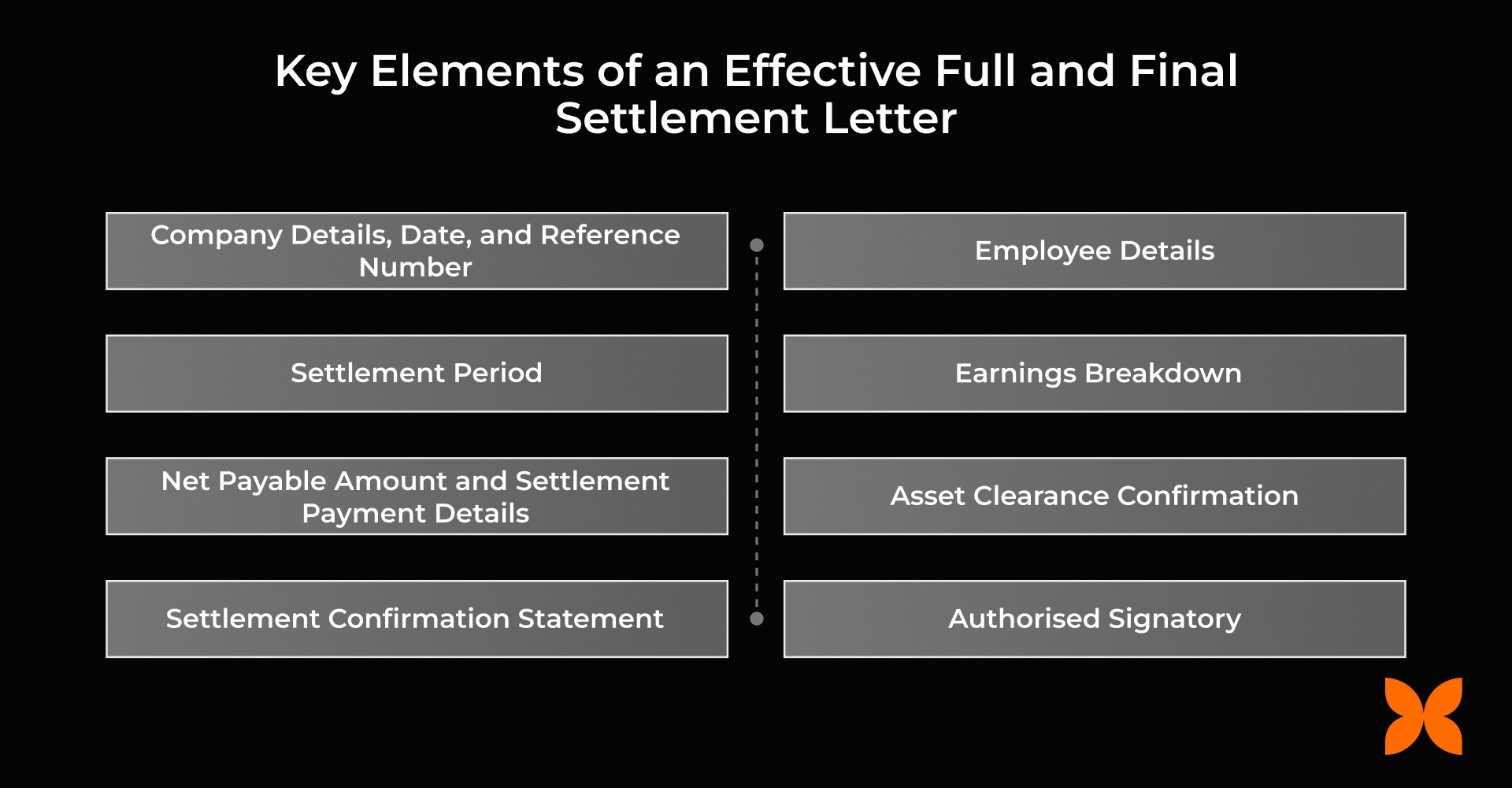

Key Elements of an Effective Full and Final Settlement Letter

A settlement letter serves as the definitive financial closing of an employee’s journey with the company. Including these specific components ensures that every payment, deduction, and tax obligation is accounted for, providing a clear and final balance that both parties can agree upon.

1. Company Details, Date, and Reference Number

The letter must be issued on official company letterhead and include the settlement date and a unique reference number. These details establish the authenticity of the document and ensure traceability for payroll, audit, and compliance purposes.

