Payroll automation can save time and reduce errors, but finding the right software isn’t always easy. With so many options in the market promising accuracy, compliance, and integrations, the choice is rarely straightforward. Picking the wrong one can lock you into clunky systems, hidden costs, or limited features that hurt your business in the long run.

To make your search easier, we’ve done the homework for you. This blog highlights the best payroll automation software in India for 2026, so you can compare top tools, avoid costly mistakes, and confidently pick a solution that keeps payroll smooth and stress-free.

But before we dive into the list, let’s start with a quick look at what payroll automation software is and how it works, so you know exactly what to look for when choosing the right solution.

Payroll automation software is a digital tool that uses technology to automate repetitive and manual tasks in the payroll process. It includes:

Calculating wages: Automatically computes salaries based on working hours, overtime, and pay rates.

Processing tax deductions: Handles tax calculations such as TDS, PF, and ESI, ensuring compliance with statutory requirements.

Generating pay stubs: Creates detailed pay slips for employees with breakdowns of earnings and deductions.

Making direct deposits: Facilitates seamless transfer of salary directly to employees’ bank accounts, reducing manual work.

Before exploring the available options in the market, it’s important to understand the key features that a payroll automation software should have. Here are the essential features to look for:

Real-time payroll processing and automation: Ensures payroll is processed instantly and without delays.

Compliance with Indian statutory laws (TDS, PF, ESI, etc.): Automatically keeps up with ever-changing compliance requirements.

Easy-to-use interfaces and self-service portals: Simplify the process for HR teams and employees alike.

Tax calculation and reporting automation: Automates tax deductions and generates reports with ease.

Seamless integration with HR and accounting systems: Ensures smooth data flow between payroll and other business systems.

Real-time sync with leave & attendance data: Syncs attendance and leave data in real time to ensure accurate payroll calculations.

Support for intern/contractor payments: Enables smooth payment processing for interns and contractors, including compliance with tax requirements.

Support for salary advances & reimbursements: Allows for the management of salary advances and employee reimbursements, ensuring timely and accurate payments.

Multi-location payroll support: Supports businesses with teams spread across various regions, managing regional tax laws and payroll rules.

Also Read: 10 Best HR Software in India For Your Growing Business

With these key features in mind, it's time to explore the best payroll automation software in India that can help you achieve seamless and efficient payroll management.

Choosing the right payroll automation software is important for your business to ensure accurate, timely, and compliant payroll management. Here are the top tools that can help you simplify payroll processes, reduce errors, and ensure compliance with Indian regulations.

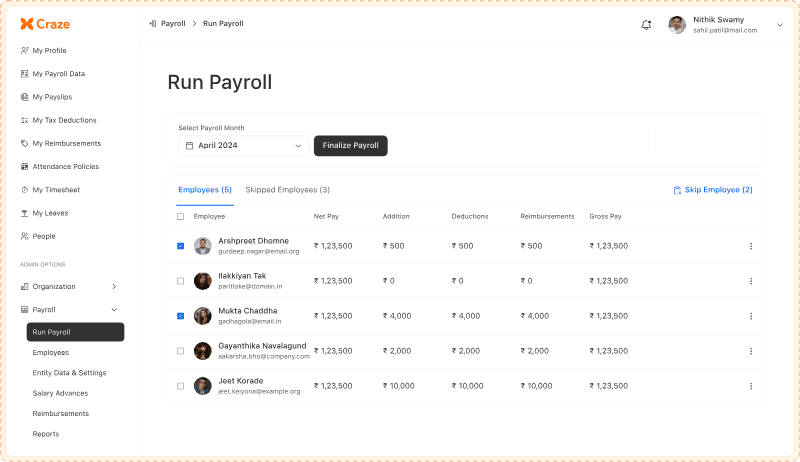

1. Craze

Craze is one of the best payroll automation software in India. It’s an all-in-one HRMS for payroll, compliance, and HR that automates pay runs, salary calculations, tax (TDS) deductions, and statutory filings.

Best For: Startups and Mid-Sized fast-growing businesses (50-500 employees).

Automation highlights: Automated salary calculations, PT & TDS computation, ESS, Intern/Contractor payments, Automated Salary Slip generation, Flexi-benefits, Salary Advances, Reimbursements, compliance reporting & advanced workflow automations.

India compliance: PF ECR, ESIC challan, PT by state, TDS Form 24Q, Form 16.

Integrations: Craze HRMS Modules, Zoho Books.

