Are you finding it hard to keep track of employee expenses as your business scales?

Between travel claims, client meetings, and everyday reimbursements, manual processes or spreadsheets often lead to errors, delays, and unhappy employees. Many startups and growing companies in India struggle with the same challenge.

What you need is a solution that simplifies reimbursements, enforces compliance, and saves time for both employees and finance teams. The right software should integrate with your existing systems, handle approvals quickly, and make expense tracking effortless, whether your team is in-office, remote, or constantly on the move.

That’s why we’ve put together this guide to the best expense reimbursement software in India for 2026. From affordable pricing to powerful features, we’ll walk you through the top options so you can choose the perfect fit for your business.

At a Glance

Manual expense tracking leads to errors, delays, and compliance risks—costing Indian SMEs both time and money.

Modern expense reimbursement software automates receipt capture, approvals, and reimbursements, ensuring accuracy and speed.

Founders gain visibility and cost control, HR heads improve employee experience, and finance teams save hours with real-time analytics.

The top tools in India for 2026 include Craze, Zoho Expense, Fyle, Happay, ITILITE, HROne, SAP Concur, Expensify, Rydoo, EnKash, and Zaggle.

Craze stands out with its affordability, GST-ready compliance, and all-in-one HR, payroll, and finance integration, ideal for startups and fast-growing businesses.

Expense management software is a digital tool that automates how businesses track, approve, and reimburse employee expenses. Instead of dealing with messy spreadsheets or endless email threads, companies can switch to smooth, automated workflows.

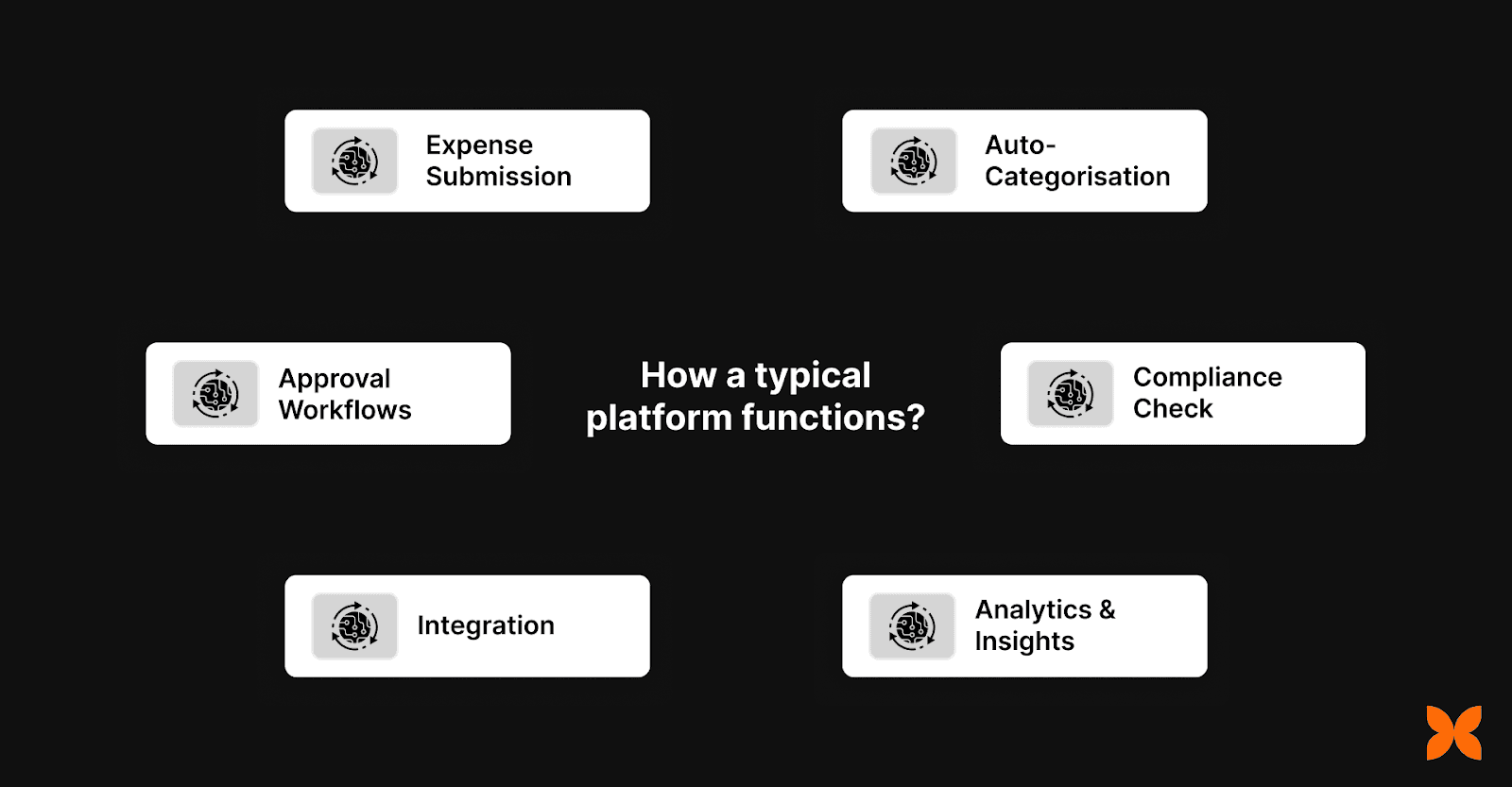

To see the difference these tools make, here’s a step-by-step overview of how a typical expense management platform functions.

Expense Submission: Employees can snap a photo of their receipts or upload them directly through mobile or web apps. This makes it quick and hassle-free to log expenses on the go.

Expense Categorisation: These software solutions let users easily choose the type of expense, such as travel, meals, utilities, or office supplies, reducing manual effort and ensuring consistent record-keeping.

Approval Workflows: Once submitted, expense requests are instantly routed to the right manager or department head. Automated notifications speed up approvals and cut down on back-and-forth emails.

Compliance Check: The software applies built-in company policies and GST/tax rules to every claim. This helps prevent errors, duplicate entries, and non-compliant expenses from slipping through.

Integration: The platform connects with payroll, HRMS, or ERP tools so reimbursements are processed smoothly and on time. This ensures that employees get paid without delays.

Analytics & Insights: Finance teams and leadership get access to dashboards and real-time reports. These insights highlight spending patterns, policy violations, and opportunities to reduce costs.

Given the complexities involved, automating expense management has become a must for Indian businesses in 2026, saving time, reducing errors, and ensuring compliance. But the real question is,

Indian businesses are under growing pressure to comply with regulations while running lean operations. Automating expense workflows helps eliminate manual errors, reduce compliance risks, and ensure faster employee reimbursements.

Smart expense management software delivers value across the organisation, helping founders, HR heads, and finance managers achieve visibility, efficiency, and control in their day-to-day operations.

Here’s a closer look at the benefits for each role:

1. Benefits for Founders

Gain complete visibility into company-wide expenses with real-time dashboards.

Control costs better and reduce financial leakages through policy enforcement.

Free up valuable time by eliminating manual approvals and spreadsheet checks.

2. Benefits for HR Heads

Reduce employee frustration with faster reimbursements and transparent workflows.

Integrate expense policies with attendance, payroll, and leave systems for smoother operations.

Improve employee experience by offering self-service expense submission via mobile apps.

3. Benefits for Finance Managers

Automate claim verification with built-in GST/tax compliance and policy checks.

Generate detailed reports to track spending trends and identify areas to save costs.

Cut down processing time significantly, allowing the finance team to focus on strategic planning.

To truly reap these advantages, your expense management software must have the right capabilities, features that streamline workflows, ensure compliance, and give you full control.

