Compensation And Benefits Policy Sample Template

A compensation and benefits policy outlines salaries, incentives, allowances, and perks for employees, ensuring fairness and compliance. Read more.

Share

TABLE OF CONTENTS

Compensation and Benefits Policy: A formal policy that outlines salary structures, allowances, perks, and other benefits to ensure fair and consistent employee compensation.

What You Get with This Policy: Transparent pay and benefits structure, improved employee satisfaction, easier HR management, and stronger retention.

What the Policy Includes: Defines pay, allowances, leave, eligibility, approval processes, and compliance to ensure transparency and smooth workforce management.

Policy Updates to Consider: Periodically review salary bands, benefits eligibility, bonus structures, and statutory compliance to match market trends and organisational growth.

How to Implement the Policy: Use the free downloadable template to set clear, standardised, and compliant compensation and benefits guidelines for your organisation.

A compensation and benefits policy is a document that defines how employees are remunerated and what additional perks they are entitled to. It ensures fairness, maintains motivation, and reduces disputes related to pay or benefits. This policy is especially important for startups and SMEs that are building HR systems or managing payroll manually.

It acts as a reference point for salary decisions, benefits provision, and ensures that all stakeholders (HR, management, and employees) are aligned on what is offered and why.

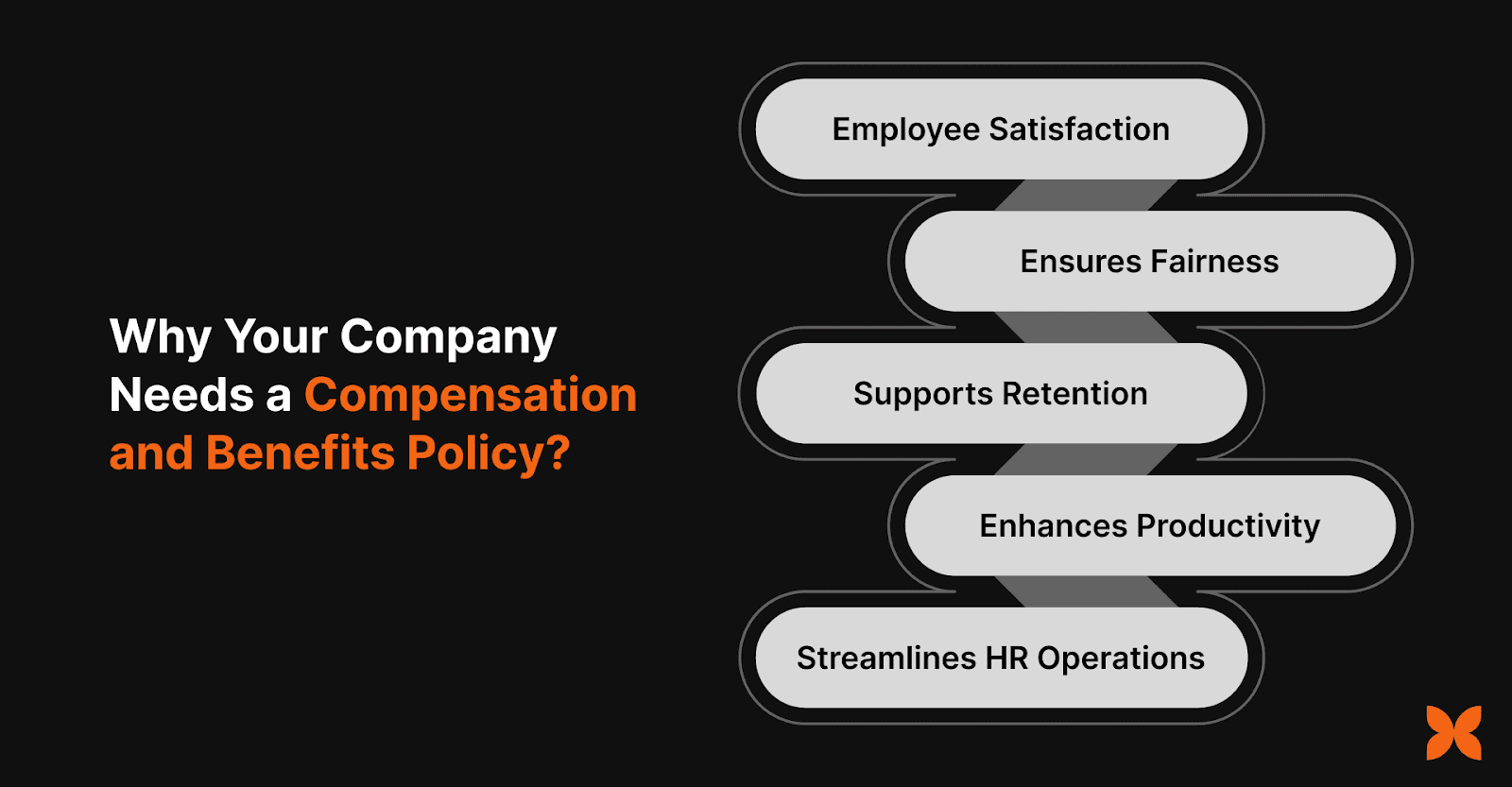

A clear and structured compensation and benefits policy ensures employees feel valued and understand exactly what they are entitled to, while helping leadership align financial planning with workforce needs. Here’s why it matters:

Improves Employee Satisfaction: Transparent policies outline pay, allowances, and perks, building trust and engagement.

Ensures Fairness: Standardised pay and benefits prevent disparities and ensure consistent allocation across roles and levels.

Supports Retention: Competitive packages and clearly communicated benefits, such as PF, gratuity, and paid leave, help retain employees.

Enhances Productivity: Structured incentives and clear compensation allow employees to focus and perform efficiently.

Streamlines HR Operations: Well-defined policies simplify payroll, claims, and approvals while maintaining statutory compliance.

Implementing a clear compensation and benefits policy aligns employee expectations with organisational goals, strengthens compliance, and builds a motivated and loyal workforce.

