Payroll day shouldn’t feel like a battleground. Yet, for many Indian HR and finance leaders, it often does, with tangled Excel sheets, last-minute corrections, missed statutory deadlines, and frantic back-and-forths between teams. These operational stresses don’t just waste hours; they sap morale and distract your team from real strategic work.

This is where payroll management systems come into action. In fact, over 60% of Indian employers are integrating AI into payroll and attendance management systems to improve accuracy and forecasting.

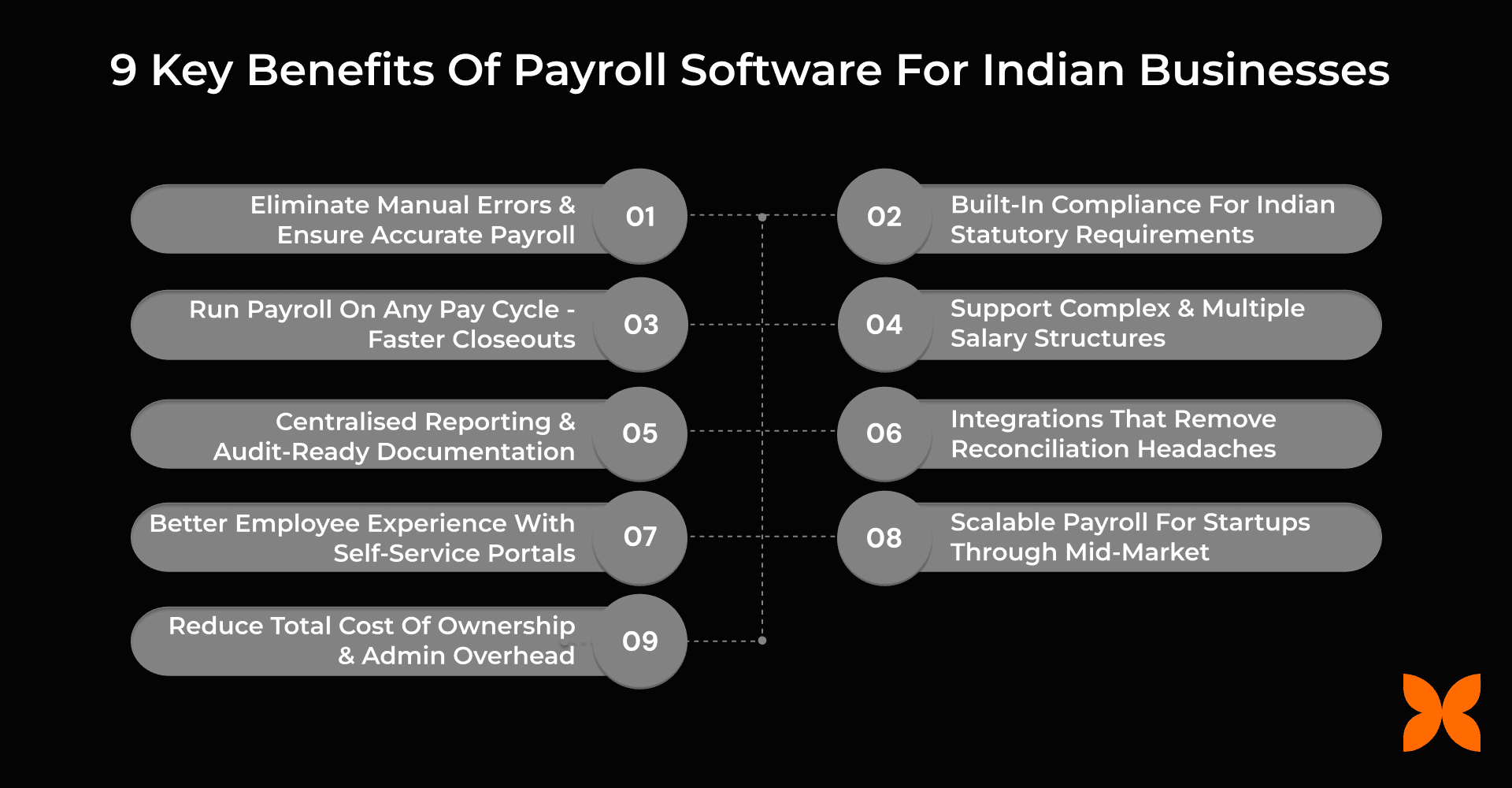

If you’re leading payroll for a fast-growing finance, ecommerce, IT, or SaaS business, especially one transitioning from spreadsheets or fragmented tools, you know the stakes are high. In this blog, we will explore 9 key, business-centric payroll system benefits that Indian companies should prioritise when evaluating solutions.

Payroll software improves accuracy, reduces errors, and enables faster payroll closure across salary, deductions, and variable pay.

Built-in statutory compliance simplifies management of TDS, PF, ESIC, and Form 16 while keeping payroll audit-ready.

Flexible pay cycles, multi-entity support, and contractor payroll make it suitable for startups and mid-market companies.

Centralised reporting and accounting integrations reduce reconciliation effort and improve financial control.

Integrating payroll with HR and IT workflows lowers administrative overhead and total cost of ownership.

Manual payroll systems often break quietly before they fail visibly. What starts as a manageable spreadsheet quickly turns into a high-risk operation as headcount grows, pay components diversify, and statutory obligations stack up. The result is rework, delays, and avoidable compliance exposure.

Below are the core reasons manual payroll does not scale for Indian businesses:

Spreadsheet Dependency Leads To Costly Errors: A single incorrect formula or outdated sheet can miscalculate salaries or deductions. Fixing these errors triggers reprocessing, employee queries, and finance rechecks, often consuming multiple workdays every month.

Too Many Pay Components To Track Manually: Indian payroll includes basic pay, multiple allowances, variable incentives, reimbursements, bonuses, and deductions. Managing these accurately across roles and teams becomes error-prone without system logic.

