Full And Final Settlement Policy: Meaning, Rules & Free Sample

Master the full and final settlement policy for a smooth exit process. Understand eligibility, payments, and compliance. Download the free template. Read more!

Share

TABLE OF CONTENTS

A full and final (F&F) policy is your official document that standardises the process for closing all financial and administrative dues when an employee leaves.

The policy's primary value is legal risk mitigation, reducing financial disputes, and ensuring compliance with Indian labour laws (e.g., Gratuity and PF).

A complete policy must detail calculations for final salary, leave encashment, statutory dues, authorised deductions (like notice period recovery), and document clearance procedures.

Implementation requires mapping the exit workflow, using a cross-functional clearance group, and automating dues calculations in your payroll system.

You can download a ready-to-use F&F policy template that includes all necessary clauses for compliance, documentation, and asset recovery.

A full and final settlement (F&F) policy is your organisation’s official document detailing the step-by-step process for closing all financial and administrative obligations when an employee leaves. It formally defines the procedure for calculating and dispensing every remaining financial component, from pending salary to accrued benefits, upon separation.

The core purpose of this policy is to create a singular source of truth for all exit dues, ensuring consistency and accuracy across the board. For the employer, it acts as a crucial control measure, protecting the company from financial errors and, more importantly, from potential legal challenges arising from payment discrepancies.

Understanding what the policy entails leads naturally to the next question: why is this document non-negotiable for your business?

While ensuring a positive final impression is valuable, the necessity of a formal full and final settlement (F&F) policy extends far beyond goodwill. It is a critical risk mitigation tool that secures your company’s financial integrity and legal standing.

A well-defined F&F policy provides immediate, measurable benefits for the employer:

Mitigation of Legal Risk: It ensures strict adherence to Indian labour legislation, such as the Payment of Wages Act and the Payment of Gratuity Act, safeguarding the company from penalties, fines, and expensive litigation over delayed or incorrect payments.

Reduced Financial Disputes: By codifying precise calculation methods for all dues, from notice period compensation to leave encashment, the policy eliminates ambiguity that fuels employee grievances and subsequent legal claims.

Operational Efficiency: A clear procedure reduces the administrative burden on HR and Finance teams, accelerating the exit process, improving data accuracy, and minimising internal back-and-forth.

Protection Against Claims: The formal policy serves as documentary evidence of fair practice and timely compliance, strengthening your defence should an ex-employee raise a dispute with the Labour Commissioner.

Enhanced Employer Brand: A transparent and predictable settlement process reinforces the company's reputation as an ethical and responsible employer, which is key to attracting top talent.

With the strategic importance established, the focus now shifts to detailing the essential components that make this policy effective.

Designing a compliant F&F policy means integrating financial calculations with legal mandates and administrative procedures. The document must precisely cover every component of the final payout to eliminate any room for misinterpretation or dispute.

A complete F&F policy document must address the following crucial areas:

Final Salary and Arrears: Specifies the method for calculating unpaid salary up to the last working day, including any pending arrears, bonuses, or reimbursements due to the employee.

Leave Encashment: Details the formula for calculating and paying for any unused earned or privilege leave balance, ensuring adherence to the applicable state-specific Shops and Establishment Acts or Factories Act.

Statutory Dues (PF & Gratuity): Clearly outlines eligibility, timelines, and payment procedures for Gratuity (if applicable under the Payment of Gratuity Act, 1972) and the transfer or withdrawal of Provident Fund (PF) contributions.

Deductions and Recoveries: Defines all authorised deductions, such as the recovery for any notice period shortfall, outstanding loans, salary advances, or costs related to unreturned company assets.

Tax Compliance: Mandates the proper deduction of Tax Deducted at Source (TDS) on taxable components and specifies the timely issuance of final tax documents, such as Form 16.

Exit Documentation: Sets the protocol for the mandatory issuance of the Relieving Letter and the necessary No-Objection Certificates (NOCs) from various departments to finalise the exit.

Processing Timeline: Establishes a clear timeline for the entire F&F process, aligning with industry best practice and statutory deadlines to ensure prompt disbursement.

To help you convert these vital components into an actionable document, we have created a sample F&F policy template below.

Also Read: Understanding the Difference between Provident Fund and Gratuity

Instead of starting from a blank page, smart leaders adopt a robust template, tailoring it to their specific business needs. A compliant policy document protects your financial integrity and is your best defence in any legal labour dispute.