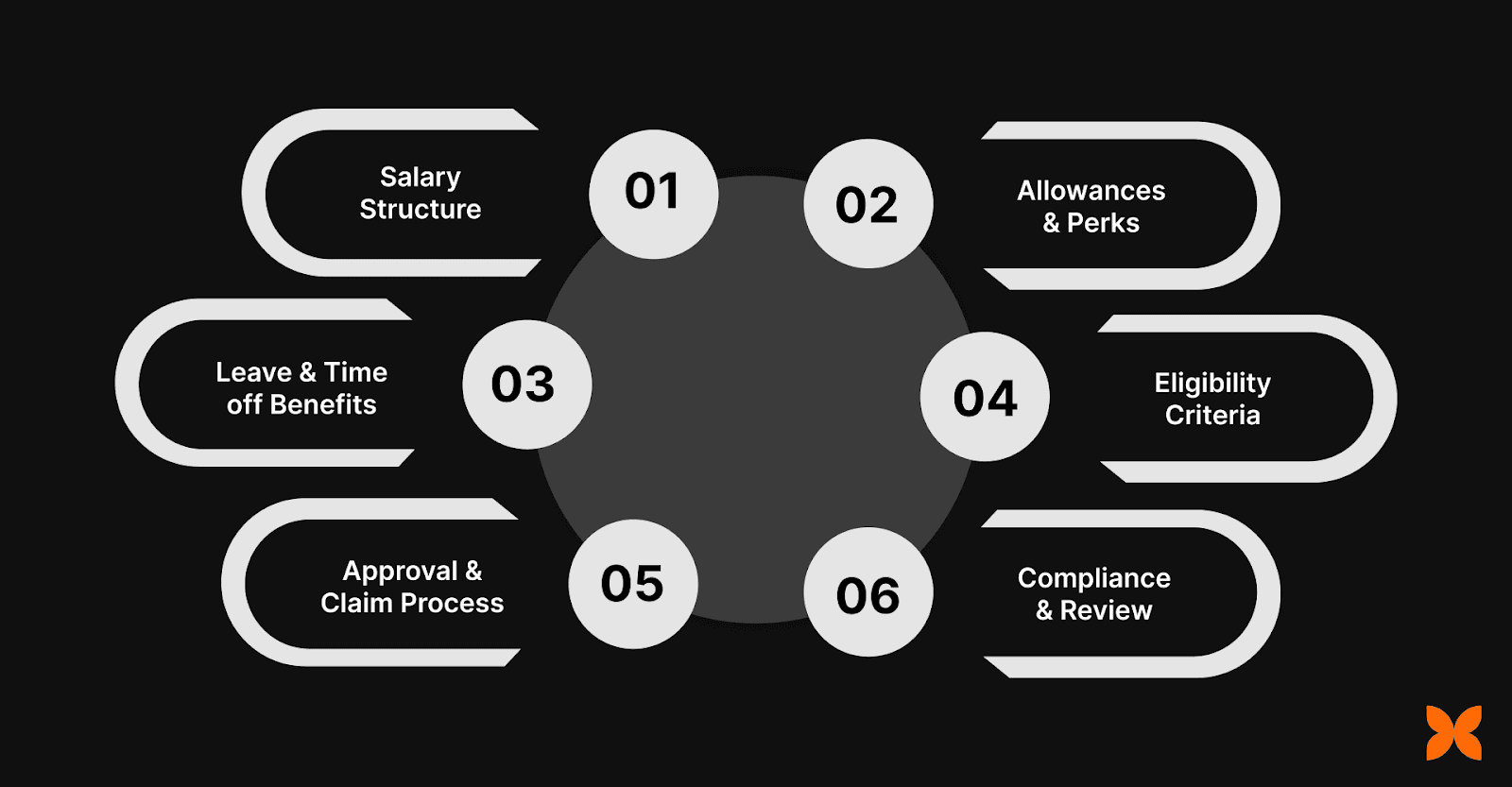

The contents of this policy act as the backbone of workforce management. Defining these elements ensures compliance, transparency, and easy administration across departments. A comprehensive policy typically covers:

Salary Structure: Defines base pay, variable components, and performance-linked incentives. Clarity here avoids surprises and builds trust.

Allowances & Perks: Covers health insurance, travel, meals, and other allowances. Good perks improve employee well-being and satisfaction.

Leave & Time-off Benefits: Specifies annual, sick, maternity/paternity leave, and other leave types. Ensures compliance and fairness.

Eligibility Criteria: Clarifies who qualifies for which benefits and under what conditions. Prevents misunderstandings.

Approval & Claim Process: Establishes clear steps for approvals and claim submissions. Improves transparency and controls misuse.

Compliance & Review: Ensures adherence to labour laws (for example, in India: provident fund, gratuity) and periodic review of benefits. Keeps the policy relevant and lawful.

Also Read: Understanding the Meaning and Calculation of Salary Arrears

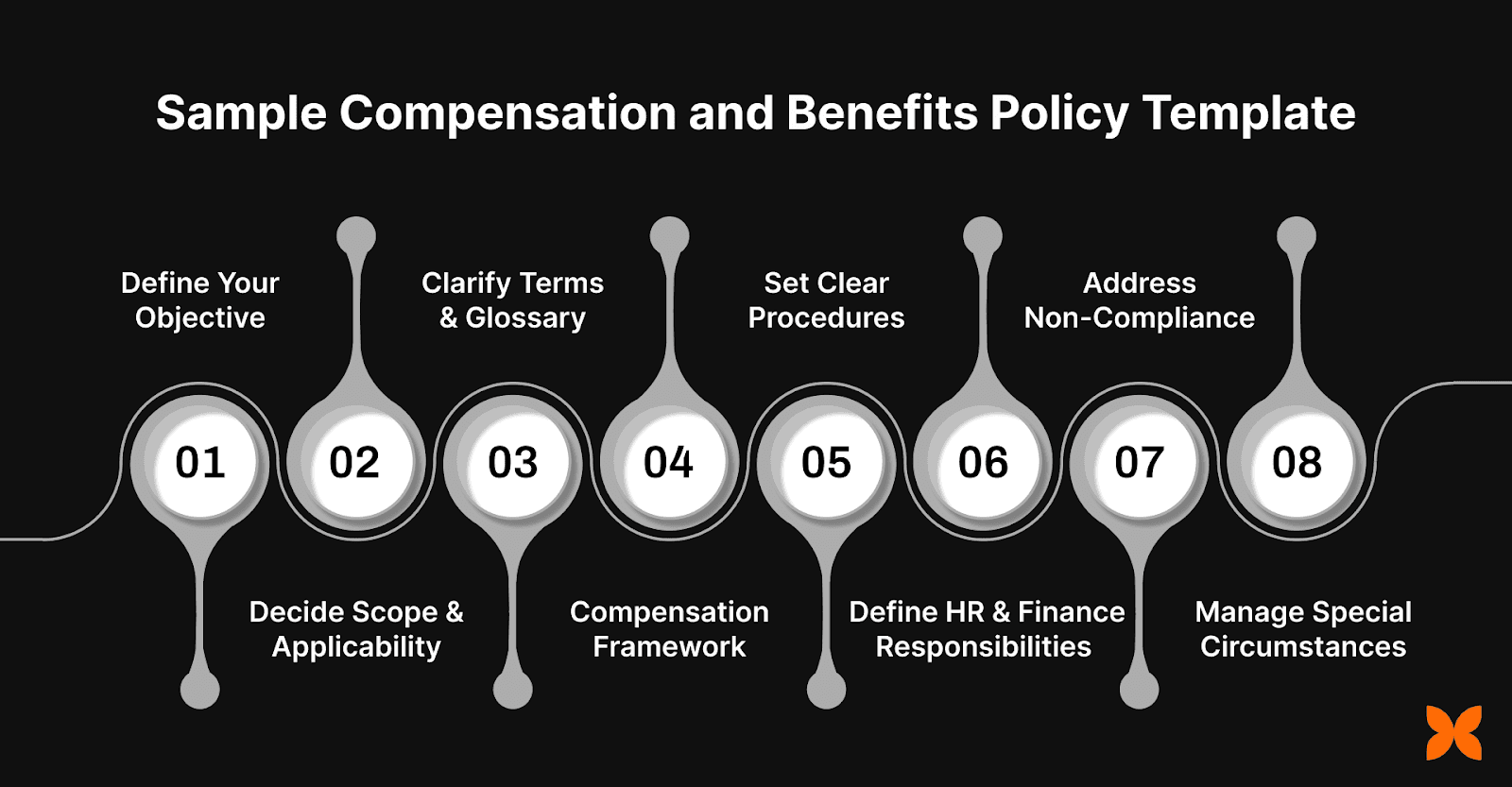

Here’s a template to help your organisation establish a structured Compensation and Benefits Policy.

Organisations can adapt this template to design competitive salary structures, define mandatory and optional benefits, and outline the responsibilities of HR and finance teams.

1. Define Your Objective

As an employer, you need to establish the rationale behind this policy. Your goal is to create a fair, transparent, and competitive pay framework that attracts talent and retains employees. This is about building trust in how compensation decisions are made.

Clarity of Purpose: Document how compensation decisions are structured and why.

Legal Alignment: Ensure the framework complies with Indian labour laws (e.g., Payment of Wages Act, 2017, and Code on Wages, 2019).

Trust-Building: Explicitly link rewards to role, performance, and statutory entitlements.

2. Decide Scope & Applicability

This section outlines to whom this policy applies, including employees and management. Defining this avoids disputes and ensures consistency.

Employee Coverage: Apply uniformly to all categories, such as permanent, probationary, contract, and part-time staff.

HR & Finance Guidance: Position this policy as the master reference for payroll and benefits.

Uniform Standards: Unless exceptions are stated, all roles and levels follow the same structure.

3. Clarify Terms & Glossary

This section should help your HR team and employees understand the meaning of essential terms used in compensation.

Basic Salary: The fixed part of wages forming the base for PF, gratuity, and other statutory benefits.

HRA (House Rent Allowance): Allowance paid to employees to meet rental expenses.

Provident Fund (PF): A retirement savings scheme applicable to employees meeting eligibility criteria, governed under the EPF Act, 1952.

ESI (Employees’ State Insurance): A social security scheme covering health and insurance for eligible employees.

Gratuity: A lump-sum benefit payable after 5 years of continuous service under the Gratuity Act, 1972.

Bonus: Statutory or discretionary extra payment linked to company performance.

Overtime: Extra wages payable for hours worked beyond regular working hours.

4. Build Your Compensation Framework

Establish the guiding principles for determining compensation.

Equal Pay for Equal Work: Ensure parity across genders, caste, or category.

Non-Discrimination: Define fairness explicitly in pay decisions.

Transparency: Communicate salary structures, increments, and bonus eligibility in writing.

5. Set Clear Procedures

Break pay into Fixed, Allowances, Variable, and Statutory Benefits.

Fixed Components

Basic Salary: Typically 40–50% of the gross salary; this also serves as the base for PF/Gratuity.

House Rent Allowance (HRA): An allowance paid to employees to meet rental expenses; the company may define the amount as per its policy.

Allowances

Travel/Conveyance: For commute or business trips.

Special/Project Allowance: Granted for role-specific needs or project requirements.

Benefits

Provident Fund (PF): Employer and employee contributions, each typically 12% of salary components excluding HRA, as defined under The Employees’ Provident Funds Scheme, 1952.

Employees’ State Insurance Corporation (ESIC): Employer 3.25%, Employee 0.75%, applicable if wages ≤ ₹21,000/month.

Paid Annual Leave: Employees are entitled to a minimum of one day of paid annual leave for every 20 days worked, which equates to approximately 12 days per year, as mandated by the Shops and Establishments Act.

Medical Insurance: Mandatory under ESIC for eligible employees; otherwise, provide private coverage.

Gratuity: Payable after 5 years of service; capped at ₹20 lakhs.

Variable Benefits

Incentives/Bonus: At least 8.33% of annual wages, capped at 20%, for employees earning ≤ ₹21,000/month under the Payment of Bonus Act, 1965.

Overtime: At twice the ordinary rate of wages as per Factories Act, 1948.

6. Define HR & Finance Responsibilities

Clearly define ownership to prevent delays in benefits or compliance issues.

HR Manager: Maintains employee master data, statutory eligibility, and communication.

Finance Manager: Ensures timely PF/ESIC contributions, gratuity provisioning, and payroll disbursal.

Joint Responsibility: Both must coordinate during exits, overtime approval, and statutory submissions.

7. Address Non-Compliance

Employees and regulators expect accountability. Define consequences for missed obligations.

Disciplinary Action: For deliberate errors, ranging from warnings to suspension.

Investigation Process: A Neutral committee investigates complaints to avoid bias.

Regulatory Penalties: Failure to pay PF/ESIC can result in fines of up to ₹25,000 and imprisonment, as stipulated under Section 14 of the EPF Act.

8. Manage Special Circumstances

Payroll errors or system delays happen. Document how exceptions are handled.

System or Bank Errors: Employees should not be penalised if a salary/benefit delay is due to technical issues.

Delayed Contributions: HR/Finance must record and rectify these contributions immediately, while informing the employees.

Force Majeure: Special provisions may apply during crises, such as the COVID-19 pandemic.

This template offers a comprehensive framework for businesses to define clear compensation structures, outline employee benefits, and ensure compliance with statutory and organisational policies.

Also Read: ESI Contribution and Calculation in Salary

Below is a ready-to-use compensation and benefits policy template that you can customise for your organisation.

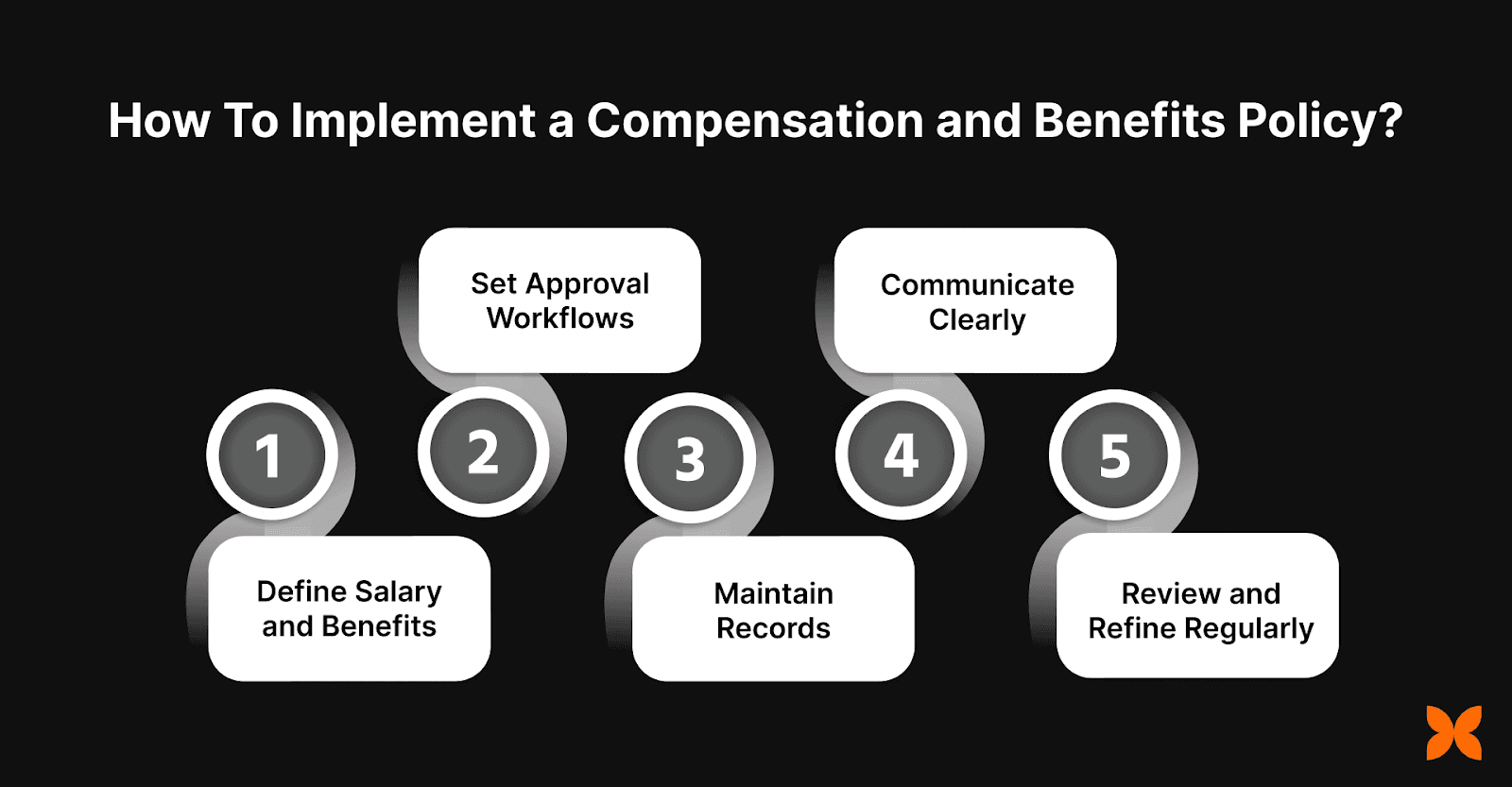

Rolling out a new policy requires clear communication and system integration. Employers must ensure employees understand the benefits, while HR can easily manage updates and claims. Here are the practical steps:

Define Salary and Benefits: Clearly specify pay structures, allowances, perks, and eligibility criteria for all employees.

Set Approval Workflows: Establish manager approvals for claims, reimbursements, and special allowances to maintain accountability and ensure transparency.

Maintain Accurate Records: Digitally track salaries, benefits, claims, and policy updates to ensure compliance and transparency.

Communicate Clearly: Share the policy with employees, clearly explain entitlements, and provide regular updates to prevent confusion.

Review and Refine Regularly: Gather feedback, assess policy effectiveness, and update it to reflect changing business needs and regulatory requirements.

By applying these steps, businesses can create a reliable framework for managing compensation effectively.

Final Thoughts

A well-defined compensation and benefits policy forms the core of strong HR governance. It directly influences how employees perceive fairness, recognition, and growth within an organisation.

Such a policy simplifies payroll and benefits administration and also ensures compliance with labour laws, helping to prevent disputes and reduce legal exposure. When employees clearly understand their pay structure and entitlements, it builds trust, motivation, and loyalty. By adopting a customisable template, organisations can adapt the framework to their workforce, industry, and compliance needs.

Disclaimer

The downloadable template and the information provided in this article are intended for general guidance and educational purposes only. They do not constitute legal advice or a legally binding document. Craze does not accept any responsibility or liability for any decisions made or actions taken based on this content. We recommend reviewing your final policy with legal or HR professionals before implementation.