2. FactoHR

factoHR delivers powerful payroll automation tailored for Indian businesses. It streamlines the entire payroll process, from precise salary calculations to automated statutory deductions and government filings (PF, ESI, TDS, PT), ensuring full compliance with the Indian law.

Best For: Startups & Small Sized Organisations.

Automation highlights: Automated salary and compliance calculations, digital onboarding, Employee Self-Service (ESS), instant payslips.

India compliance: PF ECR, ESIC challan, PT by state, TDS Form 24Q, Form 16.

Integrations: Internal HR modules, ERPs, & Accounting Tools like Tally, Quickbooks.

RazorpayX Payroll

RazorpayX Payroll offers automated payroll with TDS, PF, and ESI calculations, along with one-click salary payouts through Razorpay’s banking rails.

Best For: Only payroll requirements (banking/payout-led payroll).

Automation highlights: Auto salary calculation and payslips, TDS and PT computation, vendor and contractor payouts.

India compliance: PF ECR, ESIC challan, PT, Form 24Q support, Form 16.

Integrations: Razorpay payouts, accounting tools, HRIS connectors.

4. Zoho Payroll

Zoho Payroll automates end-to-end payroll management, ensuring compliance with India’s statutory requirements, with easy integration into Zoho's suite of business tools.

Best For: Businesses using the Zoho ecosystem

Automation highlights: Automatic salary calculation, tax deductions, and employee payslips.

India compliance: PF ECR, ESIC, TDS Form 24Q, PT by state, Form 16.

Integrations: Zoho accounting, Zoho people.

5. GreytHR

GreytHR simplifies payroll, compliance, and attendance management, offering full automation for Indian businesses, including statutory reporting and payouts.

Best For: SMEs from non-tech industries.

Automation highlights: Salary calculations, automated payslips, leave and attendance sync, and statutory compliance generation.

India compliance: PF ECR, ESIC challan, TDS Form 24Q, PT, Form 16.

Integrations: Tally, internal HR module.

Also Read: Top 15 Payroll Software Features for Indian Businesses

6. PeopleStrong

PeopleStrong offers a comprehensive HR suite that includes payroll automation, performance management, and employee engagement. It’s designed to scale as your business grows.

Best For: Enterprise-level businesses needing integrated HR and payroll solutions.

Automation highlights: Payroll, attendance, leave, performance, and compliance management all in one platform.

India compliance: PF ECR, ESIC challan, PT, TDS Form 24Q, Form 16.

Integrations: Open APIs across HRIS/Payroll/Leave/Attendance

7. HROne

HROne provides fully integrated HRMS and payroll automation software tailored for Indian organisations. It centralises HR and payroll processes on a single platform for simplified workforce management.

Best For: Mid-sized and growing enterprises managing multi-location teams.

Automation highlights: Automated payroll processing, auto-generated payslips, attendance to payroll sync, and tax and statutory computations.

India compliance: PF ECR, professional tax (state-wise), ESIC challan, Form 16, TDS (Form 24Q), bonus and gratuity calculations.

Integrations: HROne HRMS modules, accounting tools, biometric devices and API-based custom integration.

8. Darwinbox

Darwinbox Payroll is an enterprise-grade HCM platform with a powerful payroll engine built for organisations that need payroll tightly integrated with complex HR processes at scale.

Best For: Large enterprises and organisations with complex payroll & HR workflows

Automation highlights: Automated payroll calculations, configurable pay structures, multi-location payroll processing, and advanced reporting

India compliance: PF ECR, ESIC challan, Professional Tax (state-wise), TDS (Form 24Q), Form 16

Integrations: Core HR modules, attendance and leave systems, ERP and finance tools

9. Qandle

Qandle’s payroll solution integrates HR, finance, and compliance management, offering automation across employee payroll, tax deductions, and reporting.

Best For: Businesses needing customisation.

Automation highlights: Automated salary processing, tax calculations, compliance generation, and performance management.

India compliance: PF ECR, ESIC, PT, TDS Form 24Q, Form 16.

Integrations: HRMS, accounting tools, and payroll banks.

10. Paybooks

Paybooks simplifies payroll with an intuitive interface and features that cover everything from salary calculation to tax filing and compliance reporting.

Best For: Businesses prioritising statutory compliance with a payroll-first approach.

Automation highlights: Payroll automation, TDS calculation, payslips generation, and compliance management.

India compliance: PF ECR, ESIC challan, PT, TDS Form 24Q, Form 16.

Integrations: Accounting software like Tally, QuickBooks, and External HRMS.