Statutory Compliance Adds Layered Complexity: TDS, PF, ESIC, and Form 16 requirements demand precision and timely reporting. These rules change periodically and can vary by threshold, entity, or location, increasing compliance risk when tracked manually.

This is where payroll software replaces fragmented effort with structured, automated workflows designed for scale.

Also read: 10 Best Payroll Software in India

As these limitations surface, the focus shifts from fixing spreadsheets to understanding the payroll system benefits that come from adopting dedicated payroll software.

Payroll software delivers value only when it solves real operational problems, not when it adds more complexity. For Indian businesses managing growing teams, multiple pay components, and statutory obligations, the benefits must be practical, measurable, and repeatable across every payroll cycle.

Below are the nine tangible benefits Indian employers experience when payroll is managed through a dedicated payroll system:

1. Eliminate Manual Errors and Ensure Accurate Payroll

Payroll accuracy is foundational to trust, compliance, and operational stability. As teams scale, even small calculation errors can cascade into multiple corrections and employee dissatisfaction.

Below are the key ways payroll software eliminates errors and improves accuracy:

Automated Salary and Deduction Calculations: The system applies predefined rules for earnings, deductions, and statutory contributions consistently, preventing miscalculations caused by formula changes or manual overrides.

Accurate Leave and Attendance Sync: Approved leave, attendance, and overtime data flow directly into payroll, reducing errors caused by outdated inputs or last-minute manual adjustments.

Controlled Variable Pay Processing: Incentives, bonuses, and overtime are calculated using structured inputs, ensuring correct payouts without manual prorations or ad-hoc estimations.

Lower Compliance and Dispute Risk: Consistent calculations reduce discrepancies that can lead to employee grievances or regulatory scrutiny, especially during audits or statutory reviews.

Impact metrics such as time saved per payroll cycle and reduction in correction frequency are to be validated with Craze customer data before publishing.

2. Built-In Compliance For Indian Statutory Requirements

Payroll compliance in India is not a one-time setup. It requires continuous accuracy across calculations, filings, and HR documentation, with little margin for delay or error. As headcount grows, manual tracking of statutory rules increases legal exposure and operational stress.

Below are the ways payroll software enables structured and reliable statutory compliance:

System-Driven Statutory Calculations: Payroll software automatically applies statutory formulas for deductions such as income tax, provident fund, and employee insurance, ensuring calculations stay aligned with defined thresholds and contribution rules.

Timely Generation Of Compliance Reports: Statutory outputs like tax summaries, contribution statements, and annual forms are generated directly from payroll data, reducing dependency on manual compilation at month-end or year-end.

Audit-Ready Payroll Records: All payroll actions, revisions, and statutory calculations are logged and traceable, simplifying internal audits and external inspections.

Reduced Dependency On Manual Follow-Ups: Automated compliance workflows reduce last-minute coordination between HR, finance, and external consultants, ensuring statutory obligations are met consistently.

Specific statutory references and filing timelines to be verified with official Indian government sources before final publication.

3. Run Payroll On Any Pay Cycle - Faster Closeouts

Indian businesses rarely operate on a single, fixed payroll schedule. Contractors, interns, variable payouts, and salary advances often require payroll to run outside standard monthly cycles.

Below are the ways payroll software enables flexible cycles and faster payroll closures:

Support for Multiple Payroll Cycles: Payroll can be processed monthly, bi-monthly, or on custom schedules for contractors and interns, without duplicating data or maintaining parallel spreadsheets.

Efficient Handling Of Ad-Hoc Payments and Advances: One-time payouts such as bonuses, reimbursements, or salary advances are processed within the same system, reducing the need for off-cycle manual adjustments.

Parallel Payroll Runs Without Data Conflicts: Multiple payroll cycles can be executed simultaneously for different employee groups or entities, ensuring accuracy without blocking other payroll activities.

Faster Approvals and Payroll Closure: Automated approval workflows replace email-based sign-offs, enabling payroll to close on time with fewer dependencies and reduced administrative follow-ups.

4. Support Complex and Multiple Salary Structures

As organisations grow, compensation stops being uniform. Different teams, roles, and employment types require distinct salary components, payment rules, and approval flows.

Below are the ways payroll software simplifies complex salary structures and related workflows:

Multiple Salary Structures Across Roles and Teams: Payroll software supports different pay configurations for sales teams, engineering roles, contractors, and interns, ensuring each group is processed accurately without manual segregation.

Structured Variable Pay and Incentive Handling: Incentives and performance-linked payouts follow predefined rules, reducing reliance on ad-hoc calculations and ensuring consistency across pay periods.

Automated Reimbursement Policy Enforcement: Reimbursement claims are processed using configured eligibility rules and approval logic, minimising manual reviews and reducing repetitive HR interactions.

Integrated Loan and Salary Advance Management: Employee loans and advances are tracked with defined repayment schedules, ensuring deductions are applied correctly across payroll cycles without manual follow-ups.

5. Centralised Reporting and Audit-Ready Documentation

Payroll data is only useful when it can be accessed, verified, and analysed without manual compilation. As organisations scale, finance leaders need structured payroll reporting that supports decision-making, reconciliations, and audits without repeated data requests or rework.

Below are the reporting and documentation capabilities finance teams rely on from payroll software:

Master CTC and Compensation Reports: These reports provide a consolidated view of fixed and variable compensation, enabling accurate budgeting, cost analysis, and workforce planning.

Monthly Salary Registers For Reconciliation: Detailed salary registers help finance teams reconcile payroll expenses with accounting entries, reducing discrepancies during monthly and quarterly closes.

Contractor and Consultant Invoice Reports: Structured reports separate contractor payouts from employee payroll, simplifying expense categorisation and statutory reviews.

Flexible Report Export and Filtering Options: Finance teams can filter reports by entity, department, or date range and export them in commonly used formats, ensuring data is usable across financial systems.

Vendor Evaluation Reporting Checklist: When assessing payroll software, finance teams should verify support for custom fields, configurable date ranges, and downloadable reports that align with internal reporting standards.

6. Integrations That Remove Reconciliation Headaches

Payroll does not operate in isolation. When payroll data fails to sync with accounting and banking systems, finance teams spend significant time reconciling entries, correcting mismatches, and validating payouts.

Below are the integration capabilities that simplify payroll reconciliation and payouts:

Direct Sync With Accounting Systems: Payroll data flows directly into expense management platforms, eliminating manual journal entries and reducing posting errors during monthly closes.

Automated Mapping Of Payroll Components: Earnings, deductions, and statutory contributions are mapped to predefined accounting heads, ensuring consistency across financial records.

Direct Salary Payout From Payroll System: One-click payroll enables salaries to be credited directly from the payroll platform, reducing dependency on external uploads and minimising payout delays.

Improved Traceability Between Payroll and Payments: Integrated payout records allow finance teams to trace salary disbursements back to payroll runs, supporting faster issue resolution and audit verification.

7. Better Employee Experience With Self-Service Portals

As organisations scale, payroll-related questions increase in volume and urgency. When employees depend on HR for routine payroll information, response delays and data inconsistencies become common.

Below are the ways self-service payroll portals improve employee experience and operational efficiency:

On-Demand Access To Payroll Documents: Employees can view and download payslips, tax statements, and related payroll documents without raising requests or waiting for manual responses.

Real-Time Visibility Into Reimbursements and Deductions: Reimbursement status, approved claims, and applied deductions are visible within the portal, reducing follow-ups and miscommunication.

Structured Loan and Advance Requests: Employees submit loan or salary advance requests through defined workflows, ensuring clarity on approval status and repayment schedules.

Mobile-Accessible Payroll Information: Payroll portals designed for mobile use support distributed and hybrid workforces, enabling employees to access payroll information securely from any location.

8. Scalable Payroll For Startups Through Mid-Market (50–500 Employees)

Growth introduces operational complexity long before it becomes visible on the org chart. Frequent hiring, new business entities, and expanding locations place sustained pressure on payroll systems that were designed for smaller teams.

Below are the ways payroll software supports scale without disruption:

Multi-Entity Payroll Without Data Fragmentation: Payroll can be managed across multiple legal entities or business units within a single system, maintaining separation while preserving central visibility.

Support for High-Volume Hiring Periods: During rapid hiring phases, new employees are onboarded into payroll workflows without rebuilding configurations or creating parallel processes.

Cross-Location Payroll Rule Management: Payroll software accommodates location-specific rules and deductions, reducing the risk of inconsistencies as teams expand geographically.

Growth-Stage Use Case: Hiring Surge Scenario: For a fast-growing SaaS company onboarding multiple teams within a quarter, payroll software processes new salary structures, varied joining dates, and staggered pay cycles without delaying payroll closure or increasing manual effort.

9. Reduce Total Cost Of Ownership and Admin Overhead

The true cost of payroll extends beyond software pricing. Manual effort, coordination time, and error resolution often consume far more resources than license fees. Evaluating payroll from a total cost perspective helps businesses make informed, long-term decisions.

Below are the ways payroll software lowers overall cost and administrative effort:

Reduced HR and Finance Time Spent on Payroll: Automation cuts down hours spent on data collection, validations, corrections, and follow-ups, freeing teams to focus on planning and analysis.

Lower Error-Related Operational Costs: Fewer payroll errors reduce the need for reprocessing, supplementary payouts, and compliance remediation, limiting indirect financial impact.

Consolidation of Multiple Point Tools: Replacing separate systems for attendance, payroll, reimbursements, and compliance reporting reduces software sprawl and associated maintenance costs.

ROI Tracking Checklist For Payroll Evaluation: Businesses should track payroll hours saved per month, reduction in correction cycles, and time taken to close payroll to measure ongoing return on investment.

Also read: 11 Best Leave Management Software in India

Once these payroll system benefits are clear, it becomes easier to see how the benefits of payroll software multiply when payroll operates as part of an integrated HR and IT platform.

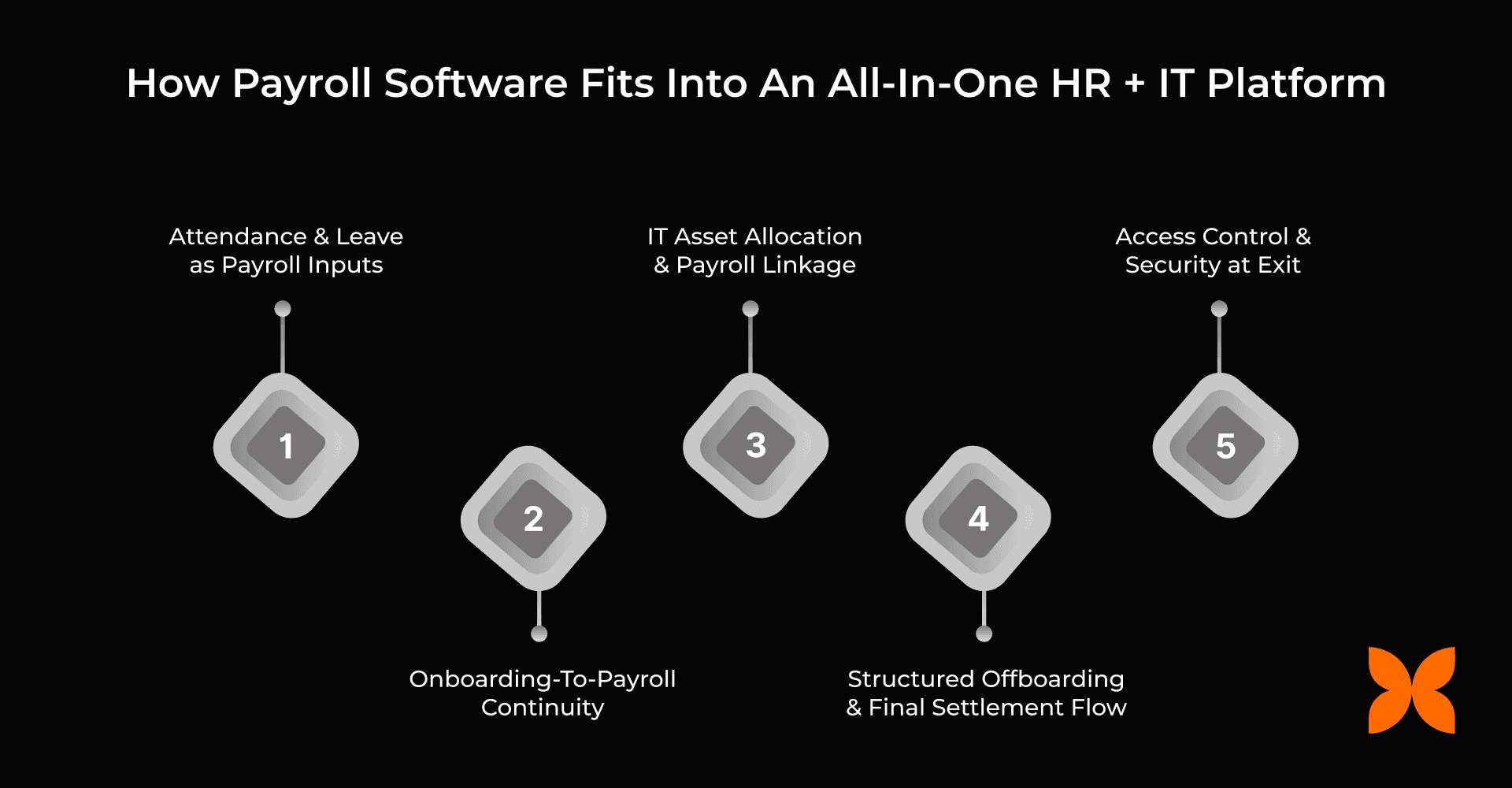

Payroll outcomes depend heavily on the accuracy and continuity of data flowing into it. When HR and IT systems operate in silos, payroll becomes a reconciliation exercise rather than a structured process. Integrated platforms align employee records from entry to exit.

Below is how payroll connects with broader HR and IT workflows in an integrated system:

Attendance and Leave as Payroll Inputs: Time, attendance, and approved leave data feed directly into payroll, ensuring salary calculations reflect actual working patterns without manual adjustments.

Onboarding-To-Payroll Continuity: Records created during employee onboarding flow into payroll automatically, eliminating duplicate data entry and reducing configuration errors.

IT Asset Allocation and Payroll Linkage: Equipment assignment data connects with payroll records, supporting scenarios such as asset-linked deductions or recovery tracking.

Structured Offboarding and Final Settlement Flow: Payroll calculations for final settlement align with exit dates, leave balances, and recoveries, reducing inconsistencies during employee exits.

Access Control and Security at Exit: Integration with identity and access management ensures system access is revoked once offboarding and asset return processes are completed, reducing data and security risks.

Track, assign, and recover all employee devices automatically while linking assets to HR workflows. Craze makes IT and payroll management seamless.

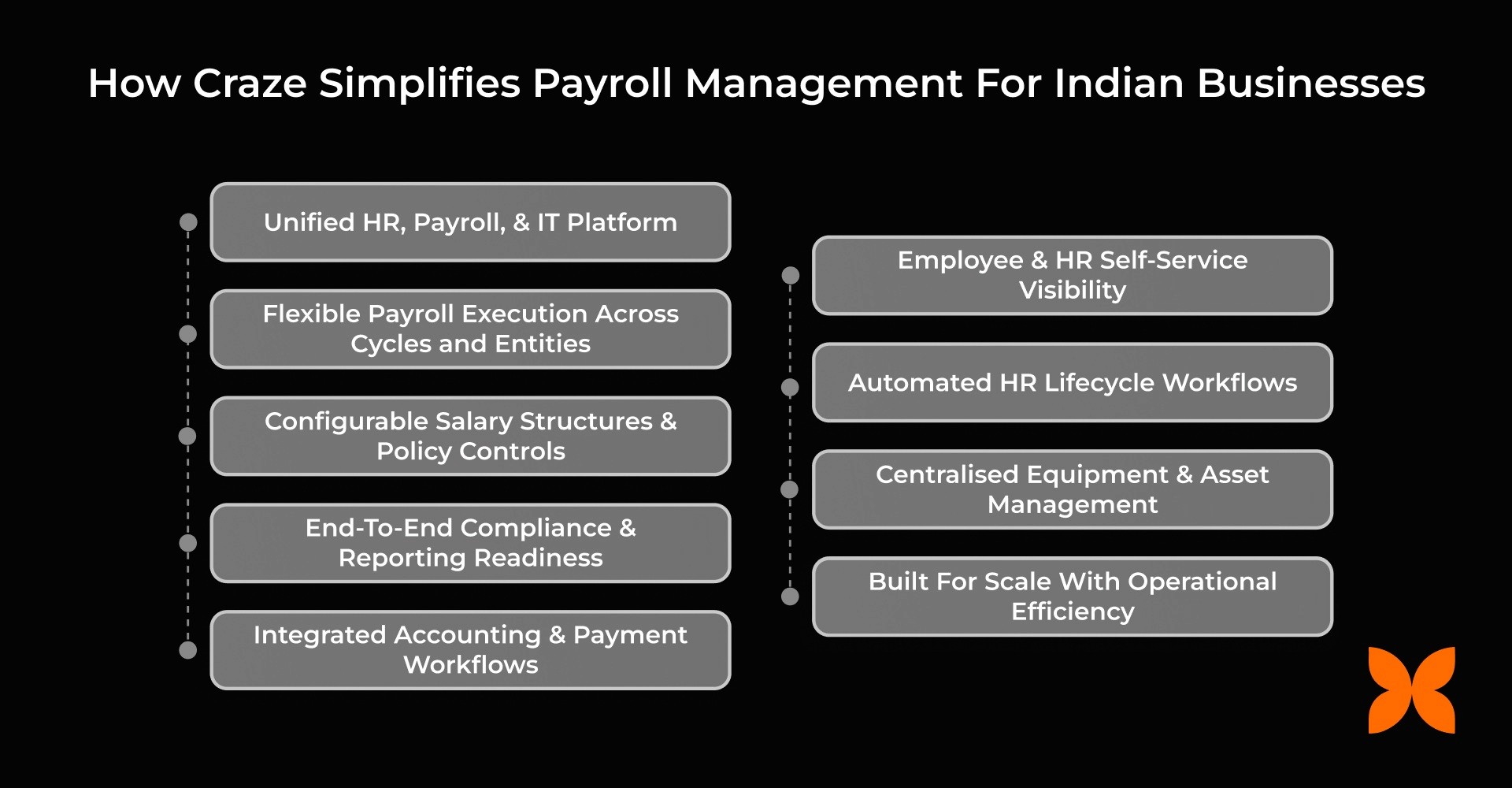

Realising the payroll system benefits discussed above requires more than isolated automation. Indian businesses need payroll to operate as part of a connected HR and IT workflow. Craze is built to deliver this integration without increasing administrative overhead.

Below is how Craze enables structured, scalable, and compliant payroll operations for Indian businesses:

Single System for Payroll, HR, and IT Operations: Craze brings payroll processing, HR workflows, and IT asset management into one platform, removing data silos and keeping employee, compensation, and operational data consistent across teams and lifecycle events.

Payroll Processing Across Cycles, Entities, and Workforce Models: Payroll can be run for different pay schedules, legal entities, and employment types, with configurable salary structures and policy controls that evolve alongside organisational and compensation changes.

Statutory Compliance and Reporting Built Into Payroll: Payroll automatically generates statutory reports, payroll documents, and audit-ready records, supporting accurate filings and compliance without manual consolidation.

Employee Visibility and Automated HR Lifecycle Processes: Employees and HR teams access payslips, benefits, reimbursements, loans, and asset details through central dashboards, while attendance, leave, onboarding, exits, and final settlements remain connected to payroll.