Tip: Always generate a unique settlement reference number for payroll and audit tracking.

2. Employee Details

The letter should clearly identify the exiting employee by mentioning their full name, employee ID, designation, department, date of joining, last working day, and resignation or termination date. This ensures the settlement is mapped to the correct employment record.

Tip: Cross-verify employee details with HRMS and payroll records before issuing the letter.

3. Settlement Period

The settlement period defines the salary cycle covered under the final payout. It establishes the exact duration for which salary and benefits have been calculated.

Tip: Always align the settlement period with the payroll cut-off date.

4. Earnings Breakdown

Full and final settlement is calculated by consolidating all payable and recoverable components linked to the employee’s exit. The calculation typically includes:

Payable Components | Deductions |

Salary up to the last working day | |

Leave encashment as per company policy | Professional tax |

Bonus or performance incentives (if applicable) | Income tax (TDS) |

Gratuity (if eligible under the Payment of Gratuity Act) | Notice period recovery (if applicable) |

Reimbursements pending approval | Outstanding loans or salary advances |

5. Net Payable Amount and Settlement Payment Details

The letter should clearly mention the final settlement amount after deductions and specify the payment mode. It must also include the cheque number or bank transaction reference along with the settlement payment date. This confirms financial closure and provides proof of payment.

Tip: Always reconcile the payment reference with bank statements before issuing the letter.

6. Asset Clearance Confirmation

The letter should confirm that the employee has returned all company assets, including the laptop, ID card, access cards, documents, and any other assigned equipment. This ensures operational closure and IT security compliance.

Tip: Always attach the signed asset clearance form to the settlement record.

7. Settlement Confirmation Statement

The letter must include a declaration stating that all financial obligations between the employer and employee have been fully settled. This confirms that no further dues or claims remain pending on either side. This statement provides legal closure to the employment relationship.

Tip: Use standard legal wording approved by your compliance or legal team.

8. Authorised Signatory

The letter must be signed by authorised representatives from HR and finance. Their designation and signature validate the document as an official and binding record. This ensures the settlement letter is legally enforceable and audit-ready.

Tip: Maintain a digital copy of all signed settlement letters for statutory records.

Also Read: Offer Letter Format: 10 Sample Templates for Modern Businesses

Once these elements are in place, the next step is understanding how to structure the FnF letter correctly.