11. Keka

Keka simplifies payroll processing with powerful automation for salary calculations, tax deductions, and compliance reports. It’s designed to work seamlessly for fast-growing teams.

Best For: Large organisation, especially with blue-collar workforce.

Automation highlights: Salary calculations, automated payslips, TDS calculations, leave and attendance management.

India compliance: PF ECR, ESIC, TDS Form 24Q, PT, Form 16.

Integrations: Internal HRMS module, Tally.

Also Read: Document Automation for HR: Simplify HR Workflows & Improve Efficiency

Let’s now explore how these solutions can directly impact your business efficiency by addressing the major challenges.

Payroll automation software significantly enhances business efficiency. These solutions not only save valuable time but also improve accuracy and employee satisfaction.

Time-saving automation of manual payroll tasks: Automates repetitive tasks such as salary calculations, tax deductions, and payslip generation, saving hours of manual work.

Reduction of human errors and compliance risks: Minimises the chances of errors in calculations and ensures compliance with tax and statutory requirements, reducing legal risks.

Simplified reporting and auditing processes: Automates the generation of payroll reports, making it easier to access, track, and audit payroll data.

Enhanced employee experience with self-service features: Allows employees to access their payslips, tax information, and leave balances through self-service portals, improving transparency and satisfaction.

Also Read: Best Human Resource Onboarding Software

Understanding the benefits of payroll automation is important, but selecting the right software that aligns with your business needs is what will truly drive those advantages.

When choosing the right payroll automation software, it’s essential to evaluate its ability to automate end-to-end payroll functions. Here are the key points you should consider to make the right choice for your business:

Automation capabilities: Ensure the software automates all payroll functions, such as salary calculations, tax deductions, reimbursements, flexi benefits, and multi-state compliance.

Business size, industry needs, and growth potential: Consider how the software will scale as your business grows and whether it suits your industry-specific requirements.

Pricing structures: Compare monthly vs. annual pricing options and assess how the software’s pricing aligns with your budget and expected return on investment (ROI).

Customizability: Choose software that can be customised to meet your company’s unique payroll processes and requirements.

Integration capabilities: Ensure the software integrates smoothly with other systems, such as HR, accounting, and time tracking tools, to reduce manual data entry and errors.

Also Read: How to Ensure Smooth Payroll Software Implementation

To ensure a smooth implementation, it's important to avoid some common mistakes when choosing payroll automation software that can hinder long-term success.

Selecting payroll automation software without careful evaluation can lead to wasted time, errors, and dissatisfaction. Below are some common pitfalls to avoid to ensure smooth adoption and better returns on investment.

Ignoring scalability needs: Choosing software that cannot handle future growth or multi-location operations may require switching tools later.

Overlooking integrations: Failing to check compatibility with HR, accounting, or attendance systems can create duplicate work and errors.

Neglecting employee experience: Not considering ease of use or self-service features may lead to frustration and low adoption rates among staff.

These mistakes are easy to overlook but can significantly impact efficiency, compliance, and employee satisfaction.

Managing payroll effectively is necessary for your business’s success, especially as it grows. Without proper automation, manual payroll processes can lead to errors, compliance issues, and wasted resources that could be better spent on strategic growth.

Automation solutions can significantly reduce the time spent on manual payroll tasks, allowing your HR team to focus on more strategic areas of business.

Q1: What is the cost of payroll automation software?

Answer: Pricing varies based on features and user count. Most solutions offer scalable pricing to suit growing businesses. On average, the cost can range from ₹50 to ₹150 per employee per month, with fixed fees typically ranging from ₹2,500 to ₹9,999 per month, depending on the software's features and the size of your organisation.

Q2: Can payroll automation software handle multi-location payroll?

Answer: Yes, several payroll solutions like Craze and GreytHR support multi-location payroll processing.

Q3: Does payroll automation software handle tax compliance?

Answer: Yes, most payroll automation software, like RazorpayX and Zoho Payroll, automatically updates for tax and compliance regulations.

Q4: Is payroll automation software suitable for startups?

Answer: Yes, solutions like Craze and RazorpayX are ideal for startups due to their scalability and ease of use.

Q5: Can employees access their payroll information directly?

Answer: Yes, software like Keka, Zoho Payroll, and Craze offer self-service portals for employees to access payslips and tax documents.

Q.6: How Payroll Automation is Transforming Business Efficiency?

Answer: Payroll automation simplifies business operations by reducing manual tasks, saving time, and ensuring accuracy.

Looking to optimise other aspects of your HR operations? Check out these top HRMS tools and software for your use case: