Corporate Travel Policy: How To Write It [+ Free Sample Template]

Implement a corporate travel policy to control costs, set clear spending limits (e.g., accommodation tiers), and ensure tax compliance. Read more.

Share

TABLE OF CONTENTS

A corporate travel policy is the formal guidebook that controls costs, ensures tax compliance (especially GST input credit), and provides duty of care for employees on business trips.

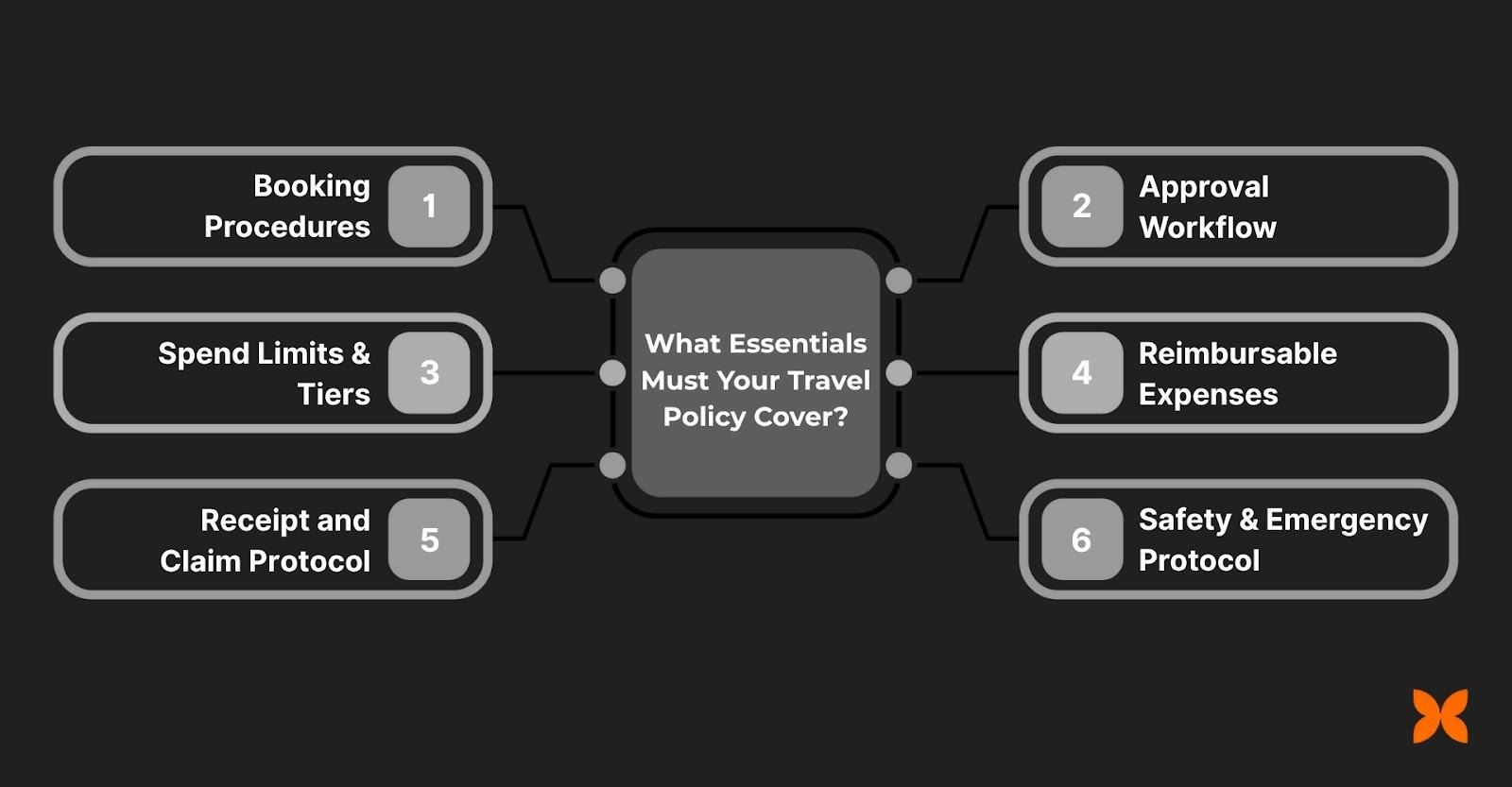

The essential components to include are booking procedures, approval workflow, clear spend limits (per diem/tiers), receipt protocols, and mandatory safety procedures.

A structured policy framework should cover mandatory approval and advance booking, accommodation and meal limits, and deadlines for expense submission.

Use an editable, ready-to-use template that simplifies the task of setting up rules for pre-trip, during-trip, and post-trip compliance.

Implementing a policy transforms travel from an unpredictable financial drain into an accountable business function, protecting your budget from overspending and audit risk.

A corporate travel policy is essentially your company's guidebook for all business trips. It's a clear, formal document that sets out the required procedures for booking travel, managing expenses, and ensuring employee safety, transforming travel from a fragmented activity into a predictable process.

A well-defined policy offers immediate and tangible benefits:

Financial Control: It allows you to set clear spend limits and mandates the use of pre-approved vendors, which are often secured at corporate rates, thereby eliminating last-minute, expensive bookings.

Compliance and Audit Ready: It provides the necessary documentation and structure to maintain strict regulatory and tax compliance, protecting the business from significant audit risks and penalties.

Reduced Admin Burden: By establishing a clear approval hierarchy and standardised expense procedures, you greatly reduce the time spent by finance and administrative staff chasing receipts and correcting non-compliant claims.

Improved Duty of Care: It establishes clear procedures for emergencies, ensuring that your company can quickly locate and assist employees while they are travelling.

To achieve this control and efficiency, you need to ensure your policy covers the right bases.

Also Read: What are Allowances in Income Tax: Types and Examples

A comprehensive travel policy serves as a risk mitigation document, preventing costly exceptions and reducing liability. To ensure your business trips are predictable and compliant from start to finish, focus on these critical areas:

Booking Procedures: Clearly define how employees must book their travel, such as mandatory use of a designated corporate travel agent or an online booking tool (OBT).

Approval Workflow: Specify the pre-trip authorisation process, like who approves the travel request, the budget, and any exceptions, before a single booking is made.

Spend Limits & Tiers: Detail the allowable classes for air travel (e.g., Economy, Premium Economy) and set per-diem limits for accommodation and meals based on the destination city or the employee's seniority.

Reimbursable Expenses: Provide a specific list of expenses that are eligible for claims (e.g., ground transport, visa fees) and, just as importantly, those that are not reimbursable.

Receipt and Claim Protocol: Mandate the format and timing for submitting expense claims, including the requirement for original, valid Goods and Services Tax (GST) compliant receipts to secure input tax credit.

Safety and Emergency Protocol: Outline the company’s duty of care, including emergency contact numbers and the process for employees to follow in case of a travel disruption or crisis.

Structuring these elements properly ensures maximum control. Now, let’s explore a practical template to help you bring your travel policy into action.

Also Read: Understanding Conveyance Allowance: Definition, Exemption, and Calculation in Salary

Creating a detailed policy minimises exceptions and reduces the time your finance team spends reviewing non-compliant reports. A structured approach covering every phase of the trip, from pre-trip, during trip, and post-trip, is key to achieving financial discipline and duty of care.

1.Define Your Policy’s Core Objective and Scope

A policy’s effectiveness starts with clarity on why it exists and who must adhere to it. This section sets the foundation for corporate alignment and eliminates ambiguity regarding applicability.

Policy Purpose: State the primary goals, such as mandatory cost control, adherence to legal and tax compliance in India (e.g., GST requirements), and guaranteeing employee safety.

Scope and Applicability: Specify that the policy covers all employees (full-time, contractual, etc.) across all domestic and international business travel initiated on behalf of the company.

Mandatory Compliance: State clearly that adherence to this policy is mandatory for any expense to be considered eligible for reimbursement.

2.Outline the Pre-Trip Approval and Booking Protocol

The best way to control costs is by ensuring compliance before the trip even starts. A clear pre-approval process prevents expensive, unauthorised bookings from ever occurring.

Mandatory Pre-Approval: Define that all travel, regardless of cost, must be approved by the employee's direct manager (or department head for international/high-cost travel) using the designated system.

Booking Channels: Mandate the use of pre-approved booking methods, such as the company’s preferred Travel Management Company (TMC) or an Online Booking Tool (OBT), to ensure corporate rates and data capture.

Advance Booking Requirement: Set a rule, such as requiring flight bookings to be made at least 7 or 14 days in advance to secure lower fares, with defined penalties or mandatory senior approval for last-minute exceptions.

Also Read: Recording Advances to Employees: A Complete Guide

3.Specify Travel and Accommodation Guidelines

This section is crucial for setting financial boundaries. Classifying travel standards based on factors like flight duration or employee seniority ensures both fairness and cost-effectiveness.

Air Travel: Define that Economy Class is the default for all domestic and short-haul international flights. Clearly state the conditions, if any, for booking Premium Economy or Business Class (e.g., only for flights exceeding six or eight hours, and only with specific executive approval).