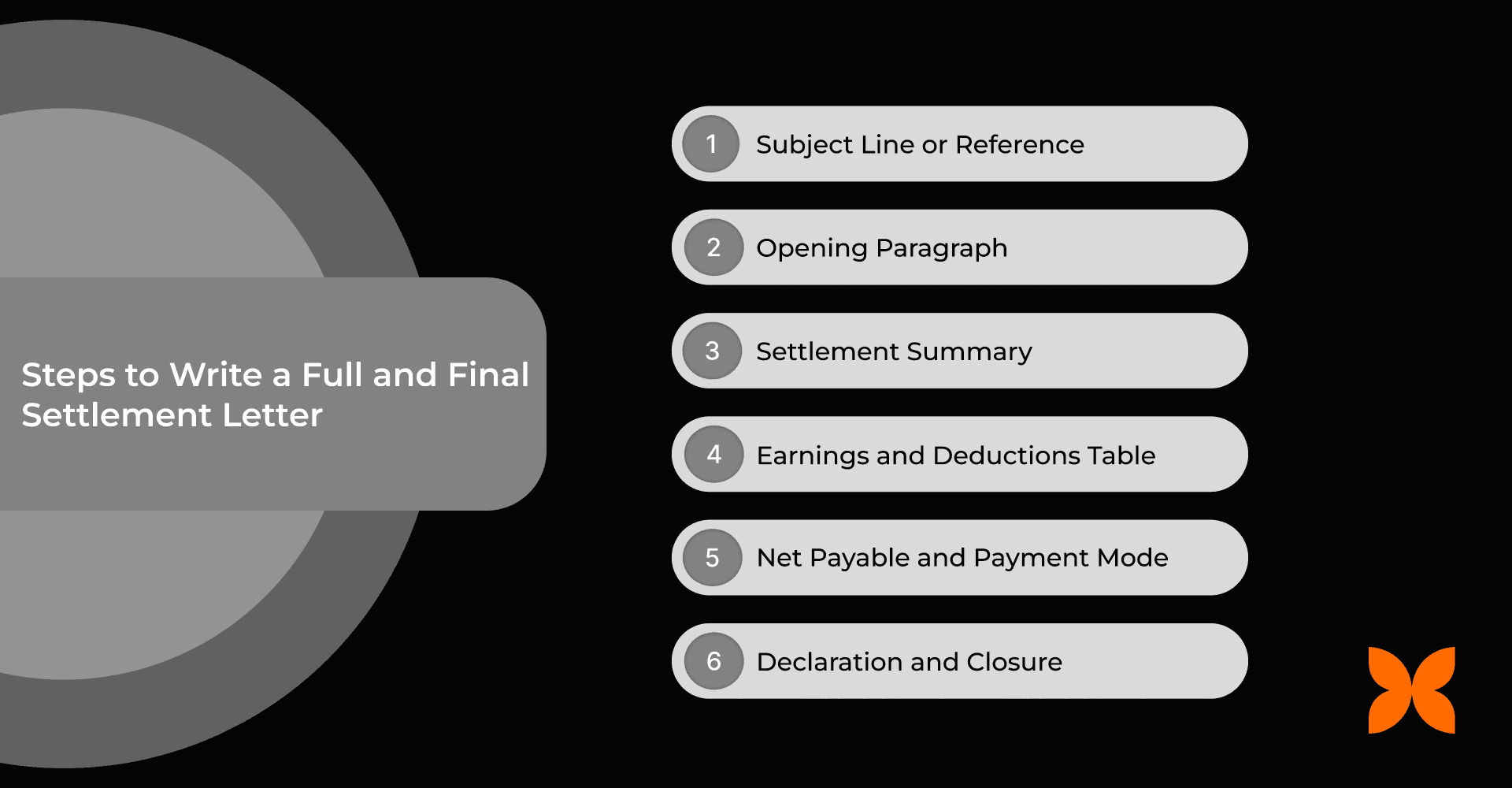

How to Write a Full and Final Settlement Letter: 6 Key Steps

Drafting this letter is about turning complex payroll data into a clear, easy-to-read summary. These steps guide you through how to phrase the settlement terms, how to present deductions without causing friction, and how to structure the final balance so the employee understands exactly how their payout was calculated.

Step 1. Subject Line or Reference

Start with a clear subject line or reference number to help track the settlement in HR and payroll records.

Example:

Subject: Full and Final Settlement Letter – [Employee Name]

Reference: FnF/2026/0458

Step 2. Opening Paragraph

Begin by confirming the employee’s exit and stating the purpose of the letter. This sets the context for the settlement.

Example: “This letter is issued to confirm the full and final settlement of your employment with [Company Name].”

Step 3. Settlement Summary

Briefly mention that all pending dues have been calculated in accordance with company policy and applicable labour laws.

Example: “All your outstanding salary, leave encashment, bonuses, and reimbursements have been computed as per company policy and legal requirements.”

Step 4. Earnings and Deductions Table

Provide a clear breakdown of payable components and deductions to avoid confusion and ensure transparency.

Example Table:

Earnings | Amount (INR) | Deductions | Amount (INR) |

Salary up to the last working day | 50,000 | Provident Fund | 6,000 |

Leave encashment | 5,000 | Professional Tax | 200 |

Bonus | 3,000 | Income Tax (TDS) | 7,500 |

Reimbursements | 2,000 | Loan Recovery | 5,000 |

Step 5. Net Payable and Payment Mode

Clearly state the final settlement amount, the payment mode (including cheque or bank transfer details), and the payment date.

Example: “The net payable amount of ₹41,300 will be transferred to your bank account ending with XXXX on 15th June 2026.”

Step 6. Declaration and Closure

End with a statement confirming that all dues have been settled and include the authorised signatory to make the letter official.

Example: “This confirms that all financial obligations between you and [Company Name] have been fully settled. We wish you success in your future endeavours.”

Signed by: [HR/Finance Authorised Signatory]

Also Read: Relieving Letter Format: Elements & 7 Free Templates

With a clear understanding of how to draft a Full and Final Settlement letter, the next step is to see how this translates into practical communication, using FnF Settlement letter templates that ensure clarity and compliance.

Full and Final Settlement Letter Template

Simplify and standardise your employee settlements using this ready-to-use full and final settlement letter template, ensuring clear and professional documentation.

[Company Letterhead or Logo]

Date: [DD/MM/YYYY]

To,

[Employee’s Full Name]

[Employee ID]

[Designation]

[Department]

Subject: Full and Final Settlement Confirmation

Dear [Employee’s First Name],

This is to formally acknowledge that your full and final settlement with [Company Name] has been processed as per company policies. Your resignation dated [Resignation Date] has been accepted, and your last working day was [Last Working Day].

The detailed breakdown of your settlement is as follows:

Component | Amount (₹) |

Salary for [Month/Partial Month] | [Amount] |

Leave encashment ([X] days) | [Amount] |

Performance/Other Bonus (if applicable) | [Amount] |

Reimbursements | [Amount] |

Gratuity (as per applicable law) | [Amount] |

Total deductions (taxes, advances, loans, etc.) | [Amount] |

Net Payable Amount | [Net Amount] |

All company assets in your possession have been returned and duly acknowledged by the respective departments. There are no pending obligations from your side.

We sincerely thank you for your contributions during your tenure at [Company Name] and wish you continued success in your future professional endeavors. For any clarification regarding this settlement, please feel free to contact the HR department.

Sincerely,

[Authorised Signatory’s Name]

[Designation]

[Company Name]

Full and Final Settlement Letter Sample

The example below illustrates how the above settlement letter format can be used in a real-world context.

ABC Tech Solutions Pvt. Ltd.

Date: 15/01/2026

To,

Ms. Priya Sharma

Employee ID: 102345

Software Engineer

Development Department

Subject: Full and Final Settlement Confirmation

Dear Priya,

This letter serves to confirm that your full and final settlement with ABC Tech Solutions Pvt. Ltd. has been completed. Your resignation submitted on 05/01/2026 was accepted, and your last working day was 14/01/2026.

Below is the detailed breakdown of your settlement:

Component | Amount (₹) |

Salary for 14 days in January | 28,000 |

Leave encashment (3 days) | 6,000 |

Performance Bonus | 15,000 |

Approved Travel Reimbursements | 2,500 |

Gratuity (as per Payment of Gratuity Act) | 35,000 |

Deductions (taxes and loan repayments) | 7,000 |

Net Payable Amount | 79,500 |

All company property assigned to you has been returned and acknowledged by the relevant departments. There are no outstanding dues pending from your side.

We sincerely thank you for your valuable contributions during your tenure and wish you continued success in your future endeavours. For any questions regarding this settlement, please contact the HR department.

Sincerely,

Radhika Mehta

HR Business Partner

ABC Tech Solutions Pvt. Ltd.

With letter formats in place, let us review the best practices that ensure a smooth settlement process.

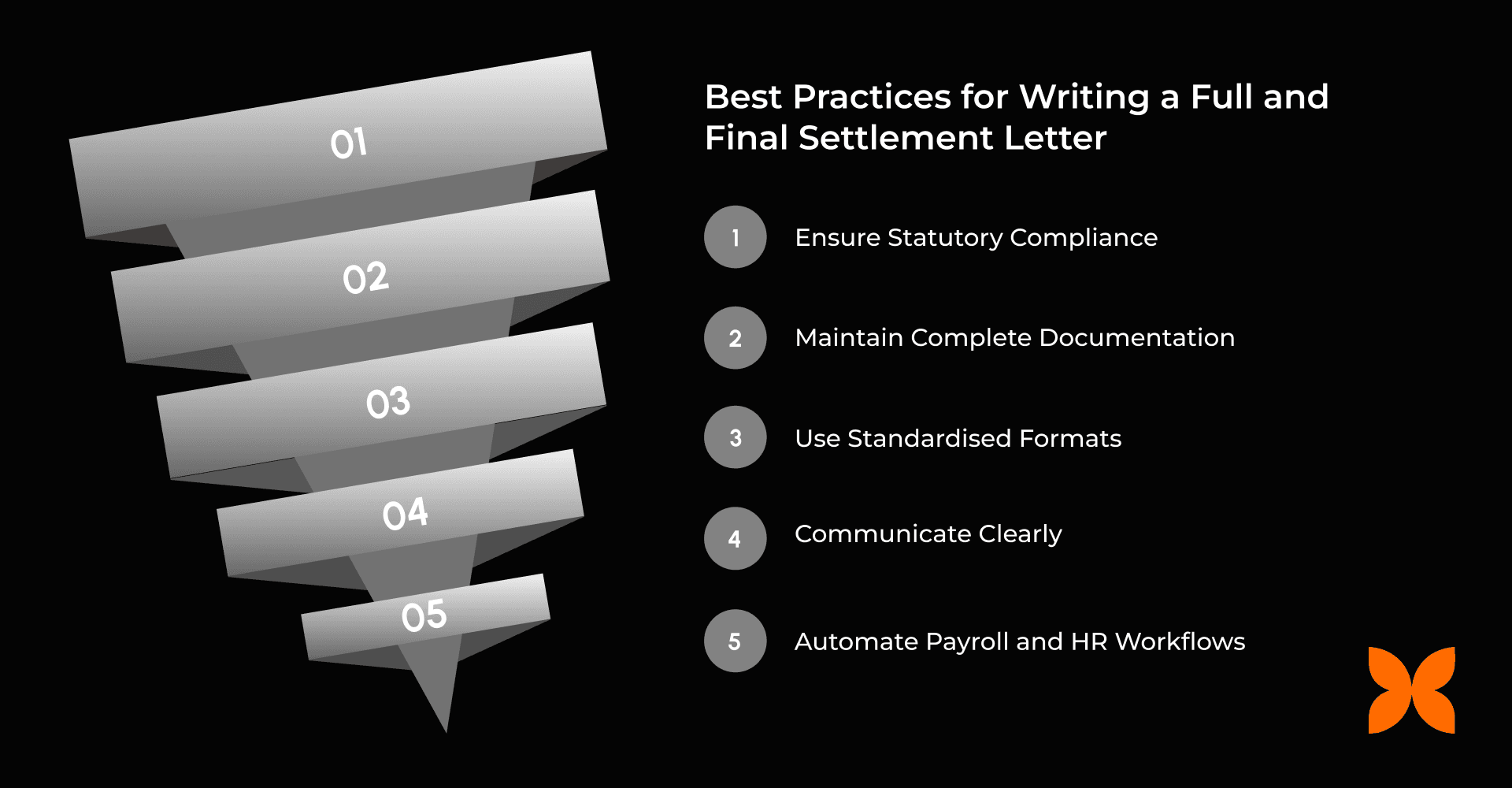

Best Practices for Writing a Full and Final Settlement Letter

Even small mistakes, such as incorrect calculation of dues, missing deductions, or unclear settlement timelines, can lead to disputes and confusion. Following a structured full and final settlement letter framework helps prevent these issues by ensuring your communication is accurate, professional, and legally compliant:

Ensure Statutory Compliance: Align all calculations with relevant Indian labour laws, including the Shops & Establishments Act, PF Act, Payment of Gratuity Act, Bonus Act, and Income Tax Act, and regularly update payroll policies to stay compliant.

Maintain Complete Documentation: Keep resignation letters, clearance forms, settlement sheets, and payment proofs properly archived, ideally in digital format with audit trails to simplify retrieval and reduce disputes.

Use Standardised Formats: Avoid ad-hoc spreadsheets or informal emails, and implement consistent templates to save time and maintain accuracy across departments.

Communicate Clearly: Explain the settlement components and include a summary table or statement of account to ensure employees understand their dues and deductions.

Automate Payroll and HR Workflows: Reduce manual errors and compliance risks by using integrated payroll software that streamlines calculations, approvals, and disbursements.

A strong FnF settlement process not only ensures legal and financial accuracy but also reinforces goodwill and professional closure, completing the employee lifecycle with integrity.

Final Thoughts

A full and final settlement letter is more than just a payroll formality; it acts as a legal, financial, and reputational safeguard for your organisation. When handled correctly, it ensures compliance, prevents disputes, and strengthens your employer brand.

For growing Indian businesses, manually managing settlements via spreadsheets and emails creates unnecessary risk. Craze offers a unified people operating system that automates HR, payroll, finance, and IT operations on a single platform.

FAQs

1. How is leave encashment calculated in FnF?

Leave encashment is calculated by multiplying the number of unused paid leaves at the time of exit by the daily salary rate, as per company policy.

2. Can an employee request an early FnF settlement?

Generally, no. Full and final settlement is processed only after all exit formalities and asset clearances are completed.

3. What happens if an error is found after issuing the FnF letter?

The employer must correct any discrepancies and provide the revised settlement amount. Proper documentation ensures disputes are resolved quickly and transparently.

4. What is the role of asset clearance in FnF?

Asset clearance confirms that the employee has returned company property such as laptops, ID cards, and access keys. FnF is processed only after this verification.

5. What happens if an employee disagrees with the settlement amount?

The employee can raise a formal query with HR. Transparent documentation of salary, deductions, and benefits ensures disputes can be resolved fairly and efficiently.