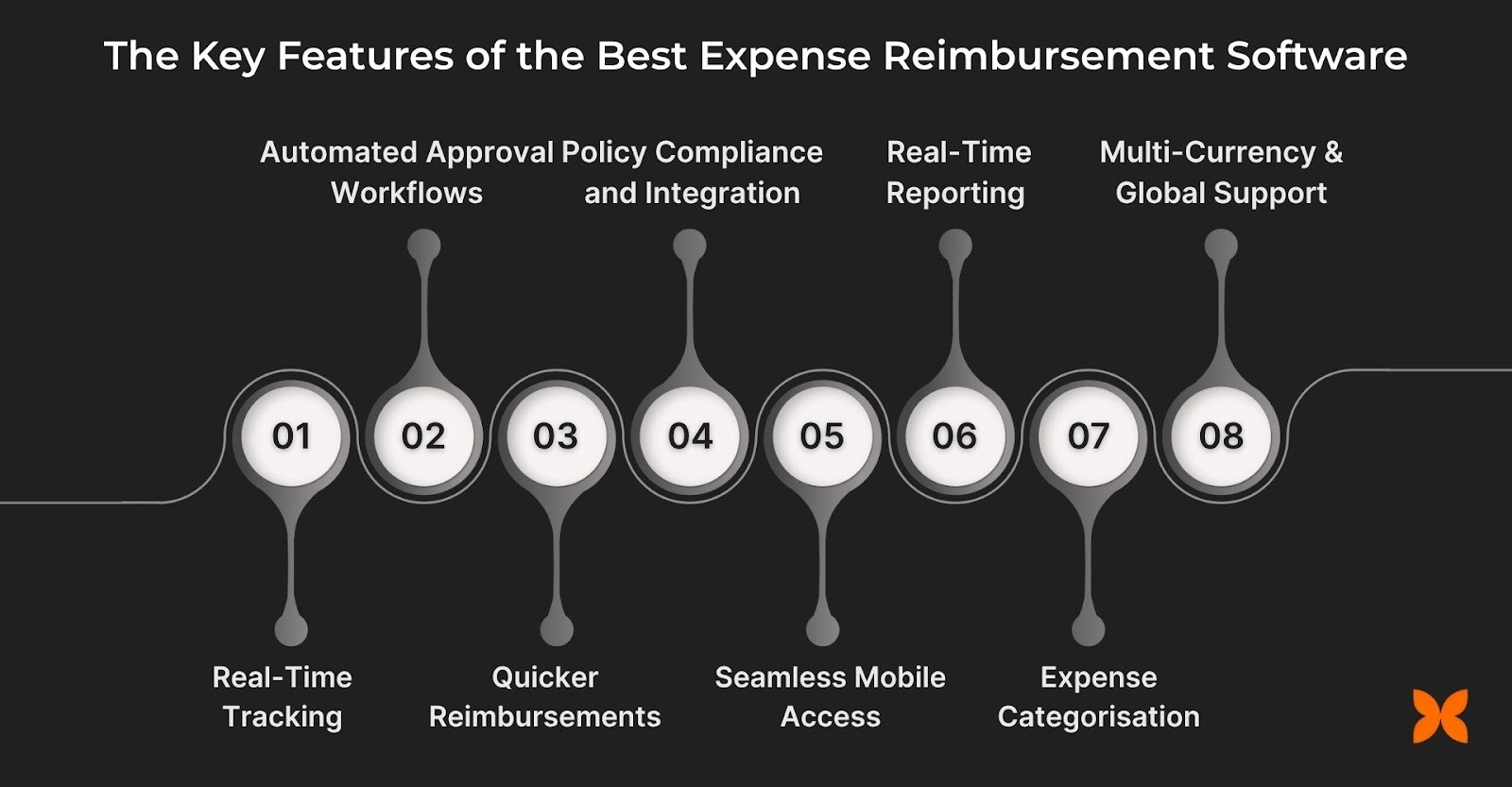

Not all expense tools are built the same. If you’re evaluating your options, these are the must-have features to look for in your next reimbursement solution:

Real-Time Tracking: Track expenses as they occur to prevent overspending and mismanagement.

Automated Approval Workflows: Automated approval chains ensure the right person reviews and approves claims, saving time and reducing errors.

Quicker Reimbursements: Automate claim approvals and payouts to ensure employees get reimbursed faster, with fewer manual checks and complete accuracy.

Policy Compliance and Integration: Built-in compliance features enforce tax, GST, and company policies while integrating with payroll, HR, or ERP systems.

Seamless Mobile Access: Mobile-friendly apps allow employees to submit receipts, check status, and track approvals on the go.

Real-Time Reporting and Analytics: Easy-to-access dashboards highlight spending patterns, policy violations, and help leaders make informed decisions.

Expense Categorisation: Automatically group expenses by type, project, or department to simplify reporting and ensure better budget tracking.

Multi-Currency & Global Support: Ideal for businesses with cross-border teams, ensuring smooth reimbursements for international travel and expenses.

Now that we know what to look for, here’s a curated list of the best expense reimbursement software in India, chosen for reliability, ease of use, and automation.

Also read: Best Payroll Software for Indian Businesses in 2026

Managing business expenses efficiently is crucial for smooth financial operations. To help you find the right fit, we’ve compiled a list of the 11 best expense reimbursement software in India, trusted by companies of all sizes for their reliability, ease of use, and automation capabilities.

Craze - Best for Startups & Fast-Growing Businesses

Zoho Expense - Best for Businesses in the Zoho Ecosystem

Fyle - Best for AI-Powered Receipt Tracking & Compliance

Happay - Best for Corporate Cards & Travel Expense Management

ITILITE - Best for Travel & Expense Management Integration

HROne - Best for businesses needing expense integrated in their HR system.

SAP Concur - Best for Large Enterprises with Global Travel Needs

Expensify - Best for Small to Mid-Sized Businesses with International Teams

Rydoo - Best for Global Teams & Real-Time Expense Reporting

EnKash - Best for Payables Automation & Expense Control

Zaggle - Best for Rewards, Cards & Expense Automation

Also Read: Top 15 Payroll Software Features for Indian Businesses

In this section, we’ll walk you through the top expense reimbursement software platforms that can simplify how your business manages employee claims, approvals, and reimbursements. Each tool has been evaluated based on pricing, key features, user reviews, and overall suitability for startups and scaleups.

From AI-powered receipt scanning to seamless GST compliance and mobile-first claim submissions, these platforms are designed to save time, reduce errors, and improve financial transparency. Let’s dive into the details of each software so you can choose the right solution for your growing business.

1. Craze

Craze is an all-in-one HR, payroll, and workforce management platform designed for startups and fast-growing businesses in India. Its expense reimbursement module eliminates manual claims and spreadsheets by automating submissions, approvals, and compliance. With a simple, mobile-first interface, Craze ensures employees get reimbursed faster while finance teams gain visibility and control.

Key Features:

Smart Expense Submission: Employees can upload receipts via mobile or web, and the system automatically scans, validates, and categorises them.

Automated Workflows: Manager approvals are streamlined with real-time notifications, reducing delays and errors.

GST & Tax Compliance: Built-in compliance checks align with Indian tax rules and company policies.

Payroll Integration: Approved expenses sync directly with payroll for smooth and on-time reimbursements.

Analytics Dashboard: Finance leaders get real-time insights into spending trends, cost centres, and policy violations.

Scalable & Startup-Friendly: Works seamlessly for a 10-member team or a 1,000-employee organisation.

Best For: Startups, SMEs & and fast-growing businesses looking for an affordable, India-first expense management solution that integrates payroll, HR, and IT into one dashboard.

Pros:

One-click expense approval and payroll sync.

Transparent, affordable pricing for startups.

Mobile-first experience for employees.

24/7 customer support and fast implementation.

Cons:

Limited global features (multi-currency is still evolving).

2. Zoho Expense

Zoho Expense is part of the Zoho ecosystem and integrates seamlessly with Zoho Books, Zoho Payroll, and other apps. It’s ideal for businesses already using Zoho tools, offering strong automation and compliance support.

Key Features

Zoho Integration: Connects seamlessly with Zoho Books, CRM, and Payroll.

Automated Reporting: Creates expense reports directly from receipts and emails.

Multi-Currency Support: Handles global transactions across different branches.

Approval Workflows: Customisable routing for quick and compliant approvals.

Best For: Businesses already in the Zoho ecosystem looking for an integrated expense management solution.

Pros:

Strong integration with other Zoho apps.

Easy-to-use mobile app for employees.

GST-ready and compliant for Indian businesses.

Cons:

Limited third-party integrations outside Zoho.

Advanced analytics are only available in higher plans.

3. Fyle

Fyle is an AI-powered expense management tool built for modern finance teams. Its OCR technology simplifies receipt tracking and ensures compliance with company policies.

Key Features

AI Receipt Scanning: Captures and categorises receipts directly from Gmail/Outlook.

Policy Enforcement: Flags non-compliant expenses instantly.

Mileage Tracking: Uses GPS to automate distance and expense calculations.

Accounting Integrations: Syncs with QuickBooks, Xero, NetSuite, and more.

Best For: SMEs and mid-sized companies that want AI-driven automation for expense tracking.

Pros:

Strong AI capabilities for auto-categorisation.

Real-time policy violation alerts.

Smooth integrations with accounting tools like QuickBooks and Xero.

Cons:

Pricing may be higher for smaller teams.

Limited global compliance compared to enterprise-grade tools.

4. Happay

Happay is a popular choice for managing corporate travel and card-based expenses. It’s widely used in industries like BFSI, IT, and services where travel and petty cash management are frequent.