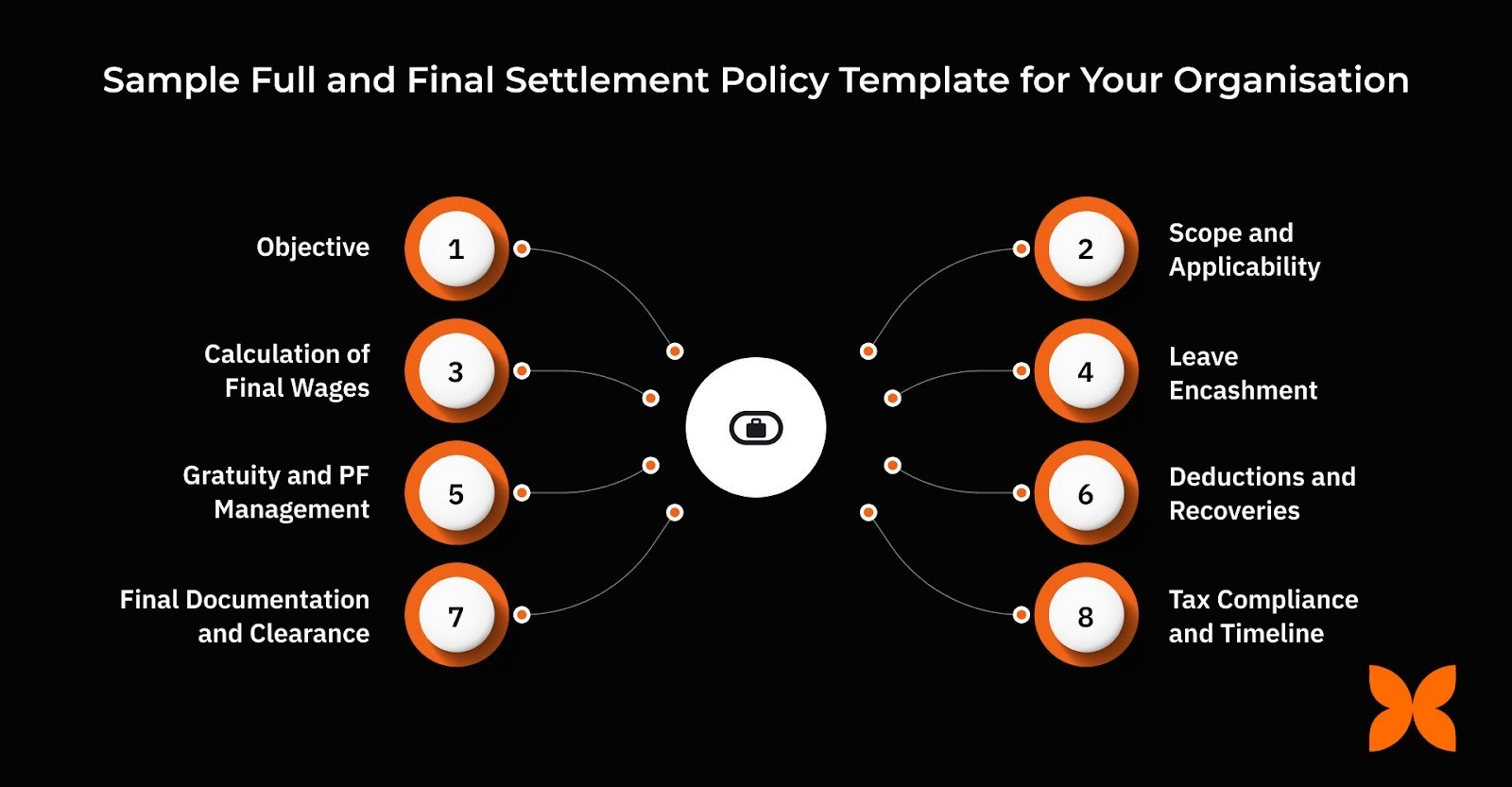

This section breaks down the essential clauses of a compliant full and final settlement policy template, providing the exact details required for legal and financial protection.

1.Objective

This clause defines the singular goal of the policy, which is critical for establishing a legally sound process.

Objective: To ensure a clear, accurate, and efficient process for the full and final settlement of all financial dues and administrative obligations upon an employee's separation, thereby maintaining legal compliance and mitigating the risk of disputes.

2.Scope and Applicability

Defining the scope prevents later debates regarding which employees and which types of separation are covered by the formal procedure.

Scope: This policy applies to all employees of the organisation, irrespective of their employment level or contract type.

Applicability: The procedure must be followed for all forms of separation, including voluntary resignation, involuntary termination, retirement, non-renewal of contract, or death.

3.Calculation of Final Wages and Arrears

This is the foundational financial section. It must clearly outline how the final working period is compensated.

Final Wages & Allowances: Specifies the method for calculating the pro-rata basic salary, Dearness Allowance (DA), and all other fixed monthly allowances (e.g., HRA, conveyance) up to the employee's documented last working day.

Arrears: Mandates the inclusion of any verified and unpaid salary arrears from previous periods, pending bonuses, or outstanding incentive payments that have been officially approved.

4.Leave Encashment

Since rules for leave encashment vary based on company policy and statute, the calculation must be precise to avoid non-compliance.

Eligibility: Clearly states which type of leave (e.g., earned, privilege) is eligible for encashment and the maximum number of days allowed as per company policy or law.

Calculation Rate: Defines the specific rate of pay used for conversion (e.g., basic salary + DA, or gross salary), and confirms this calculation adheres to the applicable state-specific Shops and Establishment Acts.

5.Gratuity and Provident Fund (PF) Management

The policy must serve as a guide for meeting critical government mandates regarding long-term benefits.

Gratuity Payment: Specifies the eligibility criteria (typically five continuous years of service) and the statutory timeline (must be paid within 30 days of separation) for disbursing gratuity under the Payment of Gratuity Act, 1972.

Provident Fund (PF): Details the procedure for the organisation's HR/Finance team to promptly process the employee's PF withdrawal or transfer forms and ensure the final employer contribution is deposited before clearance.

6.Deductions and Recoveries

This section legally authorises the company to subtract specific, documented liabilities from the final payable amount, protecting company assets.

Notice Period Recovery: Defines the exact calculation for recovering salary equivalent to the days falling short of the contractual notice period that were neither served nor waived by the company.

Outstanding Company Dues: Includes provisions for the recovery of any salary advances, personal loans, or educational assistance balances remaining unpaid.

Asset Recovery Deduction: Authorises the deduction of the cost of any unreturned company assets (e.g., laptop, mobile, ID card) if not returned in satisfactory condition after a final recovery notice.

Also Read: Statutory Salary Deductions Explained for Employees

7.Final Documentation and Clearance

These are the administrative steps that formally close the relationship and are essential for both the internal audit and the employee’s record.

No Objection/Clearance Process: Requires a formal sign-off process from relevant departments (e.g., IT, Admin, Manager) confirming the employee has no pending tasks, dues, or assets. This must be completed before the final payment is initiated.

Relieving Letter and Service Certificate: Specifies the conditions under which the Relieving Letter and, if applicable, the service/experience certificate will be issued (typically upon successful final payment clearance) and the required issuance date.

8.Tax Compliance and Timeline

Ensuring the final payment is processed under correct statutory guidelines is non-negotiable for audit and tax purposes.

TDS and Form 16: Mandates the deduction of Tax Deducted at Source (TDS) on all taxable components and ensures the timely issuance of the final Form 16 for the relevant financial year.

Processing Timeline: Establishes the official internal timeline for completing the entire F&F calculation and disbursement, referencing the statutory requirement to pay within 30 to 45 days of the last working day.

To make adopting this policy easy, we've prepared a detailed, ready-to-use F&F policy template you can download.

Successfully implementing your new F&F document requires treating the exit process like a controlled project, ensuring alignment between compliance, HR, and Finance. Here are the key steps to successfully embed the policy into your organisation’s operations:

Map the Exit Journey: Conduct a detailed review of your current offboarding workflow. Clearly map out which department (HR, Finance, IT, Manager) is responsible for each step, from resignation acceptance to final payment release, to identify and close procedural gaps.

Establish a Cross-Functional Task Force: Create a dedicated F&F clearance group comprising representatives from HR (for policy adherence), Finance (for final calculations), and the Legal/Compliance team (for statutory verification) to sign off on every settlement.

Prioritise Digitisation of Calculation: Move away from manual spreadsheets. Implement or configure your existing HRMS/Payroll software to automatically calculate pro-rata salary, leave encashment, and statutory deductions based on the policy's defined formulas.

Set Firm Clearance Gates: Institute a mandatory No-Objection Certificate (NOC) process that requires sequential sign-off from all relevant departments (IT for asset return, Finance for loan recovery) before the final payment is authorised.

Formalise Document Release: Standardise the issuance of the Relieving Letter and Form 16 release dates, linking them directly to the final payment date, ensuring both legal and financial closure happen simultaneously.

Audit and Feedback Loop: Conduct a quarterly audit of completed F&F cases against the policy to check for calculation errors or missed deadlines. Use these findings to refine the process and train relevant staff.

Making the F&F process systematic and automated protects your company’s financial stability and reputation.

Also Read: Best Payroll Software in India for Small Businesses and Startups

Final Thoughts

Your company's reputation isn't just built on how you hire; it’s cemented by how you say goodbye. A formal full and final settlement policy shifts the exit process from a chaotic scramble to a systematic, predictable function. It’s an investment in your future talent pipeline, showing every departing employee that your commitment to fair, ethical practice lasts until the very last rupee is paid.

Don't let the final step of an employee's journey become your biggest liability. By adopting a well-documented policy, you gain full control over compliance, eliminate the fear of financial audits, and ensure that every separation is handled with professional clarity. Take charge of your exit process and secure your organisation's financial and legal peace of mind today.

Disclaimer

The downloadable template and the information provided in this article are intended for general guidance and educational purposes only. They do not constitute legal advice or a legally binding document. Craze does not accept any responsibility or liability for any decisions made or actions taken based on this content. We recommend reviewing your final policy with legal or HR professionals before implementation.