With Craze streamlining processes end-to-end, the benefits of payroll software translate into measurable efficiency, accuracy, and scalability.

For Indian businesses managing growing teams, the real value of payroll software lies in operational control. Beyond automation, the payroll software benefits show up in fewer errors, predictable scaling, faster closures, and clearer financial visibility.

The benefits of payroll software go beyond speed and automation. When payroll is accurate, compliant, and well-integrated with attendance, HR data, and accounting, it creates confidence across the organisation. Employees trust their payslips, finance teams close books faster, and leadership gains better insight into workforce costs.

Schedule a free call to see how Craze can simplify payroll operations for your business.

1. How does payroll software handle changes in income tax slabs or rules in India?

Modern payroll software updates tax calculation logic based on revised income tax rules and slab changes. This ensures accurate deductions across payroll cycles without manual recalculations, reducing the risk of under- or over-deduction when tax regulations change mid-financial year.

2. Can payroll software manage payroll for employees working in multiple Indian states?

Yes, payroll software can handle multi-location payroll by applying location-specific rules where required. This is particularly useful for businesses with distributed teams, as statutory applicability, allowances, or deductions may vary depending on employee location and organisational structure.

3. What data security measures should businesses look for in payroll software?

Businesses should look for role-based access controls, audit logs, encrypted data storage, and secure authentication mechanisms. Payroll software should restrict access to sensitive salary and tax data while maintaining traceability for changes, ensuring compliance with internal security and audit requirements.

4. Is payroll software suitable for companies with hybrid or remote workforces?

Payroll software supports hybrid and remote teams by centralising payroll access through secure web and mobile platforms. Employees can access payslips and tax documents remotely, while HR and finance teams manage payroll uniformly, regardless of employee location or work arrangement.

5. How long does it typically take to implement payroll software for a mid-sized company?

Implementation timelines vary based on payroll complexity, number of entities, and data readiness. For mid-sized organisations, setup generally includes payroll configuration, data migration, validation runs, and parallel testing to ensure accuracy before the first live payroll cycle.