Key Features

Smart Corporate Cards: Real-time visibility into card transactions.

Travel Integration: Unified booking, approvals, and reimbursement workflows.

GST Compliance: Automated tax reporting and invoicing.

Analytics Dashboard: Provides insights into travel and overall employee spend.

Best For: Businesses with high travel and entertainment (T&E) spends.

Pros:

Excellent for travel-heavy organisations.

Corporate card integration reduces reconciliation time.

Mobile-first interface for employees.

Cons:

Overkill for small startups with limited travel needs.

Some advanced features are locked behind enterprise pricing.

5. ITILITE

ITILITE is an AI-powered travel and expense management platform built for modern businesses. Designed with scalability in mind, ITILITE combines business travel booking with automated expense reimbursements, making it a strong choice for startups and scaleups aiming for efficiency and cost savings.

Key Features:

AI Travel Booking: Recommends cost-effective travel options.

Unified Platform: Combines travel management with expense claims.

GST Compliance: Built-in features for tax-ready reporting in India.

Real-Time Insights: Analytics on travel spend and compliance trends.

Best For: Startups and mid-sized companies looking for a combined travel + expense management solution.

Pros:

Strong GST compliance and automation.

Intuitive mobile app for employees.

Saves time by combining travel and expenses.

Cons:

More travel-focused, expense-only users may find features excessive.

Pricing may feel premium for very small teams.

6. HROne

HROne is an all-in-one HR and payroll platform that also includes expense and reimbursement management. It suits Indian businesses that want to automate claims, approvals, and reimbursements with policy controls and GST-friendly compliance. Its biggest advantage is that approved reimbursements can sync into payroll for on-time payouts.

Key Features

Payroll-Linked Reimbursements: Approved claims can flow into payroll to reduce manual processing and payout delays.

Mobile Receipt Uploads: Employees can submit claims on the go with quick receipt capture and attachment support.

Policy Checks and Controls: Configurable rules help flag non-compliant expenses and enforce spending limits.

GST and Tax Support: Built for Indian requirements with GST-aware handling and reporting support.

Best For: Businesses that want expense reimbursements integrated with HR and payroll in a single platform.

Pros:

Payroll integration helps reimbursements get paid on time.

Mobile-first submission is convenient for employees.

Strong fit for Indian compliance needs, including GST.

Cons:

May be less suitable for teams needing deep multi-currency capabilities.

Advanced analytics may be tied to higher plans.

7. SAP Concur

SAP Concur is a global leader in travel and expense management, designed for large enterprises with complex compliance needs.

Key Features:

Global Travel Integration: Book flights, hotels, and track expenses in one platform.

Automated Compliance: Built-in global tax and policy support.

Fraud Detection: AI tools to audit and prevent false claims.

Mobile App: Capture receipts, track itineraries, and manage expenses on the go.

Best For: Large enterprises with global operations and frequent business travel.

Pros:

Enterprise-grade features and scalability.

Strong compliance and audit trail.

Integrates with ERP systems like SAP and Oracle.

Cons:

Expensive for SMEs.

Setup and onboarding can be complex.

8. Expensify

Expensify is a global expense management platform popular with businesses that have distributed or international teams. It supports multi-currency, credit card reconciliation, and real-time receipt scanning.

Key Features

SmartScan Receipts: AI-powered scanning and auto-categorisation.

Global Support: Multi-currency and international card integrations.

Direct Reimbursements: ACH transfers for faster payouts.

Accounting Sync: Works with QuickBooks, NetSuite, and other major tools.

Best For: SMBs with global or remote teams needing cross-border expense management.

Pros:

Great for international expense workflows.

Intuitive mobile app for employees.

Corporate card integration.

Cons:

Higher pricing compared to India-focused tools.

It may feel complex for very small teams.

9. Rydoo

Rydoo is a globally trusted expense management solution with strong support in India. Known for its clean design and mobile-first workflows, Rydoo enables employees to submit expenses on the go while finance teams maintain compliance and control.

Key Features:

Real-Time Submission: Expenses can be submitted, approved, and reimbursed instantly.

Multi-Currency Support: Ideal for startups working with global clients.

System Integrations: Connects with ERP, payroll, and accounting systems.

Mobile-First Design: Quick submission and approval via app.

Best For: Startups with international clients or remote teams needing multi-currency support.