Accommodation: Set a maximum star-rating (e.g., 3-star or 4-star equivalent) and a city-specific price cap for hotels. The policy should encourage the use of properties listed with the company’s negotiated corporate rates.

Ground Transportation: Prioritise cost-effective methods like local taxi services (e.g., Uber/Ola) or public transport. Define when rental cars are permitted and the required class of vehicle.

4.Detail Per Diem, Meal, and Incidental Expenses

Standardising daily allowances is the most effective way to eliminate minor expense report disputes and provide employees with a predictable cash flow for their trip.

Per Diem Allowance: Establish city-based, fixed daily allowances (per diem) for meals and incidentals. This amount is paid regardless of actual spend, removing the need for receipts for small items.

Client Business Meals: Define that meals with clients or external business partners must be separately documented, and require a receipt and a clear business purpose to be reimbursed outside the per diem limit.

Ineligible Expenses: Explicitly list items that will never be reimbursed, such as personal entertainment, minibar charges, hotel room service beyond the meal allowance, or travel for accompanying family members.

5.Establish Post-Trip Expense Reporting and Reimbursement

A lack of deadlines and clear documentation rules slows down the finance cycle and impacts accurate tax filing. This section must enforce discipline in the expense submission process.

Submission Deadline: Employees must submit their complete expense reports, including all required receipts, within X days (e.g., 5 or 7 working days) of completing the trip.

Receipt Requirements: Mandate the submission of original or high-quality digital receipts for all expenses over a defined threshold (e.g., ₹500). Highlight the requirement for vendor details on receipts to claim GST input credit.

Review and Approval: Specify the finance team's role in auditing claims for policy compliance before the final reimbursement is processed.

6.Mandate Travel Safety and Non-Compliance Protocols

Ensuring employee safety is a legal and ethical requirement (Duty of Care). Furthermore, establishing consequences for violations maintains the policy's credibility.

Emergency Contact and Support: Provide a list of 24/7 company and third-party emergency contacts (HR, travel security partner, local embassy details for international travel).

Non-Compliance Consequences: State clearly that violations, such as booking outside approved channels or submitting fraudulent claims, will result in denial of reimbursement and may lead to formal disciplinary action.

Policy Exceptions: Include a provision defining how unforeseen exceptions (e.g., mandatory flight cancellations, emergency medical needs) will be handled, ensuring fairness without compromising financial control.

Defining these areas gives you an immediate, deployable policy framework. You can use this ready-to-use template to implement it in your organisation today.

Also Read: Also Read: Understanding the Meaning and Rules of Leave Travel Allowance (LTA)

A perfectly written policy is useless if it sits unread. The real value is unlocked during implementation, where clear communication and consistent oversight turn rules into established company practice.

Here’s how to ensure your new policy delivers maximum impact:

Rollout and Training: Do not simply email the document. Hold mandatory training sessions for frequent travellers and managers to walk them through the booking process, the limits, and the consequences of non-compliance.

Establish Accountability: Clearly assign the responsibility for pre-trip approval to the reporting manager and the final expense audit to the finance team, eliminating any confusion about who owns which part of the process.

Automate Enforcement: Use expense management software to build policy rules directly into the system. This allows the system to automatically flag or block out-of-policy spending before it becomes a financial problem.

Monitor and Report: Regularly review reports on policy exceptions and non-compliant spend. Use this data, not to penalise immediately, but to identify which rules are most often broken and require clearer communication or revision.

Set a Review Cycle: Schedule a mandatory review of the entire policy every six to twelve months. This ensures accommodation rates, airfare limits, and local transport rules remain competitive and relevant to current market costs.

When implemented with discipline, your corporate travel policy becomes a powerful tool for cost control and organisational efficiency.

Also Read: 10 Best HR Compliance Software in India for Small Businesses and Startups

Final Thoughts

Trying to manage business travel without clear rules is like leaving money on the table. You're not just chasing lost receipts; you’re introducing guesswork and unnecessary friction for your high-value employees. By putting this detailed structure in place, you take command of that significant travel budget, ensuring every rupee spent is compliant and intentional.

The real return is the culture you build. A clear, reliable travel policy signals to your team that the company is organised and fair, which allows your employees to focus completely on the business objective of their trip, not on the complex process of getting reimbursed. Implement this policy today, and transform travel from an unpredictable drain into a valuable, accountable business function.

Disclaimer

The downloadable template and the information provided in this article are intended for general guidance and educational purposes only. They do not constitute legal advice or a legally binding document. Craze does not accept any responsibility or liability for any decisions made or actions taken based on this content. We recommend reviewing your final policy with legal or HR professionals before implementation.