Pros:

Sleek UI with quick adoption.

Strong global compliance features.

Excellent integration ecosystem.

Cons:

Higher cost compared to India-first solutions.

Some features require enterprise-level plans.

10. EnKash

EnKash is a popular Indian fintech platform offering expense management, cards, and payables automation. Its reimbursement module is built for businesses that want to integrate credit cards, accounts payable, and expense tracking in one solution.

Key Features:

Expense Cards: Employee cards linked with instant claim tracking.

GST-Compliant Workflows: Automated GST invoicing and compliance reports.

ERP Integrations: Auto-sync with major accounting platforms.

Payables Automation: Manage vendor payments, GST, and reimbursements.

Best For: Startups and scaleups needing end-to-end spend management.

Pros:

Strong compliance features for Indian regulations.

Covers both reimbursements and vendor management.

Flexible approval structures.

Cons:

It can feel complex for startups needing simple reimbursements only.

Some advanced features are locked behind enterprise plans.

11. Zaggle

Zaggle is an Indian-first fintech and expense automation platform that integrates reimbursements, prepaid cards, and rewards. Known for its flexibility, it helps companies simplify expense claims while boosting employee engagement.

Key Features:

Automated Expense Capture: Receipts are uploaded and categorised instantly.

Corporate Cards: Prepaid and company cards with real-time monitoring.

Spend Analytics: Dashboards for expense insights and control.

Rewards Integration: Combine expense tracking with employee perks.

Best For: Startups that want expense management + rewards integration.

Pros:

Strong focus on employee engagement.

Affordable for SMEs and startups.

Flexible prepaid card ecosystem.

Cons:

More rewards-focused than other platforms.

Limited international compliance features.

Read more: Employee Database Management System for HR Leaders: What It Is, How It Helps, and How to Choose

By evaluating these factors carefully, businesses can find a solution that saves time, ensures compliance, and improves employee satisfaction.

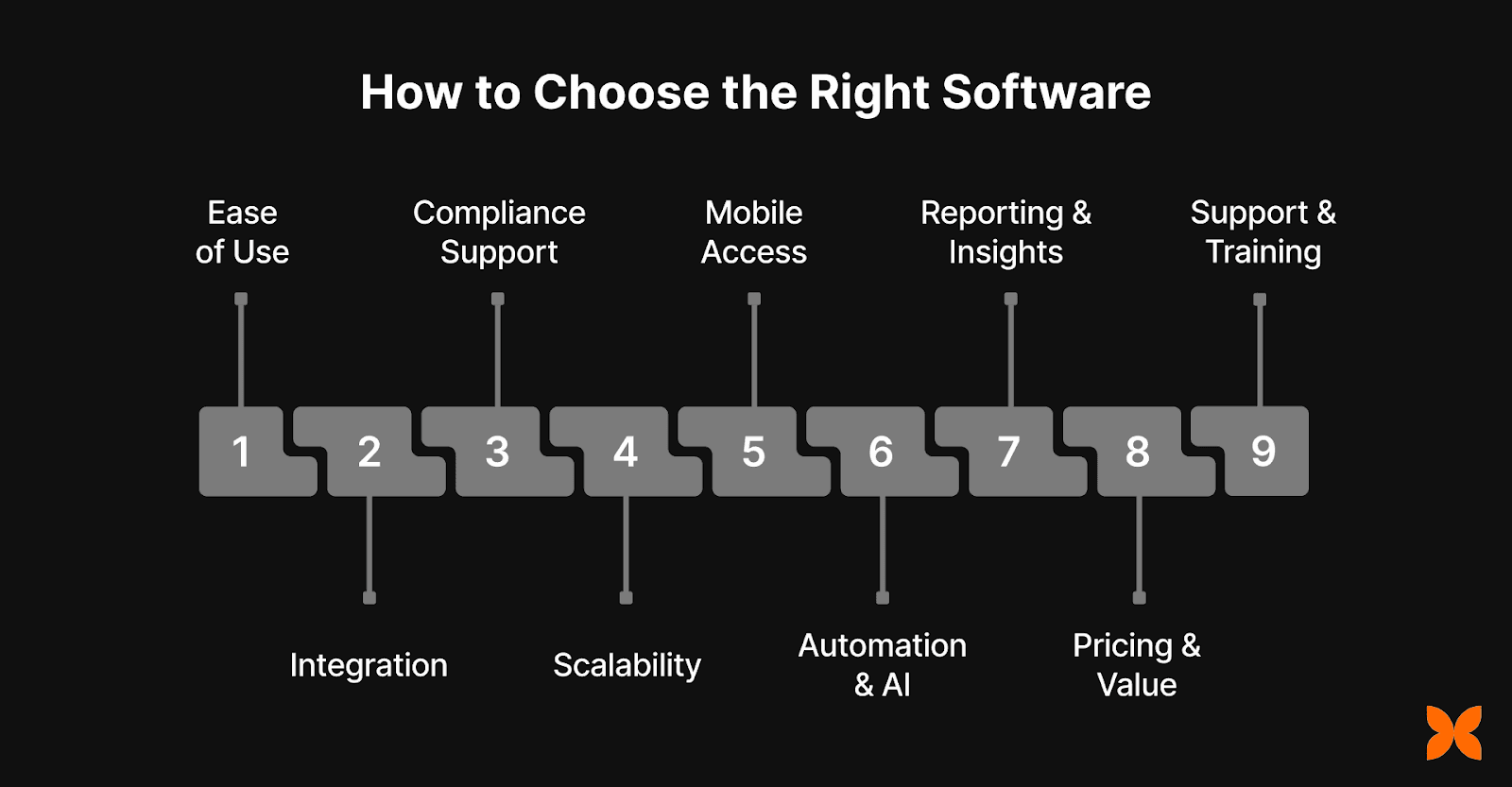

With so many options available, picking the right expense reimbursement software can feel overwhelming. The key is to match the software’s capabilities with your business size, industry, and growth stage. Here are some important factors to consider:

Ease of Use: The platform should have an intuitive interface so employees can submit expenses without training hassles.

Integration: Check if it connects smoothly with your existing payroll, HRMS, and accounting systems.

Compliance Support: Ensure the software is updated for GST, Indian tax laws, and company policies to avoid penalties.

Scalability: Choose a tool that can grow with your business, whether you’re a 20-person startup or a 1,000-member scaleup.

Mobile Access: A mobile-first app ensures employees can submit receipts and managers can approve claims on the go.

Reporting & Insights: Real-time analytics help finance teams track spending patterns and make smarter budget decisions.

Pricing & Value: Don’t just look at the base price; consider what features are included at each tier and whether hidden costs exist.

Support & Training: Reliable customer support and onboarding assistance are crucial for smooth adoption.

The right expense management software should not only save time but also empower your finance team to focus on strategic goals, rather than chasing receipts and approvals.

Managing expenses doesn’t have to be complicated or time-consuming. With the right expense reimbursement software, businesses can simplify every step, from submitting claims to approving and reimbursing them, while staying compliant and transparent.

The tools we’ve covered are among the best expense reimbursement software in India, built to suit different business sizes and needs. Whether you’re a startup aiming to save time or a large enterprise focused on control and compliance, there’s a solution designed for you.

Adopting an automated system not only improves accuracy and speed but also frees up your finance team to focus on what really matters, driving business growth.

1. What is expense reimbursement software?

Expense reimbursement software is a digital tool that helps businesses automate the process of submitting, approving, and reimbursing employee expenses. It replaces manual spreadsheets with easy mobile submissions, policy checks, and real-time reporting.

2. Why do startups and SMEs in India need expense management software?

Manual expense tracking often leads to errors, delays, and compliance risks. Software solutions help Indian startups save time, ensure GST/tax compliance, and give finance teams visibility into spending patterns.

3. How does expense management software integrate with payroll and HR?

Most modern tools, including Craze, integrate directly with payroll, HR, and ERP systems. This ensures reimbursements are processed seamlessly, without manual entries or delays.

4. What are the must-have features of expense reimbursement software?

Key features include receipt scanning, quick reimbursements, approval workflows, GST/tax compliance, mobile access, and real-time reporting.

5. How much does expense reimbursement software cost in India?

Pricing varies widely. Some tools, like Craze, start from ₹60 per employee/month, while enterprise-grade platforms like SAP Concur or Darwinbox may charge higher, customised rates.

6. Is expense data safe with cloud-based solutions?

Yes. Leading providers like Craze, Zoho Expense, and Happay use bank-grade security, encryption, and access controls to protect sensitive financial data.

Looking to optimise other aspects of your HR operations? Check out these top HRMS tools and software for your use case: